This Is Not Investment Advice

Looking back at the report from this most recent Sunday, we noted the following:

Some commentary from The Market Ear at ZeroHedge.com regarding the ‘Melt Up’:

Here’s the IBD Big Picture for after the July 9th session:

It’s been more or less more of the same since except perhaps for the situation with bonds. I see definite signs of wobbling in Japan and the UK and Germany, but bonds have rallied a bit here in America. Japan’s challenges perhaps are giving Bitcoin a kick in the rear as well.

Back to Japan

With a critical election looming and the rice crisis worsening, we can see more Bond VOL brewing in Japan already. This is something we have discussed here for years and a lot more in recent months. The chart we keep displaying tells you more than what you would get watching CNBC for hours.

The below is the JGB 30YR 4HR - lotta dumping these last few sessions in a hurry:

Let’s see what happens. As discussed many times already, I am not fighting this ‘Melt Up’ as shown below and previously looking to further capture it in the best way possible preferably.

Bitcoin Weekly

Bitcoin 4HR

Here is my reaction to this latest move and pop above $109.5Kish for now . . . . . . . . note the volume surges with the lift off of $105.9Kish and $109.5Kish on this 4HR. This is a positive sign but follow through is needed for sure.

BitcoinMagazinePro.com M2 YOY vs BTC YOY

Liquidation Heat Map - Two Week Timeframe

Bitcoin Bottom Line:

Let the market tell/show us what is next

For now it appears there is a break above $109.5Kish after what should have become very obvious in terms of BTC battling this level and the multiple other ones noted here many times . . . . . . . this is preliminary, it needs to follow through and continue or else could be right back into the box or worse if a failure occurs

In addition to mounting FA positive factors the environment is quite helpful now to BTC except for the steepen/flatten dynamic which is ‘dynamic’ shall we say . . . . . . Risk On storms ahead so what is stopping Bitcoin? Where is all the big volume and Money Flow to take it much higher? Time will tell.

Moving a bit on its own now note Gold and Silver not leading the charge this time for now

The setup is there yet again, knocking on the door of the Moon shall we say, but will Bitcoin take advantage at the End of the Day or does Mr. Wong see more time looking up at a Moon not fully shining bright

Risk On/Off

HYG Weekly

High Yield Debt is behaving quite bullishly actually still:

QQQ Weekly

Yeah volume is generally weak, but Price and Money Flow keep chugging along bullishly as of now:

Risk On/Off Bottom Line:

Yes there are a million reasons why we should get a sharp correction . . . . . . . . put/call ratio strikingly low . . . . . . fear/greed back to flashing massive greed . . . . . . . “it’s gone up so much” . . . . . . . . too much spending who will pay for it all???? . . . . . Buyback Beast on hiatus . . . . . and the list goes on and on

Leading stocks are performing well . . . . . . . and not only that but some of the biggest players around (MSFT, AMZN, NVDA) have either just entered buy points or recently broken out of buy point areas . . . . . . so the biggest players could be charging even higher . . . . . . me personally I am not standing in front of that

New leaders are also emerging, very bullish sign

Yield Curve in America is providing challenges with the flip flopping between steepening and flattening and signaling growth versus stagflation . . . . . . how much of this is capital flight BACK into America???? We don’t know but though Risk On continues to surge debt is giving multiple different signals

My warning signs will intensely flash Red if/when leading stocks start getting hit on volume and the indices have more and more rallies intra-day that fizzle into the close

