This Is Not Investment Advice

How Much Is Adoption Holding Back the Bitcoin Price?

Interesting question for sure. This prior piece here asking Why Isn’t Bitcoin Up More might be helpful as well if interested. Given the data in that post, let’s dive in on some adoption data to see what we can find.

Peak Rates on the Products You Need

Peak Bank was designed for those who want to bank boldly, providing a 100 percent digital platform that combines convenience and powerful money management tools. Our high-yield savings accounts offer rates as high as 4.35% APY* while remaining accessible and flexible, ensuring you stay in control at all times. Apply online to start your ascent.

Member FDIC

The below chart from BitcoinMagazinePro.com shows the relationship between the Bitcoin price and market value and the number of new addresses created. Specifically - this measures the number of unique addresses that appeared in a transaction on chain.

When I look at that chart above I can’t help but wonder about why new address creation has clearly moderated a bit while failing to stay on the trend it maintained until late 2023.

The below chart also from BitcoinMagazinePro.com depicts Miner Revenue from Fees and the Bitcoin exchange rate:

To me - the above reinforces the 1st chart about lack of new address creation while highlighting how not all components of the ecosystem are firing on all cylinders.

The below chart highlights the capacity of the Bitcoin Lightning Network in fiat and in BTC:

Here is a look at transactions from DeFi on Stacks:

Of course there are many, many other pieces of data or metrics to consider in terms of adoption, but taking into consideration the above and some pent up thoughts on this here is what keeps jumping out at me:

When looking at those that say follow the financial news and prices on a daily basis or more frequently . . . . . . . . . there is a quite high level of awareness of Bitcoin . . . . . . . . many have even transacted buy/sell

Of this same group with strong awareness of Bitcoin, my senses tell me less than 1% of them have executed a transaction on chain within the last 180 days

My senses tell me we have this group of “crypto people” and within this group that touches crypto daily, a bigger chunk of them touch coins other than Bitcoin for repetitive, frequent use and actual transactions

My senses tell me we have this group of “Bitcoin people” say here in America, but the vast majority currently only see it as similar to buying a Mag7 stock

Adoption amongst business connected to buy/sell and the markets is rising and building momentum, and for sure more businesses are adding Bitcoin as a reserve asset

Stacks transactions in August were almost double that of February, but graphically you can see there has not been consistent rapid growth yet

Lightning Network is in many ways thriving but not yet exploding with user growth and capacity added (blue on the chart is reality and the green is what Bitcoiners want to see happen)

In terms of how much this literally is impacting the exchange rate, I truly have no idea or way of pinning that down. What I would say is that it isn’t helpful. By many metrics (for example MVRV-Z Score) we seem to be kind of stuck in the middle. Perhaps lagging adoption and transactions is impacting that, but I don’t know for sure.

Regarding the price action, let’s take a look.

We noted over the weekend and previously this zone below the $110Kish level of $107K to $108.7Kish. Well - we saw Bitcoin tap $108,709 . . . . . . . . . so was that enough?

Time will tell. You’ll notice with Bitcoin and Risk On during general uptrends or bullish periods the markets tend to front run a lot of bounce areas/zones.

Bitcoin Weekly

Despite a lot of drama and a new ATH, the Money Flow on the Weekly has been Red for over a month now.

Bitcoin Daily

The Money Flow is still Red on the Daily. Inside that Blue Circle - was that enough work getting done to initiate a bullish reversal? Time will tell. Let’s check the 4HR.

Bitcoin 4HR

In my humble opinion, this bounce thus far off the $108.7Kish appears tepid and rather weak. So far. Time will tell.

For me personally - still active yet cautious and very picky, light and nimble.

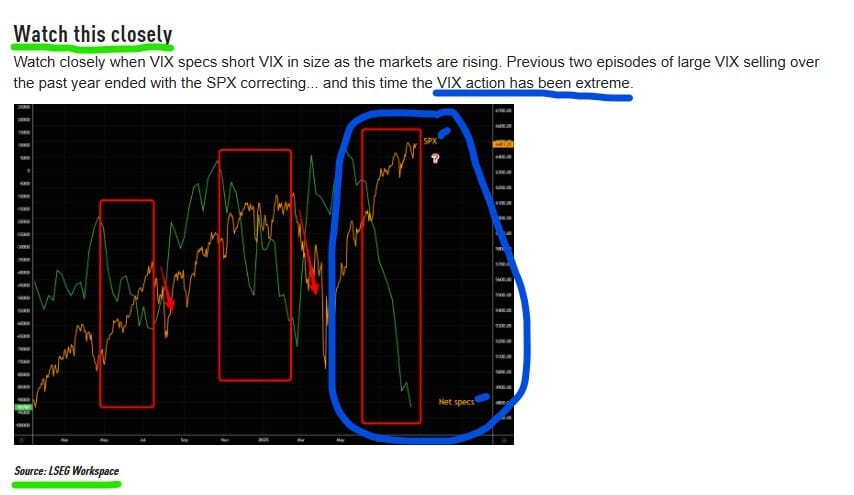

Bonus Chart - when they keep selling that VOL over and over again for that “free money” . . . . . . . . . . you know it’s free so it will go on forever right?