This Is Not Investment Advice

An Oracle Saves The Day, ‘Melt Up’ Gains a New Powerful Industry Group . . . . . . . . Bitcoin Springs To Life Again Teasing Breakaway

Credit. AI Trade. NVDA $170. Bonds chilled out again though may be nearing end of the rally, NVDA popped back above $170 (MSFT also leaps above key level Friday), and the AI Trade starts bringing more ammunition to the fight (see below for IBD Industry Group rocketing up the rankings).

An oracle of sorts must have come up with the idea for the ORCL “stick save” for this time as Risk On was teetering on running out of steam dragging the Generals around. The puck (Risk On fading if you will) was heading into the net, and there was a beautiful stick save by the goalie right at the last second.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

The latest on inflation this week via the CPI:

I’m not trying to make the case that inflation, and inflation expectations, are running rampant right now. All I’ve been saying essentially is that if one views with an open mind . . . . . . . inflation appears to be pesky and persistent. It’s not as if consumers and businesses are unilaterally seeing price drops that are easing their cost structures.

UST is comatose as depicted by MOVE:

Regarding the AI Bubble, there are multiple valuation based metrics and otherwise highlighting the insanity. And as stated I’m aboard the ‘Melt Up’ and am open minded about all the data and ebbs and flows. However - one metric really jumps at me.

We are at the highest levels ever in terms of the percentage of the money in circulation deployed into equities. So, based on the behavior of participants, we are saying that buying now is a better entry point than when the S&P had a PE below 10, dividend yield above the 2YR Note, and we hadn’t even gotten the lift from 401K/IRAs yet. Wow.

Nonetheless - this week the big moment arrives . . . . . . . “the most important Fed meeting in history”. Not really sure what Powell could do to provide even more of a bullish surprise impulse (100 BPS cut stocks soar then plunge realizing he’s in a panic?), so even with a 50 BPS cut Risk On has already front run quite a bit of exuberance. Will be interesting to see how credit reacts versus equities. My senses are telling me equities may very well do everything in their power to spin this Fed Meeting as uber bullish while credit may view it with more skepticism and caution.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Data from Glassnode - did the short term holders (less than 3 months) suffer enough losses here recently (Blue Circle) or does it need to get more painful as it has previously?