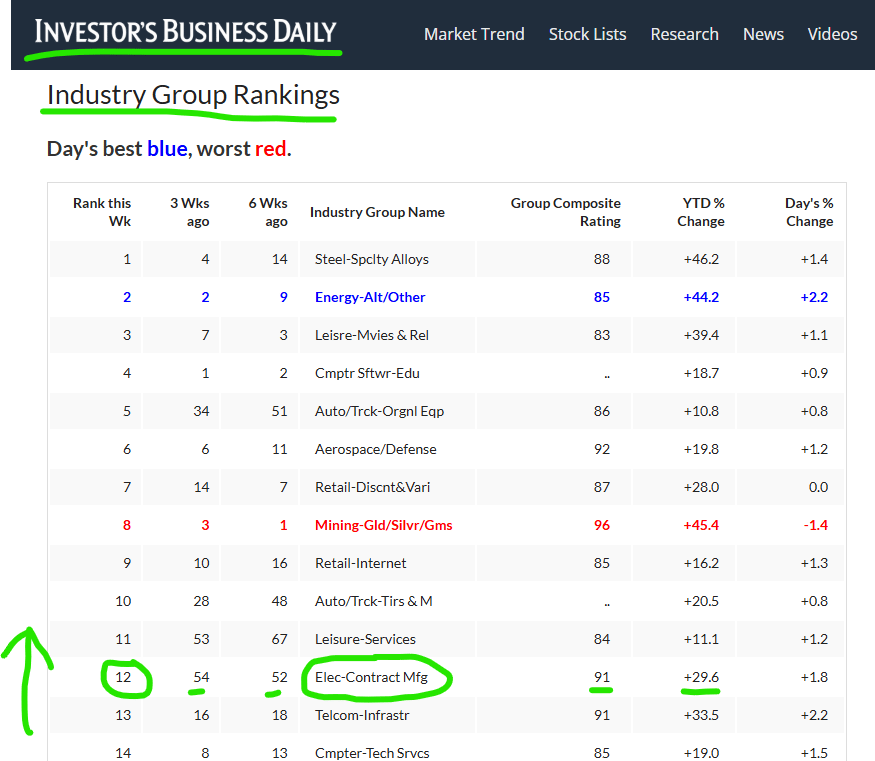

Top Industry Group Targeted . . . . . . . Will They Let Us Join The Fun?

Very interested in getting a decent entry into this group:

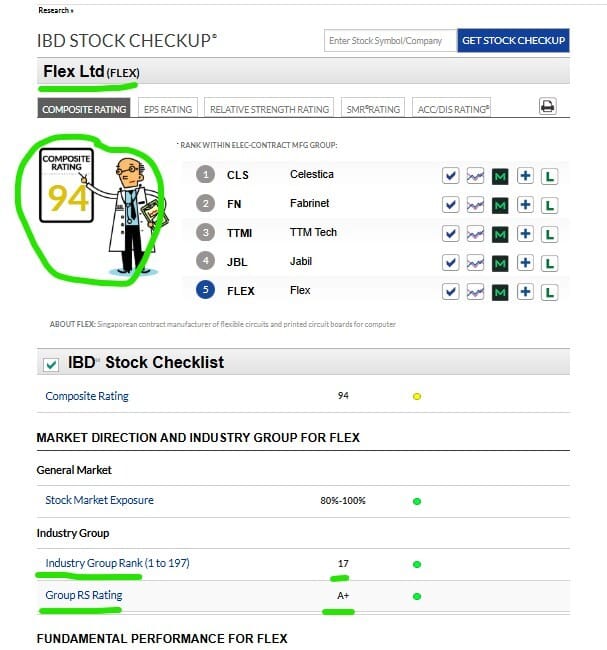

FLEX intrigues me:

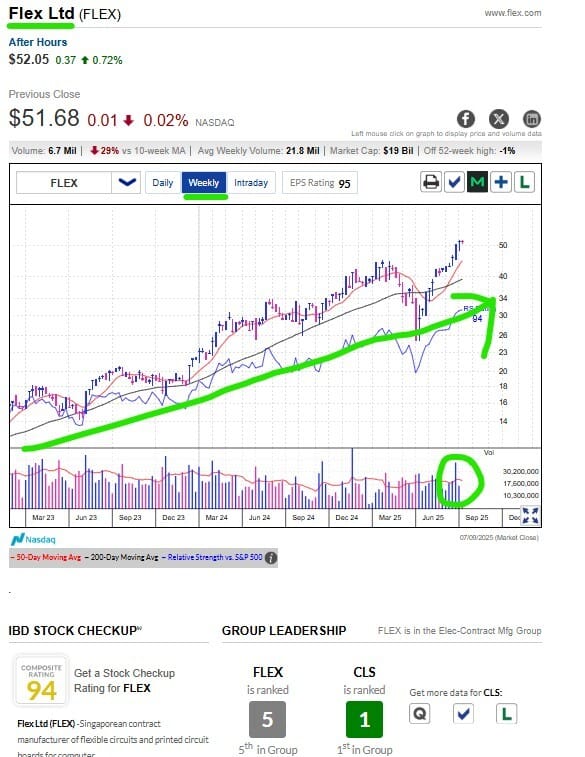

Very, very bullish action well prior to the ‘Melt Up’ rebound from the Trade War:

Get Matched With the Best HRIS/ATS Software, for Free!

