This Is Not Investment Advice

Note - charts from 8/6 at roughly 8AM EST. Look for the weekend report on Saturday or Sunday AM.

Why Isn’t Bitcoin Going Much Higher?

Seems that many are wondering why Bitcoin isn’t “up a lot more”. FA - Fundamental Analysis. TA - Technical Analysis. In my opinion, Bitcoin gets a 9/10 for FA. However, the exchange rate is set at the margin every second of every day 24/7/365. Just because “MSTR is stacking so much” that may or may not impact the exchange rate at any given time and at any particular Time Frame. Let’s dive in.

One of the things many cling to is “global liquidity” and/or “the global M2 chart” that “shows that Bitcoin will go to the moon” . . . . . . . fair enough. There are other ways to view this relationship, and what concerns me most is the choppiness of the data and difference in Time Frames. Global M2 is a big, lumbering beast. Let’s look below at the YOY percentage change in Global M2 versus the same for Bitcoin courtesy of BitcoinMagazinePro.com:

As we have seen in the past, when Global M2 surges higher there is generally a notable and strong response from Bitcoin. Look inside the Blue Circle. Global M2 is advancing and rising, yes, but is it surging persistently? Looks to me like it is getting cranked up, then stalling, then cranking up again. Note the two small Blue Ticks where it is flatlining these last few weeks . . . . . . . . kinda like Bitcoin.

Another great tool from BitcoinMagazinePro.com looks at the Yield Curve and its impact on Bitcoin:

Note how Bitcoin for sure appreciates the spread moving from negative to positive, but the last few months we have seen flip flopping between a flattening Yield Curve and a steepening Yield Curve. Note how during this time Bitcoin has teased back and forth between breaking away higher or lower.

Supply Adjusted Coin Days Destroyed - notice any patterns or trends? Looks like whenever it pops above 1.00 there is a fairly strong correlation with a local or major top:

Bitcoin 4HR

Bitcoin Monthly

In my humble opinion, Higher Time Frames are more influential and significant than Lower Time Frames such as the 4HR or 1HR. The below is a Monthly Time Frame chart. Money Flow on the Monthly is Green but it isn’t exploding higher. The Monthly looks bullish overall as is fairly obvious on a longer timeline, but there are some soft spots. Note the decline in volume generally on this move up last several months and the two Blue Circle candles that closed and spent most of the time in the bottom half of the range.

Bitcoin Weekly

Personally, I find the Weekly Time Frame to be the most useful and impactful overall. Money Flow is currently Red on the Weekly.

Bitcoin Daily

The daily chart does not look bullish at this moment - in my view.

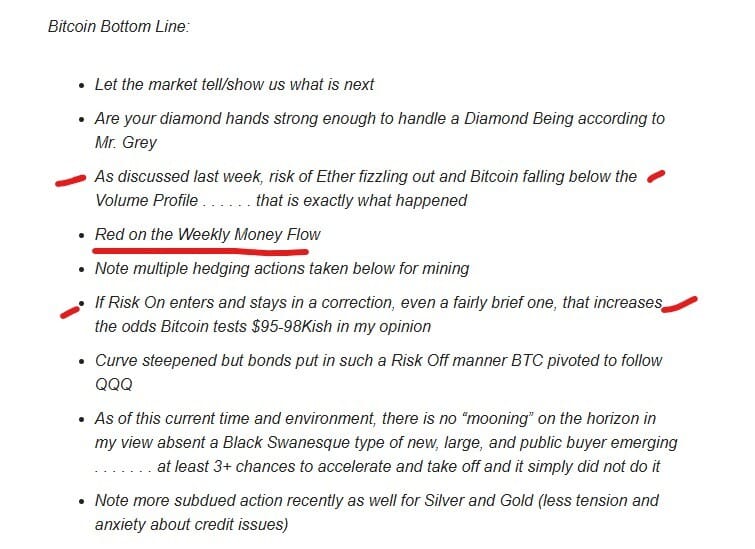

Bitcoin Bottom Line:

Let the market tell/show us what is next

$112.6Kish and $114.8Kish on Lower Time Frames might be significant

Prove it to us with a break above $119.5Kish to get the bullish Money Flow cranked up

MOVE is comatose, bonds currently asleep peacefully (for now), following QQQ out of apathy???

Coin Days Destroyed, M2 YOY Growth, Yield Curve . . . . . . . . . all potentially very helpful but currently in somewhat of a stalled or neutral position

Bitcoin has fallen out (below) of a prior Volume Profile ($114.8Kish to $119.5Kish roughly) as Eth fizzled as well along with a sluggish QQQ and Risk On setting in the here and now . . . . . . . . . reality

In my opinion, most bullish outcome might be a test and STRONG bounce from $109.5Kish/$110Kish and it needs to be a strong move . . . . . . this could change things significantly

Breaking $112.6Kish increases odds of testing $110Kish for sure

Here is what was published most recently:

Stacks Simmering

My perception and opinion is that “building on Bitcoin” is ultimately where most of the ‘Alt Season’ big gains will be made over time. Maybe I’m wrong. Either way, I’ve noticed that Stacks tends to act as almost a barometer or proxy for how much ‘Risk On’ is present in the Bitcoin trading action. In other words, when Bitcoin seems like it is revving up to move a lot higher, Stacks tends to get cranked up as well.

Stacks might be saying “not yet”. Here is the weekly chart for STX:

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.