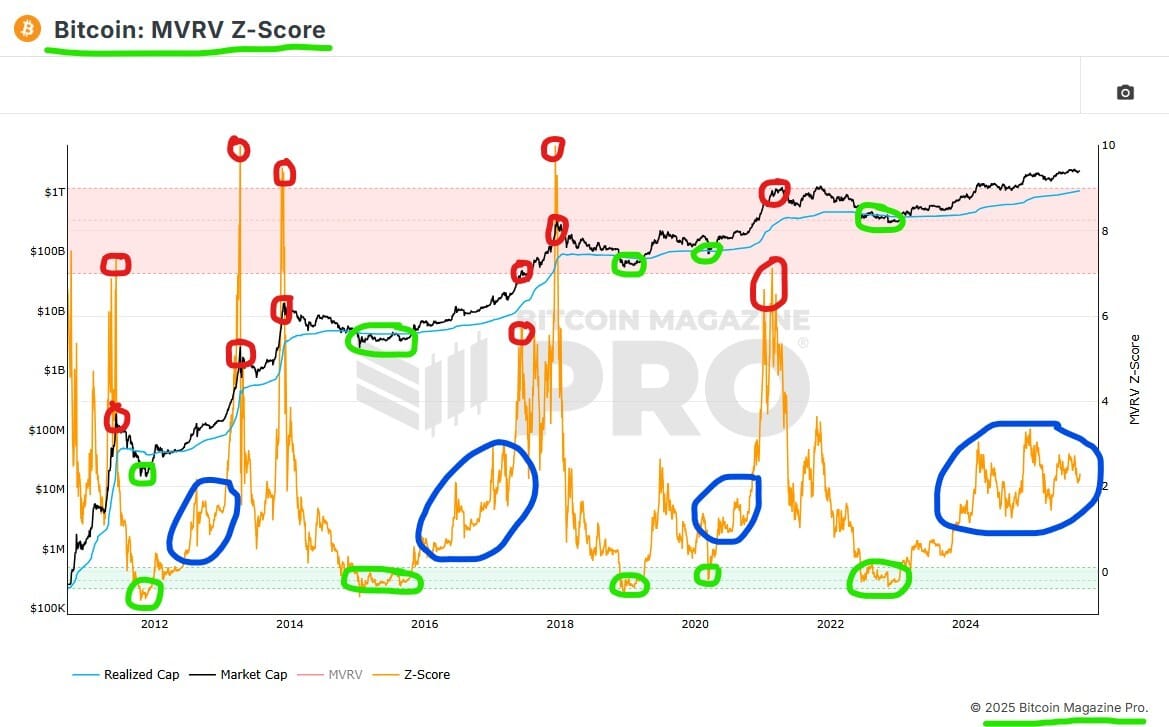

MVRV Z-Score

Another great tool from BitcoinMagazinePro.com - the MVRV Z Score has been pretty accurate over the years giving you the Green and Red signals. Right now it’s continuing it’s pattern of confusion and lack of clear cut direction - if you think about it that’s not a bad way of describing Bitcoin trading action as well in 2025. Let’s compare the Blue Circles . . . . . . . . . it is plausible and possible we are still in a warm up phase or getting cranked up for future action:

Liquidation Heat Map - Two Week Time Frame

Note the bulk of the liquidity underneath has shifted upwards to that $109Kish hot spot:

Bitcoin Bottom Line:

Let the market tell/show us what is next

The Money Flow on the Weekly flipped to Green

As stated last week, yes we got the bounce off of the $107-$108.9Kish zone and it looks almost perfect except for lack of Volume and Conviction . . . . . . . . . this is a very proper zone from which to bounce in my view but not out of the woods just yet

$117.5Kish, $118.5Kish

Let’s see how business is resolved with $116K and how this weekly candle closes, there is potential for that bullish weekly candle to appear that is desperately needed at the present time

Note the liquidity creeping up below to that critical $109Kish zone

Show us an aggressive break above $120.8Kish and in my view the Money Flow will start to show up in a much more significant way

Here we go again Green on Monthly and Weekly but will it do it this time? Already had multiple chances in 2025 to really run away . . . . . . .

A new Lower High yet again is still very much possible . . . . . . . my senses are this is a major factor the market is monitoring, will it set another Lower High vicinity $115-$116Kish or is this bounce from a well soiled launch point the real deal?????

Risk On/Off

With NVDA and MSFT behaving the ‘Melt Up’ picked up even more steam this week.

NVDA Weekly

HYG Weekly

COIN Weekly

Did the Oracle stick save and BTC flipping Green on the Weekly give COIN a chance here to get back on track?

