This Is Not Investment Advice

If You’re Flummoxed and Puzzled About Bitcoin Not Soaring . . . . . . . . . . . Bessent’s Late July Refunding Connects Some Dots

Plenty of participants seemingly remain puzzled and near frozen in a state of disbelief about why Bitcoin is or is not moving in a certain direction. Frustration mounts among some as they wonder “why isn’t Bitcoin going up a lot more” while insisting that “all the central banks are printing money”.

Professional Bitcoin Mining Made Simple

With Bitcoin breaking through $120k recently, smart entrepreneurs aren't just buying at record highs - they're generating Bitcoin through professional mining operations at production cost.

Abundant Mines makes Bitcoin mining completely turnkey. You own the Bitcoin-generating equipment in our green energy facilities while our professionals handle everything else. No technical expertise required. No equipment management. No operational headaches.

Receive daily BTC payouts straight to your wallet, benefit from massive tax advantages through 100% bonus depreciation, and acquire Bitcoin significantly below market rates. It's like owning the money printer instead of buying the money.

Perfect for busy professionals who want serious Bitcoin exposure without complexity. Our clients include successful entrepreneurs who've scaled from test investments to multi-million dollar mining operations.

Claim your free month of professional Bitcoin hosting and see how the smart money generates Bitcoin.

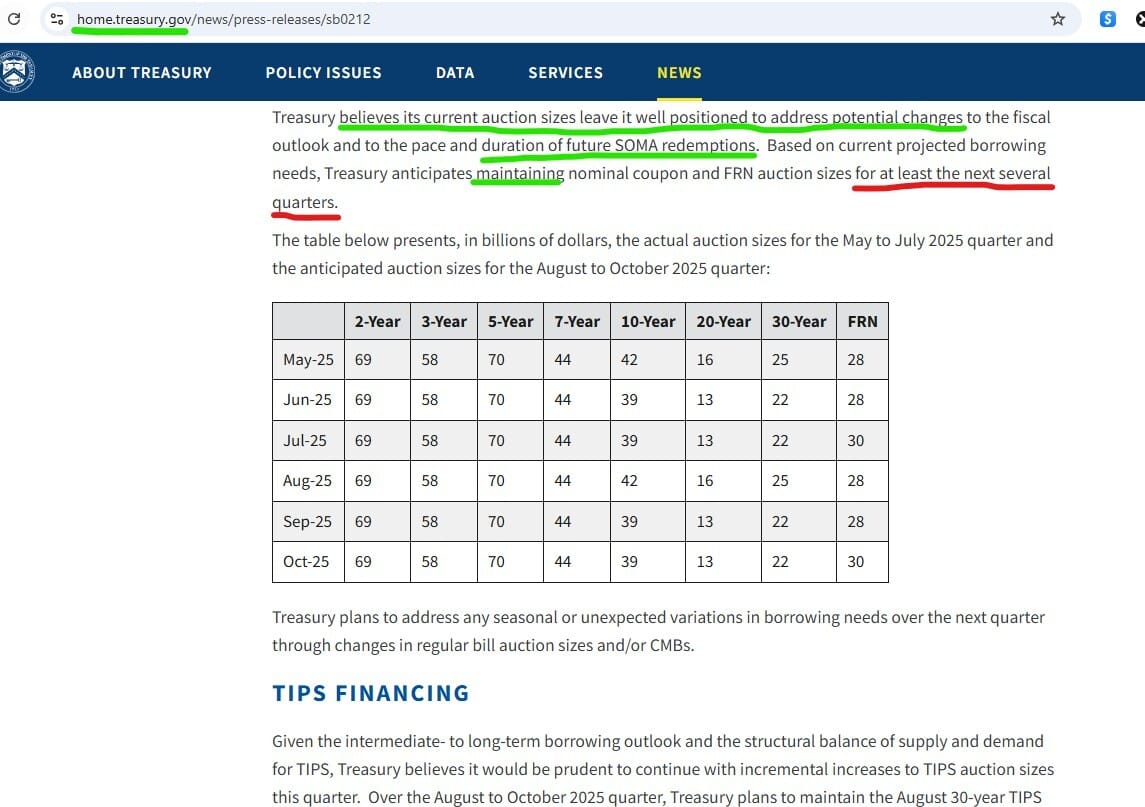

Before we get into that, let’s first take a look at the credit market. In late July (on the 28th and 30th - remember these two late July dates), Treasury Secretary Bessent laid out the policy statement for the 3rd quarter and financing estimates.

