This Is Not Investment Advice

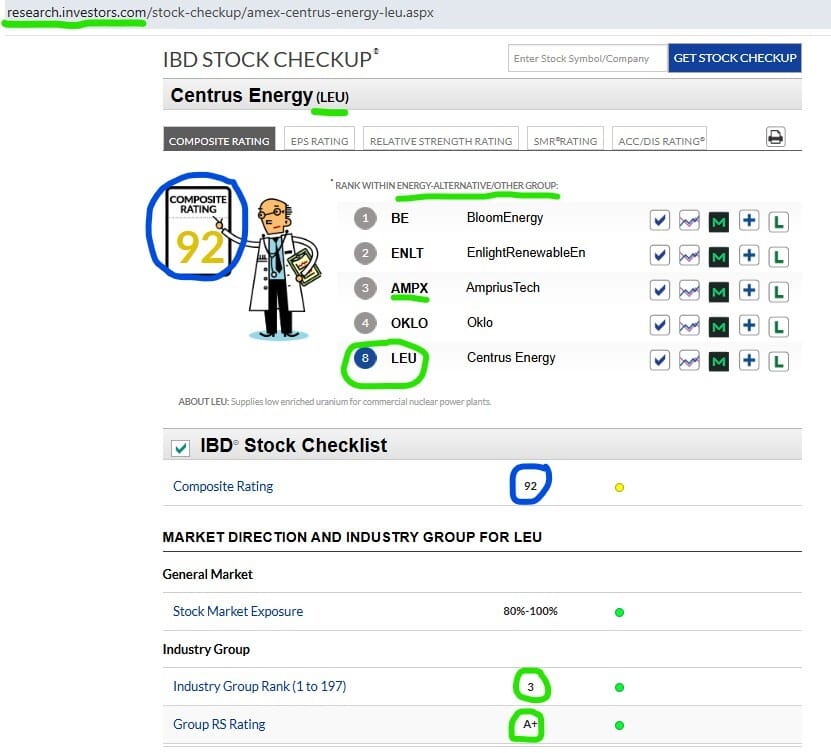

All Three of These High Fliers Come From a Top Ten IBD Industry Group

This post will look at three stocks from two key Industry Groups:

Mining - Metal Ores

Energy - Alt/Other

Founders need better information.

Get a single daily brief that filters the noise and delivers the signals founders actually use.

All the best stories — curated by a founder who reads everything so you don't have to.

And it’s totally free. We pay to subscribe, you get the good stuff.

LEU

Sole license holder in U.S. of critical components/materials for Low Enriched Uranium. Holds all the cards for a while and by the time others join it won’t matter.

