This Is Not Investment Advice

‘Melt Up’ Heading For Another Battle

My views and senses related to the ‘Melt Up’, BOMO, pressure higher on yields, and others haven’t changed at all. However - over the next say 2-60 trading sessions we could see higher VOL and still very much stay on a long term trajectory of the ‘Melt Up’. Specific to equities (and BTC via the Money Flow coming in/out from the ETFs and TradFi) I discuss below some factors that could strongly suggest that some of the drugs and booze are getting yanked from the party house soon.

Not calling for anything imminent - in fact could easily see new ATHs first along with all the media celebrations, etc. Perhaps GeoPoly can swing in both directions and end up not as bad as feared. Just saying the equity market is at such extremes in some ways there is a point where you have to bring the fighter jets back in and let the engines cool off.

Bitcoin Monthly

Bitcoin Weekly

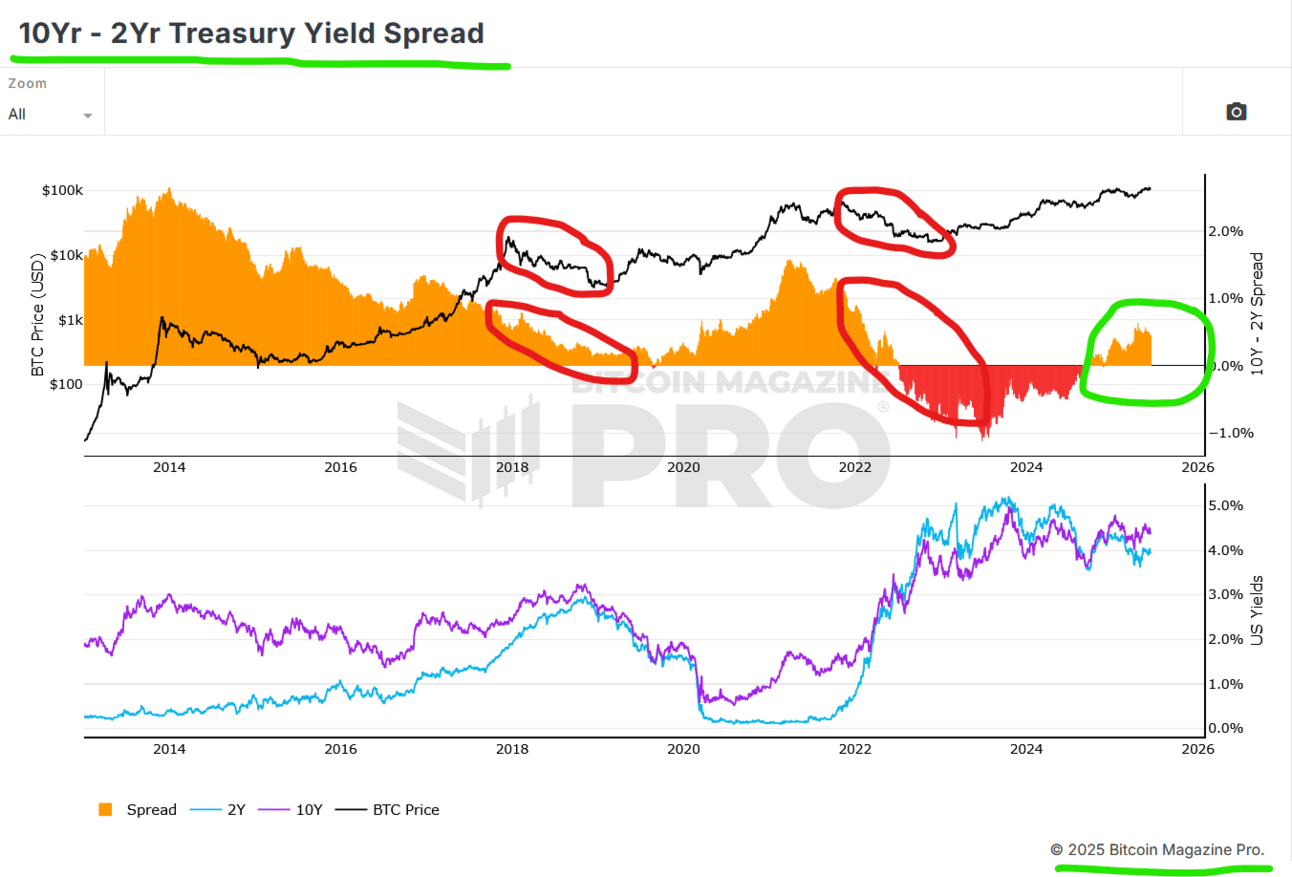

Yes, yields have enjoyed the hit to forward econ projections dropping from the oil spike and the “flight to safety” in war, but either way this trend shown below from BitcoinMagazinePro.com isn’t going away and can accelerate when the debt issuance really picks up:

BTC tends to enjoy curve steepening and positive real yields:

