This Is Not Investment Advice

Quantum Computing - Do We Want Exposure To This Now?

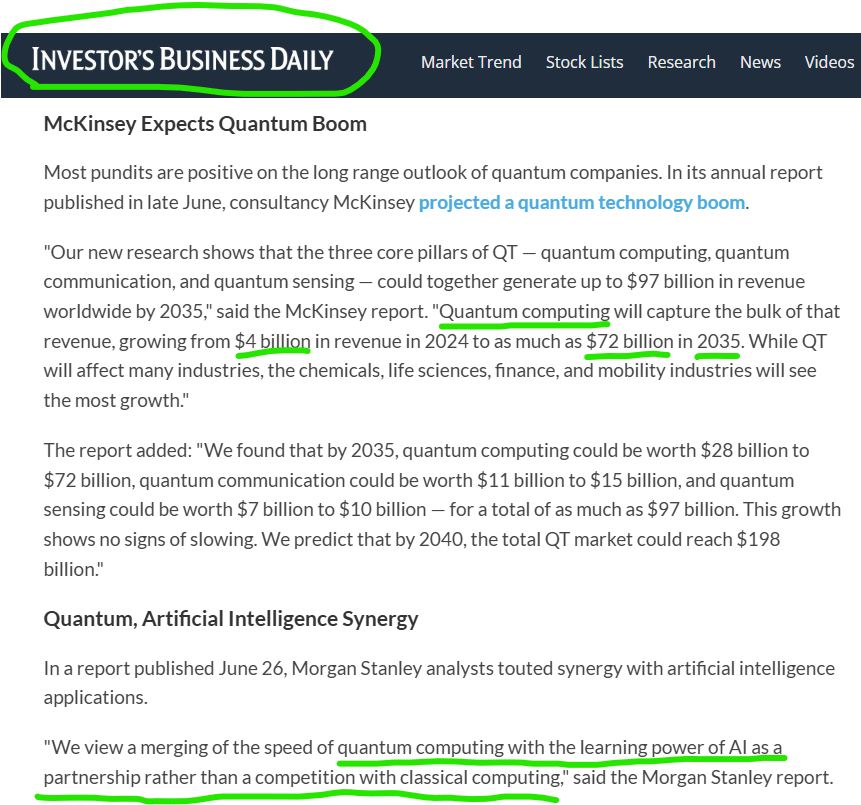

First - why? My senses have been strongly leaning since early April towards the possibility of a legitimate new Bull Market in equities that could last a while along with the ‘Melt Up’ and Option B sponsored by Treasury Secretary Bessent. Ok then, who are the big winners going to be? Let’s check in on Quantum Computing.

Here is a broad overlay of some recent activity and insight:

How is the group doing? The “quantum computing stocks” are tucked inside the Computer Hardware, Periphery grouping. Bear in mind not every single stock in this group is a “quantum stock” per se. As we can see the group was red hot 6 weeks ago and has been bouncing around:

Makes sense as we all heard lots of noise and hype about Quantum Computing throughout 2025, so naturally the equities would be trading up and down with this as the market tries to digest what is going on here.

Here’s the Top 5 in the group:

I am a bit intrigued by QBTS. Not a tiny little ant that trades like a penny stock yet perhaps not fully absorbed and devoured yet by the market. Let’s look deeper:

Earnings - not so hot, getting caught up with the rest of the group perhaps:

