This Is Not Investment Advice

As Loans Grease The Skids Risk On Gets Signal from ‘Hawkish’ Powell . . . . . . Careful Doubting Fed’s Ammo Stack . . . . . . . . . Behemoths Start Engines . . . . . . . . . Bitcoin Kneels to Bessent Flex

The biggest Fed Meeting in history they say. Bitcoin grabbed the liquidity sitting above it heading in and Risk On kinda shrugged its shoulders. Credit. AI Trade. NVDA $170. NVDA played along and in general investors are at least finding more plausible opportunities with a ‘Melt Up’ that still could be gaining momentum.

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

Yet again at the risk of being even less popular - I’m just not seeing any type of imminent return to “money printer go brrrrrr” at least in America. Powell had a chance at the presser to expand his views on Balance Sheet expansion or contraction and all he did was confirm the contraction schedule. Bessent’s late July flex still holds. Reserves are adequate. The plumbing seems to be ok and has been. To clarify again - in my view QE in some form is still forthcoming, but I am emphasizing again I simply don’t see it as imminent in any way. Bessent even recently penned an editorial in the WSJ hammering QE as a tool.

So where will all the new money come from? Although the broader topic needs a distinct post and focus - the primary way money/liquidity expands is via the generation of new loans.

Here’s a long term look at Commercial and Industrial loans in America.

Here is a look at the last year:

Interesting - ever since we sniffed out the ‘Melt Up’ starting in mid-April right here . . . . . . . . . loan growth is accelerating at the Commercial and Industrial level.

Yes - Bessent (via BOMO) can and will buy LT debt. Yes - the TGA ebbs and flows. Yes - the Fed might engage in QE or some variation of QE (such as BanQE with the banks buying and holding more UST). However - call me crazy I simply am not seeing anything in the here and now that says the Fed will run out and “start printing money” via QE anytime soon. Loans “create new money” via accounting entries and are capable of providing some of the stimulus the economy needs.

As it stands right now - we have pending stimulus forthcoming from the Big Bill and percolating stimulus brewing with loan growth and the use of credit obviously in need to pay for all of this AI Infrastructure. Also of note, at least in my view, are Powell’s “hawkish” remarks with the media after the meeting. I have a different take.

Powell was emphasizing shifting from restrictive to neutral. He stated clearly they weren’t accommodating or easing but rather moving from restrictive to neutral because they find themselves challenged with the two ends of the dual mandate in contrast to each other. One translation I’ll offer (and perhaps Risk On agrees with me) is the following: “yeah not super dovish but he’s telling us we aren’t even in easing mode yet so more could be coming”. Being more prudent now, in some ways, is way more bullish because the ammunition is still stacked very high in storage.

One of Goldman Sachs’ top traders might share similar thoughts, or maybe he doesn’t. I have no way of knowing for sure unless we discussed it together. Nonetheless, from a recent Zerohedge.com piece covering his notes we see the following:

I concur with Mr. Schiavone on this. It’s almost as if Risk On now has its own mini-Yen Carry with Risk On’s perception of expectations for more stimulus (something always dangling in front perceived to be “good” or “bullish”) . . . . . . . . . . . one of the consequences is an even more dovish close to zero if not negative real rates on the 2YR and implied 1YR. That’s bullish and supportive of Risk On. Money is cheap. 2YR minus core CPI is close to zero (goes negative when Fed cut expectations rise if viewing a mythical 1YR Note . . . . . . i.e. “one year real rates go negative” is a thing in and out). Spread for BBB rated corporate debt is barely positive over the 10YR Note. Money is cheap. I realize rate cut expectations slid this week I’m more broadly looking at this concept here.