Here’s the Treasury statement from July 28:

Couple observations:

Bessent is telling you they need to borrow more now (from the 7/28 context) because the TGA is low and they need to buff it up along with lower projected cash receipts (govt ‘revenue’)

TGA filling up can be seen or interpreted as bearish for Risk On - i.e. not good for Bitcoin at the margin

Ok, so that happened. Then on July 30, this is the Treasury Policy Statement:

Along with the following discussing Bills and Buybacks:

Couple observations:

Bessent is massaging longer duration here in a couple ways by boosting buybacks of LT and flexing the lack of increases in LT debt auction sizes . . . . . . . . . . . doing some can kicking . . . . . . . . . bearish for Bitcoin via taking the tension away from “the massive debt problem” . . . . . . he’s said “we’re good with these auction sizes and we’ll be buying more ourselves” which tells the market to worry a lot less about LT yields (on the surface)

SOMA (the Fed’s mechanical leftovers executing QT used to buy new debt at auctions) included in projections . . . . . . could be bigger buffer than realized?

Use of Bills will only increase as will buffing up the TGA

In my view - essentially what happened at the end of July is that Bessent came out with a major flex telling the market not to worry about how this massive debacle related to sovereign debt will be managed/handled. He bought some more time and the market seems to like it quite a bit with bonds rallying. He’s also effectively playing the “least ugly duckling” game persuasively considering debt fund managers have to buy debt from someone (look at JGB, Gilts, etc. as other options to compare). For the present moment and context . . . . . . . . . . . . Bessent created a lot less urgency or rush to buy Bitcoin.

Here is what CDS are saying:

With the labor data really struggling along with the above analysis of Treasury actions, it’s no wonder longer duration in the U.S. has recently massively outperformed its peers.

So what else happened in late July?

One could easily argue that potential local tops formed in NVDA, COIN, BTC, and other Risk On assets while CRCL got a good nudge down that week after already sliding well off its highs. Since late July MSTR has essentially gone straight down.

So does this mean that the debt problem is fixed and we don’t really need Bitcoin as much? No. Treasury Secretary Bessent is buying some time and trying to further gain the confidence of the market.

Why does it matter what MSTR, COIN, and CRCL do? Money Flow. Accumulation/Distribution. The institutions move the market with their Money Flow and buying/selling which results in Accumulation/Distribution. MSTR is a direct bet on BTC. COIN and CRCL are highly connected to BTC and large and liquid enough for the institutions to use them.

Since late July both Bitcoin and the largest proxies to Bitcoin have been Red on the Weekly Money Flow. Coincidence?

Of course this is not the only thing impacting Bitcoin, but in my humble view I would not discount the significance. New reports come out at the end of October.

The elephants in the room are Gold and Silver. If Bessent has convinced the markets in the short term that he has a relatively coherent plan for kicking the can and managing the debt issue, then why are Gold and Silver breaking out?

It could be for a variety of reasons not the least of which is both working through consolidations and breaking out technically. Both are recent breakouts as well so the divergence hasn’t been ongoing for long periods.

In terms of Bitcoin, I don’t see the late July announcements as putting a lid on Bitcoin. Let’s not forget that the below chart is Global M2. Bitcoin is always a global issue, but we all know the U.S. policymakers and Fed are the biggest sources of impact currently.

What I would say is the following in my humble opinion:

likely more evidence the “cycles” are done

Bessent is buying time by tapping the brakes on the unraveling of the U.S. financial condition

difficult to see a “mooning” or any of the very aggressive bullish action without the market at least starting to discount a shift in Treasury Policy . . . . . . . . . i.e. Bessent shifting from keeping auctions contained/shuffled to a clear cut expansion/increase in the size of the pending auctions

this along with rate of change of Global M2 likely the two biggest macro/FA factors hanging over Bitcoin currently . . . . . . . . . . . . policy moves bullishly while liquidity stalls in neutral . . . . . . . Treasury Company scrutiny third biggest FA issue in my view

credit market reaction to ugly auctions has been relatively muted and benign . . . . . . . entirely possible in the context of Bitcoin the market cares much more about the supply of Treasuries looming and pending rather than today’s auction conditions (easily mopped up with intervention if needed) . . . . . . . curve important and it has been fairly non-flatteny as of late

for all the talk of the “refi wall” and “sovereign debt crisis” based on MOVE at the moment the market simply is not concerned . . . . . . . though MOVE did spring to life a bit recently

Bitcoin Weekly

And as if there aren’t enough questions or factors to consider, Bitcoin is attempting to turn Green on the Weekly Money Flow . . . . . . . . need to see aggressive energy and Money Flow.