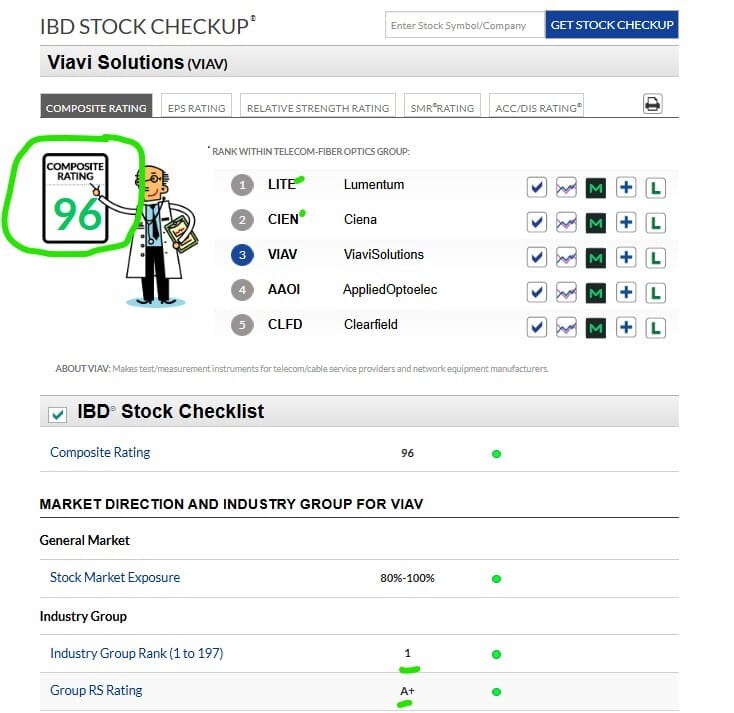

There is one IBD Industry Group that has really rocketed up the rankings recently: Telecom - Fibre Optics. This could very well be the AI Trade and ‘Melt Up’ sucking forward another new Industry Group into the AI Infrastructure basket from the market’s standpoint. This might be a fairly bullish sign that it is expanding to other sectors.

We took a good look at FLEX right here in this post several weeks ago. Worked on this one weeks ago building.

FLEX Weekly

VIAV

Been working this one last week, earlier this week, and Friday.

The IBD Industry Group is taking off like a rocket, perhaps turning the corner here with this one picking up sales/earnings momentum? We’ll look at the chart as well to see if the market thinks so.

IBD says it’s under heavy accumulation. We’ll see if some funds start sniffing it out more.

Many in the group are way, way past reasonable entry points with maybe VIAV not yet moving as much. Time will tell.

VIAV Daily

Risk On/Off Bottom Line:

Got the stick save yet again with the ORCL forecast . . . . . . . is the forecast insane???? . . . . . . maybe . . . . . . might not matter in the here and now it provided another jolt for the ‘Melt Up’

If new groups start launching forward showing they are “joining the AI Trade” that is rather bullish frankly . . . . . . we got one recently

On Tuesday and Friday this week yet again we had scenarios where equities and Risk On “should have” broken down and suffered more . . . . . but here we are again with equities being bought up throughout the week in a bullish manner

CTAs and positioning reasonably chiller but absolutely still pushing forward long biased

Million reasons for the bubble to burst eventually, in my view the key is still to watch for the indices to have big down days on increasing volume closing at or near the lows for the day with Leading Stocks getting hit hard . . . . . . . . until then I’m not sure what steps in front aside from the two factors discussed (credit/AI Trade)

NVDA sneaks above $170 and on Friday MSFT glided above key level

LT yields are very helpful currently to Risk On and the AI Trade seemingly has a new lease on life and perhaps a runway through the end of the year

Might need Powell to explicitly break hawkish this week for high as a kite on giddiness stocks to view the Fed as any type of obstacle in the here and now

Fed Meeting could cause a pivot in LT yields . . . . . . but even so it will take time for yields to grind higher to the point where they clip equities

Upside bias remains until Leading Stocks are getting hit hard on big volume in my view . . . . . . . . . . this is most plausible scenario in the near and intermediate term

Though I’ve added more exposure recently very cautiously I’m not out here swinging wildly by any means, prudent and cautious and VERY aware of risks to Risk On

STX Weekly

Stacks to me isn’t a perfect signal by any means, but I find it to be an intriguing proxy or barometer for the Risk On appetite specifically within Bitcoin. Looks like it is definitely aware, awake, and listening to Bitcoin move off the $107Kish, but there is not yet any strong thrust of Volume or Money Flow.

HYPE Daily

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: sold another 15% or so of that stash so total about half sold, this one vicinity $114Kish. Total about half of mining stack converted to fiat and earning. UPDATE: sold another 5% or so at $112Kish. More than half sold total.

If the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is Green on the Weekly so shifting accordingly. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. Watching any bounce from $107Kish very closely. Could long or wait for yet another lower high then long SBIT again but with an even bigger position. UPDATE: No position will see how $116Kish works out.

TBT back a bit

Alex Grey

Mystic Eye