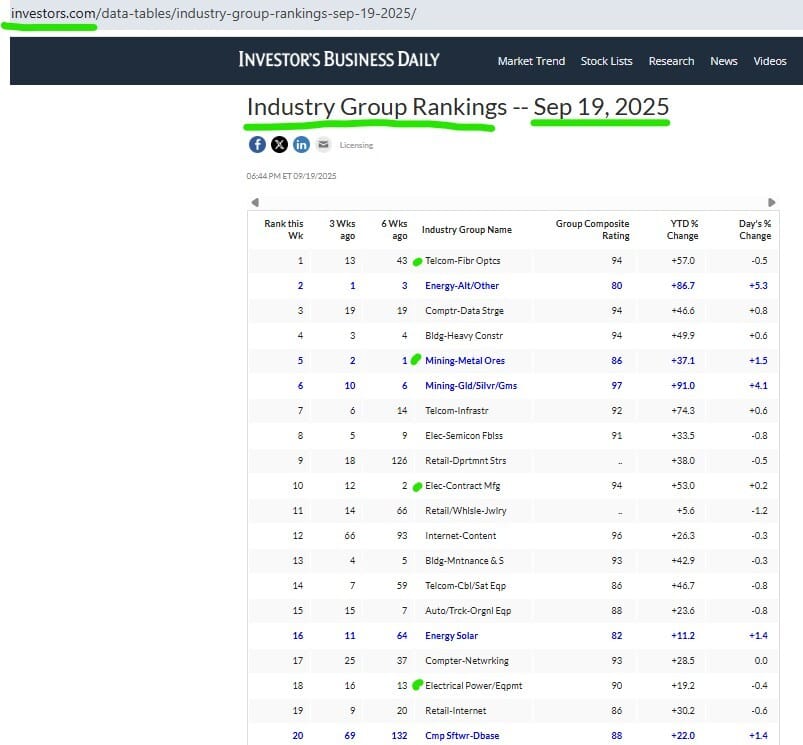

Certain parts of the market (see recent analysis of IBD Industry Groups) already have very substantial momentum. Powell just told us he isn’t giving everything away right now but that we are also not even yet in an easing mode. Something to think carefully about when looking at the momentum and direction currently while acknowledging the Fed still has a ton of bullets to fire if it chooses to do so.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Interesting data here from Glassnode on Options Net Premium Strike Heatmap. Glassnode makes the case that the intense put selling has helped cushion the blows these last few months. Dealers are short puts so when the market dips they have to get long spot as a hedge thus providing a cushion.

Goldman Sachs trader provides insight that sounds a lot like we discussed a little while back regarding the Bessent flex in late July curbing supply and starting to buy.

Supply Adjusted Coin Days Destroyed

This is another very solid tool from BitcoinMagazinePro.com shown below. In my view what’s particularly relevant here is that this shows behavior and actions from long term holders in the context of what they perceived to be the scenario at the time. So - you see the ratio burst above the 1.0 level when longer term coins are moving and there is some correlation with tops forming either locally or aligned with the “cycles” (I’m not “anti-cycle” just not convinced we are as beholden to a set time schedule as we may have been in the past for various reasons). Again - this is action from those holding coins for very long periods of time that decided to now move them.

Everything Indicator

Liquidation Heat Map - Two Week Time Frame

From Coinglass:

Bitcoin Bottom Line

Let the market tell/show us what is next

As projected and detailed in a mid-week report published, it appears that Bitcoin did in fact go grab that liquidity above during this FOMC week . . . . . . . . . is the $116Kish to $117.5Kish area carved out this week yet another Lower High . . . . . . . and if so does that alone signal a trend change on higher time frames and switch??????? Not known yet

Choppy and frustrating action here for a while now, a legit, firm break above $120.8Kish in my humble opinion brings in substantially more Money Flow and Volume, break below $107Kish might possibly change the overall trend on Higher Time Frames

Retail? It’s not as if it isn’t plausible just look at equities, Chinese stocks, Gold, Silver, and other assets or securities . . . . . . . in my view it will take 3-4 weeks minimum of strong Green candles to even get retail to start seriously sniffing around so chicken egg and on and on we go . . . . . . .

Perhaps worth considering is that Risk On post-FOMC in my view has even more support now (see below, real yields, expectations, more coming, etc.) but Bitcoin directly is not receiving any of the “Bitcoin specific” love and affection such as stone cold QE . . . . . . all of the aforementioned “help Bitcoin” but don’t necessarily “moon Bitcoin” . . . . . . . . . hence the “crypto crowd” constantly expressing disappointment

$117.5Kish, $118.5Kish

$115.5Kish, $113.5Kish, $112.2Kish

Bessent Flex, Global M2 rate of change, somber mood regarding link to dilution . . . . . . reality

Risk On/Off

The below shows the Top 10 stocks overall from Investors Business Daily pulled from the IBD 50. A poignant and timely question about NVDA in my view . . . . . . .