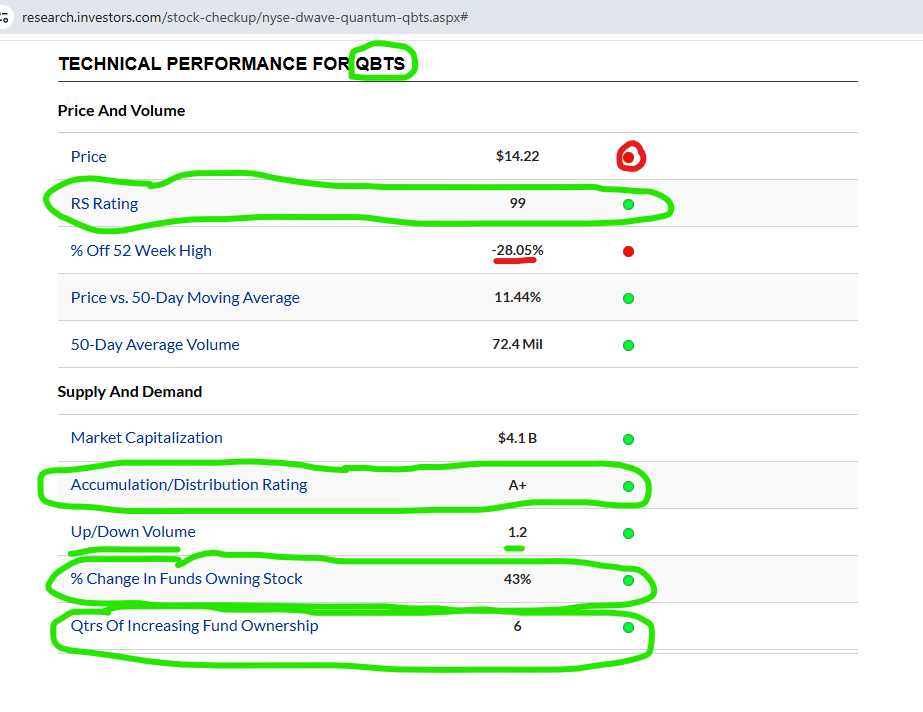

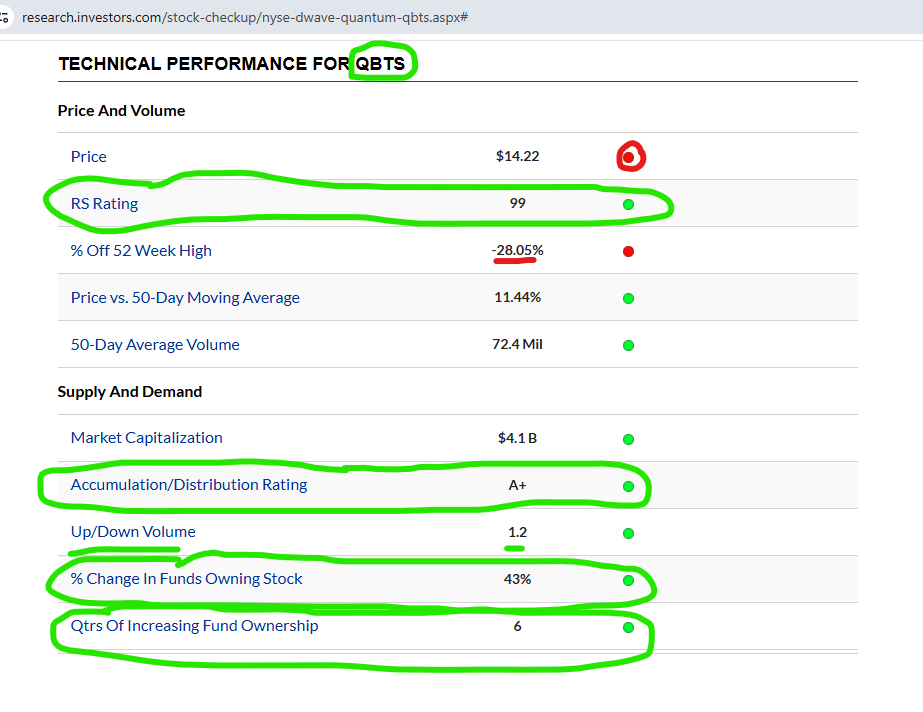

So what this means is that RIGHT NOW this stock does not rank all that well for EPS growth, but remember the market is a discounting mechanism. Let’s look at some other factors:

Do I want exposure to Quantum Computing as a play or a sector if you will? Yes.

So let’s look at QBTS:

EPS growth lacking currently, but in a group that many project to be growing rapidly and possibly bringing transformative and revolutionary tech to the marketplace

RS is 99/100 meaning the stock is moving and in a very good way overall

Funds keep buying it as it’s been 18 months straight of increasing fund ownership

Accumulation/Distribution rating of A+

And of course, the chart:

Conclusion:

I am building a position

Sector appears to be consolidating recent huge gains and maintaining very bullish posture in terms of Price/Volume and Accumulation/Distribution

Institutions have been buying this for a while and the RS is still a 99/100, tells me Da Boys want exposure here