This Is Not Investment Advice

Does it matter? We can all see on-chain activity for the Bitcoin network is a bit light and most certainly has not risen along with the exchange rate since the fall of 2024. In a general sense over the years transaction activity would rise along with bullish price action, but we haven’t really seen that this time. Why? Or, so what? Does it even matter? I think it does but not in an emergency or crisis type of way.

Glassnode recently took a dive into this issue to see what is exactly going on here. The chart below shows what they call Monetary vs Non-Monetary transactions. The Monetary are what you would imagine and the others are things like Runes, Ordinals, etc.

As shown, the typical transactions we would expect have been relatively stable while things like Inscriptions (and retail participation) have faded in and out.

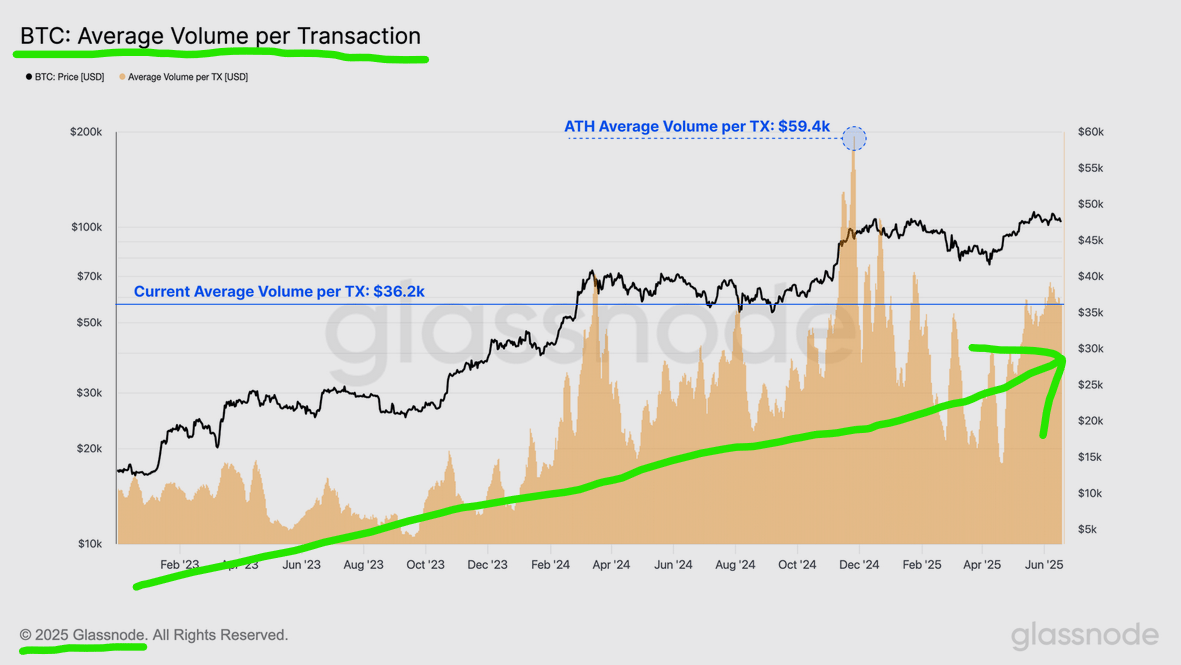

The chart shown below depicts that the average volume in fiat per transaction has been generally rising. I view this as a positive trend overall showing more confidence by participants in using the Bitcoin Network to settle larger and larger transactions. I also see this as more evidence of the lack of retail participation specifically since the fall of 2024. Bitcoin made some big moves since then, but retail is still very quiet in terms of trading/investing and perhaps also as well in terms of day to day use of Bitcoin.

This chart shown below is quite interesting. We can see that during prior bullish periods, the Fee Ratio Multiple would drop meaning a higher percentage of miner revenue was driven by fees with the bullish price action and sentiment. We are clearly not seeing it this time as shown here:

Here’s a few things I take from this, all of course simply my own humble opinion and nothing more:

In terms of trading/investing, Retail remains a near non-factor as we see that via exchange action but also the lack of retail transactions and boosts to fee income based on activity

Larger participants and institutions continue to drive a lot of action, ETF has more influence than many of us might like

the easy come, easy go nature of Runes and Inscriptions in terms of impact on transactions/fees further indication of the in and out nature of retail’s participation and grass roots, ground level adoption

Adoption and Medium of Exchange and other metrics many like to assess and critique are not absent or gone, it’s more like the network is much further along as a settlement layer than it is as a “coffee shop medium of exchange” at the moment