This Is Not Investment Advice

Reviewing Updates to Risk On/Off Posture

First, a few reminders:

We do not make predictions

We do always strive to view with an open mind the tools and resources that we know are effective

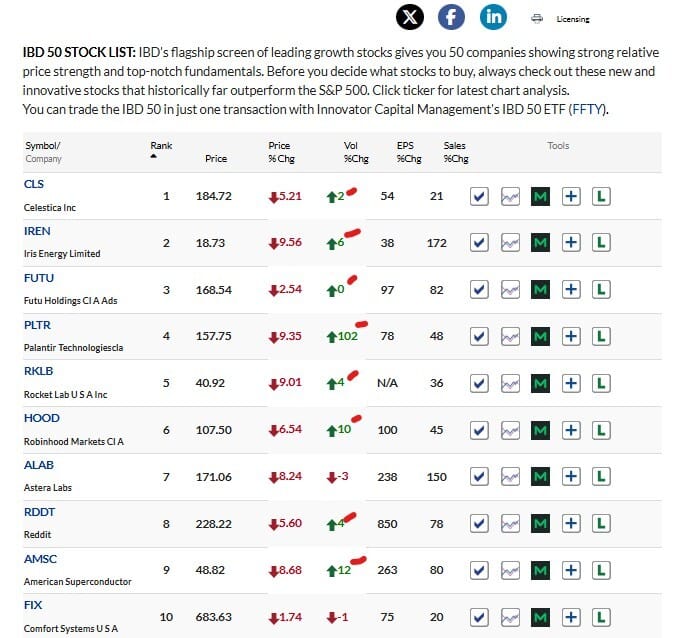

Here is a snapshot of the top ten stocks from the Investors Business Daily Top 50 after the close on 8/19:

This is not a bullish sign. We have stated repeatedly since the ‘Melt Up’ began in mid-April that one of the key warning signs to watch for is Leading Stocks getting hit hard. That is starting to happen now.

Swap, Bridge, and Track Tokens Across 14+ Chains

The Uniswap web app lets you seamlessly trade tokens across 14+ chains with transparent pricing.

Built on audited smart contracts and protected by real-time token warnings, Uniswap helps you avoid scams and stay in control of your assets.

Whether you're discovering new tokens, bridging between chains, or monitoring your portfolio, do it all in one place — fast, secure, and onchain.

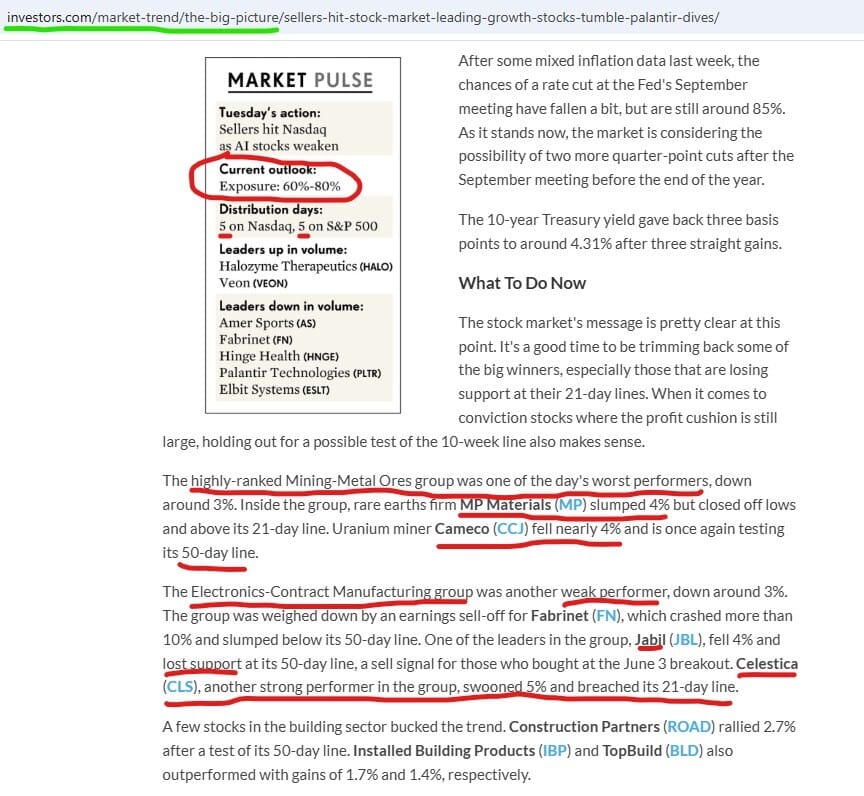

There were several important aspects of The Big Picture published by IBD after the 8/19 session. Let’s take a look at them.

Here are notes on some Top Industry Groups:

QQQ Daily

For me personally, I am maintaining the cautious stance and defensive posture. In my view - equities started to see very notable distribution a couple weeks ago and now we may be seeing the follow through - i.e. the Accumulation/Distribution warning signs apparently were accurate.

Bitcoin Weekly

$117.6Kish

$116.4Kish

$111Kish

$109.8Kish

$108.7Kish

$107Kish

$95-98Kish