Does researching HR Systems feel like a second job?

The old way meant hours of demos, irrelevant product suggestions, getting bombarded with cold emails and sales calls.

But there’s a better way.

With SelectSoftware Reviews, spend 15 minutes with an HR software expert and get 2–3 vendor recommendations tailored to your unique needs—no sales pitches, no demos.

SSR’s free HR software matching service helps you cut through the noise and focus only on solutions that truly fit your team’s needs. No guesswork. No fluff. Just insights from real HR experts.

Why HR teams trust SSR:

✅ 100% free service with no sales pressure

✅ 2–3 tailored recommendations from 1,000+ vetted options

✅ Rated 4.9/5 by HR teams and trusted by 15,000+ companies

Skip the old way—find your right HRIS/ATS in a new way, for free!

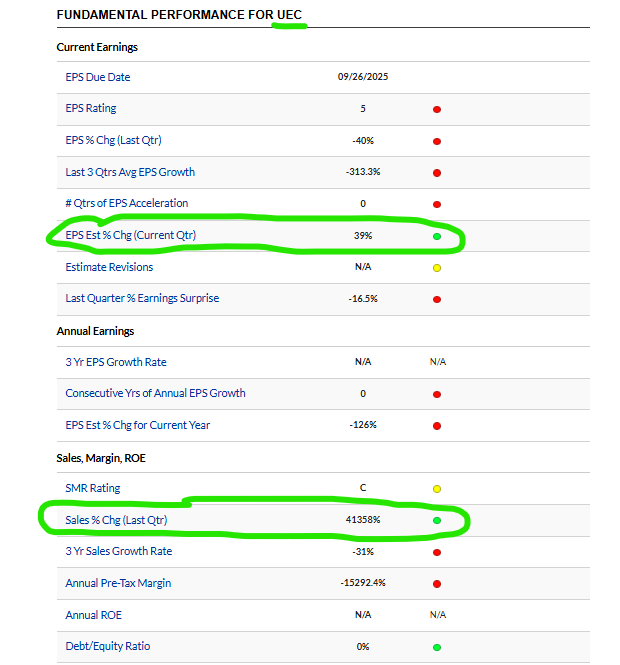

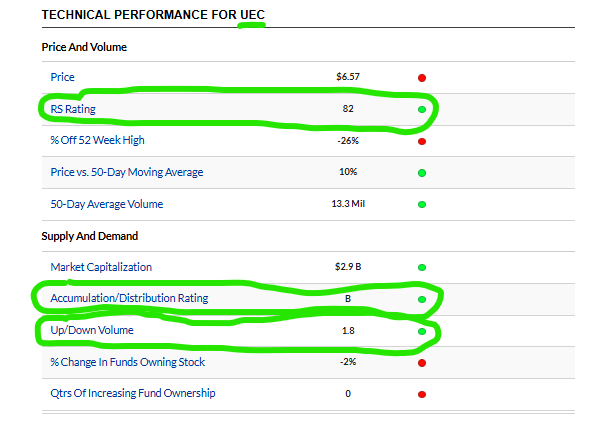

Added to UEC And Building More

Been chipping away at this one. I am very bullish on the Industry Group. It will take time to get a lot of projects approved but we may have sustained demand growth for Uranium and services for a decade or more.

It’s not the top performer now by any means, but I’m intrigued (beyond just the group) by the trading action, A/D rating, and recent liveliness with earnings and sales growth.

This trading action intrigues me as well:

Subscribe to our brand new YouTube Channel

Matthew Wong

End of the Day