Good catch again by The Market Ear at ZH regarding my potentially misguided obsession about how US households seemingly already dug through the couches and elsewhere to fire away with the spare change in the Daq. JPM says take a chill pill it’s global and we aren’t overheated yet:

My response: logical and reasonable take . . . . . . . . . . so from the U.S. perspective AI absolutely must deliver simply sensational returns or else . . . . . . . . . .

IBD Top 20 Industry Groups

UST 10YR Daily

As we have projected here on multiple occasions . . . . . . . . . . with the Fed actually cutting we may see a pivot in the longer duration bond rally in America. Yields rose this week with the curve maintaining its flatness more or less . . . . . . . but let’s see what happens from here. Not sure Risk On even cares until the 10YR breaks (if it does) that Blue Circle which is where Bessent flexed. My senses are that credit may bounce around between inflation data, labor data, and the market’s perception of Bessent’s flex.

Personally I’m not inclined to make any kind of decisive statement regarding the retail participation in Risk On. Who am I to decide? For all we know it might continue or even increase, or maybe it plummets after the next actual correction. Seems like it is a bit persistent as 2025 wears on (from The Market Ear at Zerohedge.com):

NVDA Weekly

HYG Weekly

MSTR Weekly

AGX Weekly

Risk On/Off Bottom Line

Overbought and extended yes absolutely, vomiting all over all reasonable valuation metrics yes indeed . . . . . . . . there will be corrections/consolidations the question is how and what they look like . . . . . . . . . absent longer duration yields above a comfort zone will the corrections knock down Leading Stocks for the count or reset their engines?

Junk debt continues to trade quite bullishly . . . . . . . . my response (insert shoulder shrug emoji) . . . . . . accepting that 5/6 weeks have been bullish . . . . . . MOVE and Bessent Flex added support here in my view

“Until tech credit spreads crack” . . . . . . . totally concur with the logic when credit calls out the hyper-scalers for overspending the top is in . . . . . . . . . though it’s plausible equities top before credit signals in my view if momentum shifts

Two bullish weeks in a row for NVDA . . . . . . . . . . AGX might be getting wound up

Like with the impossibly brilliant Tracks in the Blue Forest from Mr. Wong after all these years I can’t figure out if those footprints are coming towards me or going away from me or if it is even me looking back . . . . . . . . . trying to get comfortable being uncomfortable . . . . . . . follow the Money Flow and Acc/Dis in my opinion

Upside bias remains in my humble opinion until credit whispers in our ears or the indices are down big on big volume closing at or near the lows of the day and Leading Stocks are getting hit hard on big volume

Positioning and the Pros remains . . . . . . . . . . . on a net basis helpful with potential as they are in but not ALL IN or by any means out of ammo

Personally I would be just as cautious/careful about chasing and buying something that is way over extended as I am about an overall market correction that knocks nearly everything down

As ridiculous as certain things are (RSI, valuations, etc.) this is not the time to short . . . . . . . . . in my humble opinion . . . . . . not a play for me right now

Lotta Laos Energy, Lotta Laos Debt . . . . . . Let’s Make a Deal

Regardless of the political details and local and regional nuances, this is a compelling example of Game Theory and how no other “crypto” or “token” is anywhere even close to Bitcoin in terms of real world impact. Laos apparently has immense surplus electricity but also a mountain of debt used to build dams and other resources. Enter Bitcoin Mining.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: sold another 15% or so of that stash so total about half sold, this one vicinity $114Kish. Total about half of mining stack converted to fiat and earning. UPDATE: sold another 5% or so at $112Kish. More than half sold total.

If the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is bouncing between Green and Red on the Weekly so shifting accordingly. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. Watching any bounce from $107Kish very closely. Could long or wait for yet another lower high then long SBIT again but with an even bigger position. UPDATE: No position will see how $116Kish works out. Very weak action this week overall but it did not plummet and I already have a firm defensive posture so I want to see how it trades throughout the weekend and early next week.

TBT back a bit, still nibbling

Matthew Wong

Tracks in the Blue Forest