LEU Weekly

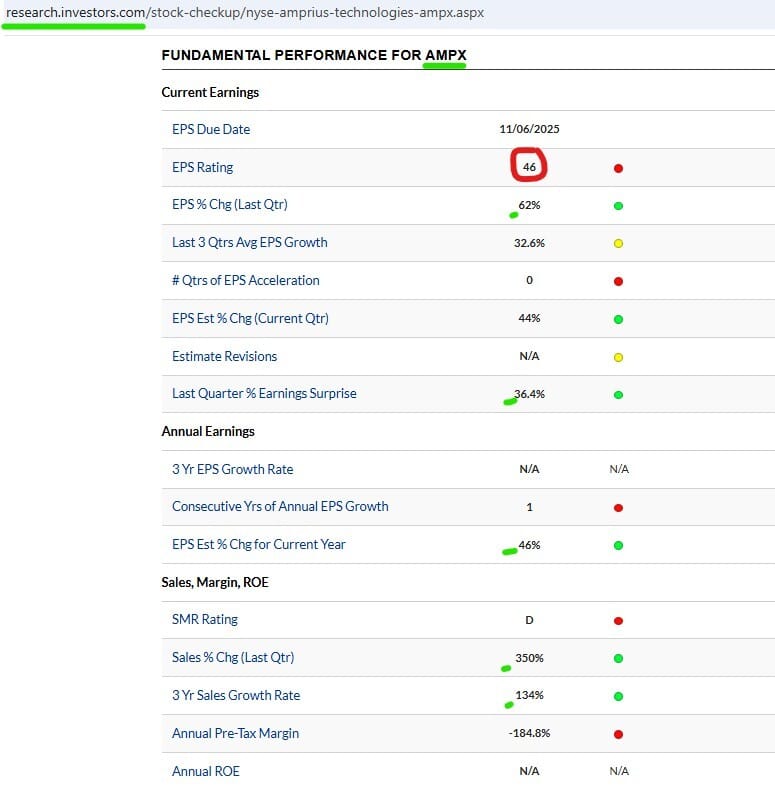

AMPX

Batteries for drones. Department of War needs a lot more drones and they’ll get them one way or another. Just reported results that blew out estimates big time.

AMPX Weekly

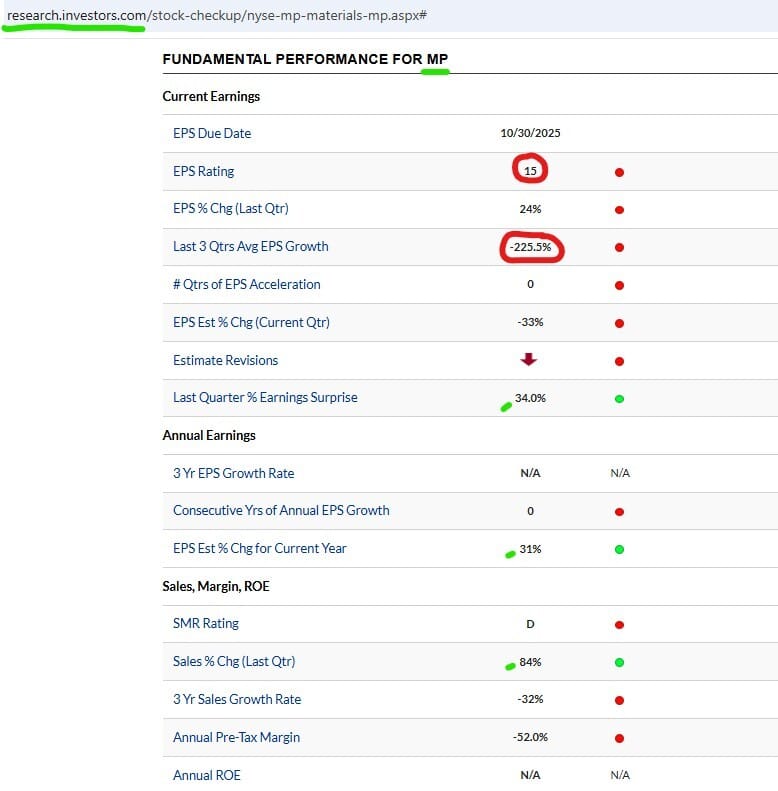

MP

Holds a very nice hand on rare earths. Department of War already invested and has minimum purchases planned. If the Department of War needs these resources they’ll get them one way or another.

MP Weekly

So - what to do with all of this and these stocks? These scenarios present a dilemma for me personally. Exposure would be appealing, but buying something that is extended can be highly risky, particularly if market momentum for Risk On shifts.

Thoughts and observations:

all three of these stocks currently have poor/weak EPS ratings and “fundamentals” on paper . . . . . . . the market is a discounting mechanism . . . . . . . . consider asking WHY they have a RS of 99 in some cases with current weak earnings . . . . . . . . . . each perhaps sits in a certain position currently that the market wants badly

If Risk On actually enters into a perfectly beautiful and contained correction . . . . . . . then these stocks might give you an absolutely perfect, dream setup . . . . . . things don’t always work out that way

Max Pain arguably right now is UP UP UP . . . . . . . . if Risk On stays in rally mode these stocks are not likely to gently come down and tap you on the shoulder and say “hey now you should buy me”

Again - IF a meaningful correction there could be some nice options here, again IF

AMPX recently broke out and is forming a tight consolidation, MP/LEU both formed decent looking bases here . . . . . . . . . . . . . who knows what might happen in the ‘Melt Up’ these are real Wild Cards here

I’ve done some small nibbling in AMPX this week. Watching closely on Lower Time Frames.

If you’re very bearish and seeking a hedge, long the market’s highest fliers is one method.