This Is Not Investment Advice

****Add Bitcoin Rewards To Your Mobile and Web Apps - Increase Daily User Engagement and Revenue****

The Market Right Now - Rare Earths

Generally I certainly don’t obsess about “financial news” and stock specific news. It’s already baked into the chart in almost all cases outside of bizarre Black Swan type events. However - in this case and facing this scenario right here and right now . . . . . it is a bit different for some investments related to the ‘Melt Up’.

With Rare Earths and Uranium as examples . . . . . we have scenarios where there simply isn’t any cash flow at all or any meaningful cash flow at the moment. The market is primarily focused on the assets in possession and activating and monetizing the assets. I can’t predict the news and never will be able to do so. No point in worrying about it.

Given that - let’s check in on our Top Play in the Rare Earths space. Let’s see what is going on and if we are on course or off base with this play. Analyzing the specific news in this case makes more sense to me so we can see the most important part . . . . . what does the market think and how is it reacting.

NB

NB Weekly

Thoughts and observations:

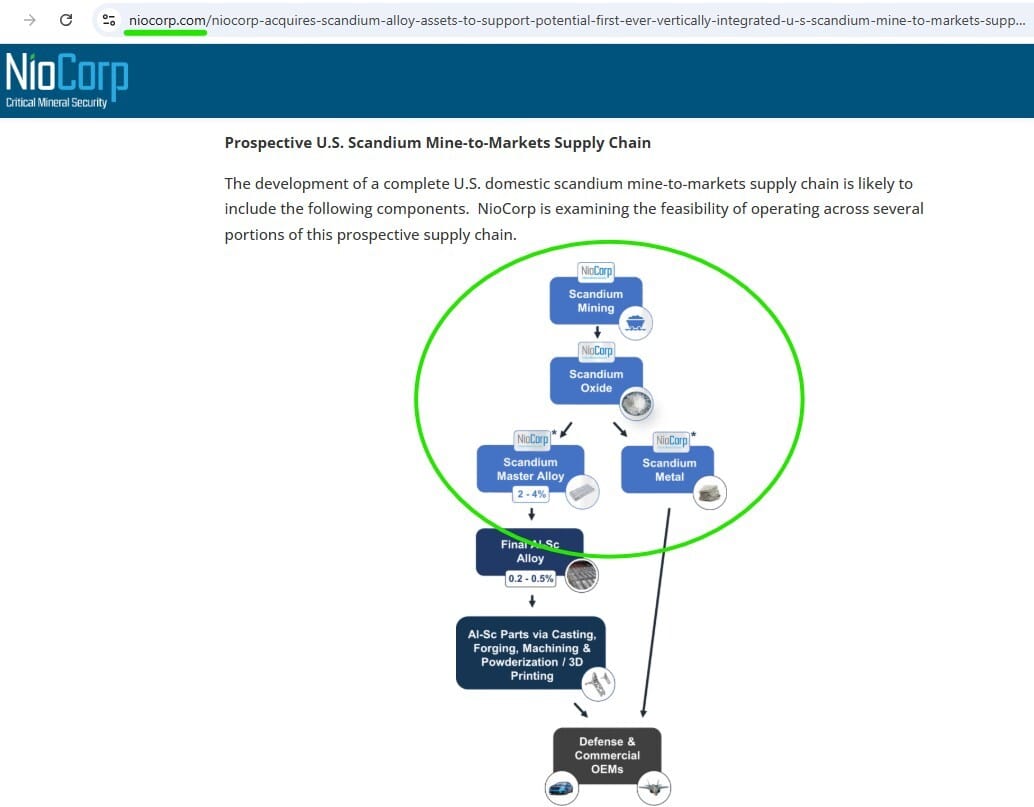

Company claims just the current project under consideration formally and officially has a Net Present Value of $2.5B and can provide EBITDA of $400Mish for 38 straight years . . . . . . from the news above Scandium would be a business above and beyond that . . . . . and there is also the battery and magnet and refining opportunity as well for full vertical integration in the United States . . . . . .

This Scandium stuff is not speculation in my view but far from a guarantee . . . . . the company is projecting in good faith that it is plausible . . . . . . looking at the image they provided above a vertically integrated scenario such as that would be of very high interest to the Department of War (Scandium and the Niobium they already have lined up) and many other large customers potentially . . . . . . they still need financing for the heavy lifting portion of this Elk Creek project . . . . . . .

Interesting tidbit (look at checkup above for NB from IBD) . . . . top stocks in Mining - Metal Ores for Accumulation/Distribution at the moment all about Lithium and Copper . . . . . .

NB . . . . . . had the offering a few months back so they are good for the $44M to build the entry way Mine Portal . . . . need a big chunk of cash to kick the actual big stuff into gear . . . . . they are setting themselves up to be an extremely attractive partner to anyone in America concerned with National Security and economic growth . . . . . so who will step in to help with the financing??????

I fully realize others are more advanced at the moment (say MP and LEU both of which we have exposure to) . . . . and in some cases the market reflects that . . . . . . so where is the market showing interest without having allowed or revealed too much investor fun to take place yet . . . . and where can we avoid overhyped junk that is far too speculative . . . . maybe that is NB . . . .

Considering the company has no operating cash flow and needs a bunch of cash to ultimately get where it wants to go . . . . . I gotta say not too unhappy to see Acc/Dis rated A- and Up/Down Volume at 1.0 with the stock hugging its 10 Week EMA . . . . . and the Weekly Chart tells me the bulk of the selling already happened and likely more longer term capital sits holding most now . . . . . .

My posture . . . . . it is not yet my biggest ‘Melt Up’ play but it could become that . . . . . will continue nibbling/adding over next year or so likely . . . . . . I’m not “trading” this right now this is a position I want to build further fully acknowledging I can’t control the headline risk . . . . . I have no idea when or exactly how this stock might ultimately start to really move my main concern now is seeing if/how much alignment there is with the potential and the market action . . . . . I like what I see the market is treating this one quite well actually considering it has no cash flow and needs more cash and liquidity in a big way before the real fun might start . . . . .