This Is Not Investment Advice

An Arms Race Can Get Carried Away . . . . . . . . IBD Industry Groups Uncover More Players . . . . . . Adding Two More to Watch List

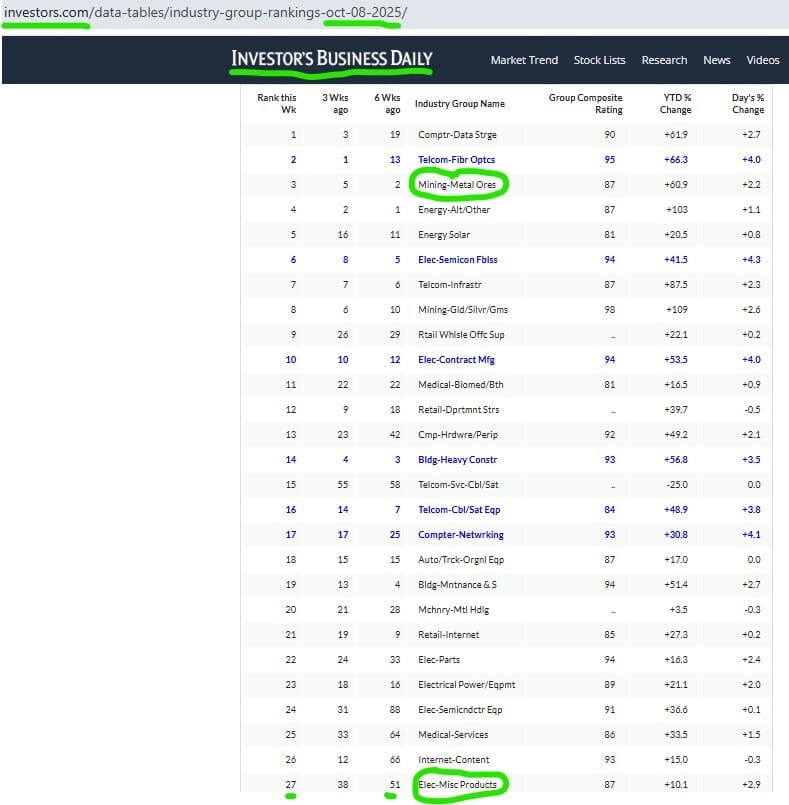

First - why? Things are moving very rapidly. Markets are not waiting around to identify and seize things that are “mission critical” such as uranium, rare earths, and even AI infrastructure in general.

Before getting into the two stocks, let’s take a look at a long term Weekly chart of a recent addition (LEU) we grabbed when it traded under $300 a few weeks ago:

Sustained increases in trading volume can be very bullish in my view. The key component is the ‘sustained’ part. Volume can spike on a dud due to M&A or something else but does it continue? The trading volume for LEU has increased very substantially. This means not only do a lot more people know and track the stock . . . . . . . a lot more institutions are active as well with this added volume.

DVLT

Proprietary tech to use AI to disrupt audio waves and more. Just got a huge cash infusion and has active clients with the new AI tech.

DVLT Daily

This is a Daily chart. Keep that in mind. DVLT is a long, long ways from where LEU is in terms of establishing the attention of the market. The question is if this recent huge surge in trading action is signs of more to come?

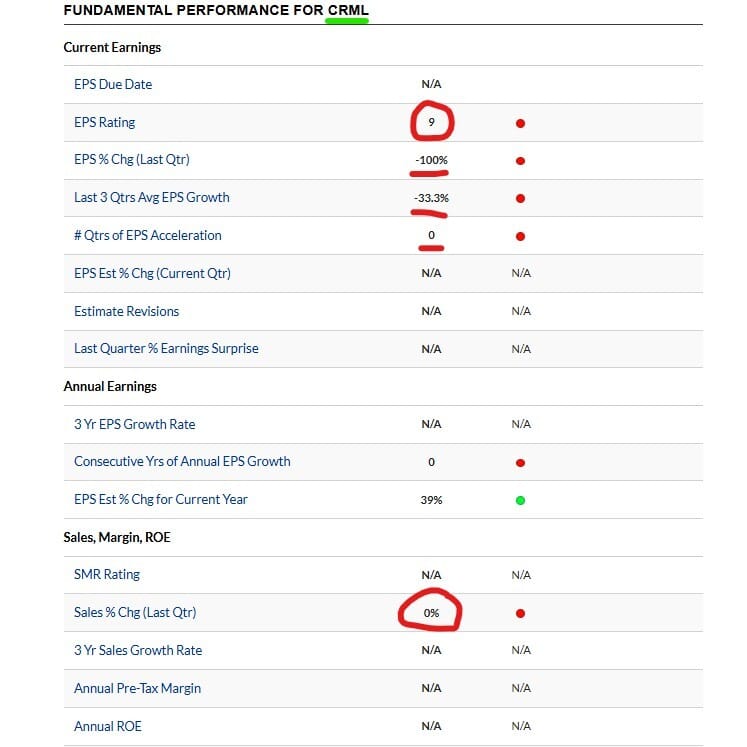

CRML

Rare earths and more.

CRML Daily

Thoughts and observations:

DVLT has ongoing cash flow, CRML not so much

Two more instances where RS is sky high yet the typical “fundamentals” are currently lagging . . . . . . . . . market is a discounting mechanism that seeks out the max pain possible by moving instruments to extreme points

Another scenario where in my view investors must ask themselves if they want exposure or more exposure to these facets of the market . . . . . . if so must operate in the conditions that exist

Up/Down Volume, Acc/Dis, and institutions moving into CRML is eye catching

Up/Down Volume and Acc/Dis for DVLT is eye catching

Challenging scenarios to find a proper or excellent entry point . . . . . . . . sprinkling as best as one can is a potential option by watching Lower Time Frames closely . . . . . . . . . in my view would deploy capital in pieces if desired with this level of volatility and movement as best as possible and not betting the farm obviously