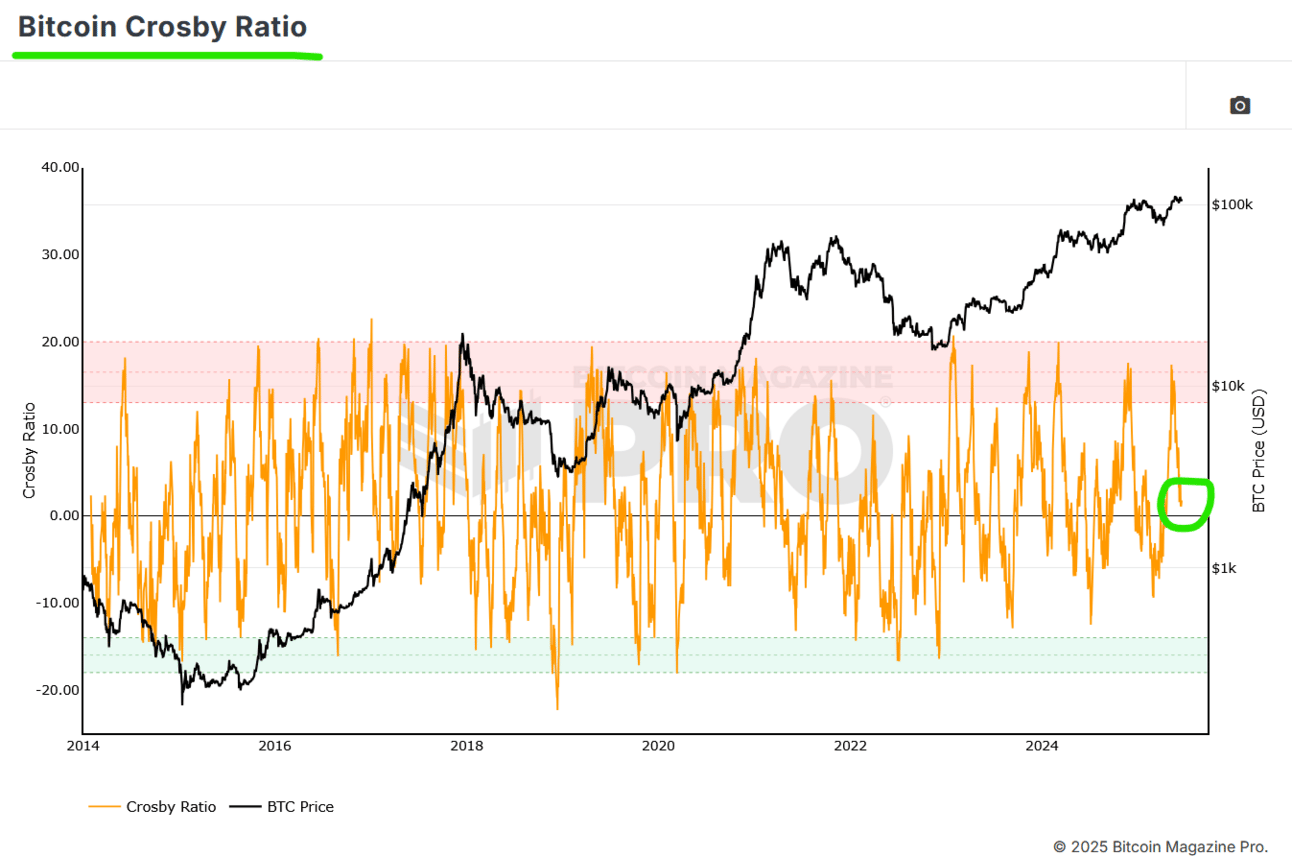

Crosby Ratio kinda hangin’ out in the middle showing the momentum and fear/greed balance looking at Money Flow and different time frames:

Liquidation Heat Map - Two Week Time Frame

Bitcoin Bottom Line:

Let the market tell/show us what is next

$109.5Kish/$105.9Kish/$103Kish/$100Kish - $97Kish

Genius Act a big deal for many reasons, could let banks create/print their own stablecoins - all very, very bullish for Bitcoin

No escaping the correlation with Risk On/Off most especially with heightened GeoPoly tensions, it is what it is

Money Flow on Higher Time Frames and otherwise still appears to be in a quite strong position all things considered

Mr. Grey, one known to perhaps get into deeper thinking, still sees The Great Turn ahead with BTC perhaps acting more on its own

Risk On/Off

Powell Flexes His Shrug

Call me crazy, but sounded to me like Powell kicked rate cuts out even further. He flexed his muscles on the labor market holding up (he is correct as of this moment) and to me sounded like he is very open minded shall we say to the idea of inflation now picking up from the tariffs (not sure how he gets to this one). Nonetheless - Powell Shrugs again.

Recent oil longs willing to buy it right up to those technical levels . . . . . . . . but not beyond. Let's see how long they stick around.

Who is loading up the guns with more ammo next (The Market Ear at ZeroHedge.com)?

Equity market walking towards the end of a plank refusing to take the blindfold off to at least see where it ends . . . . . . . . . handful or so of sessions more and the Buyback Beast takes the drugs and hibernates for a while.

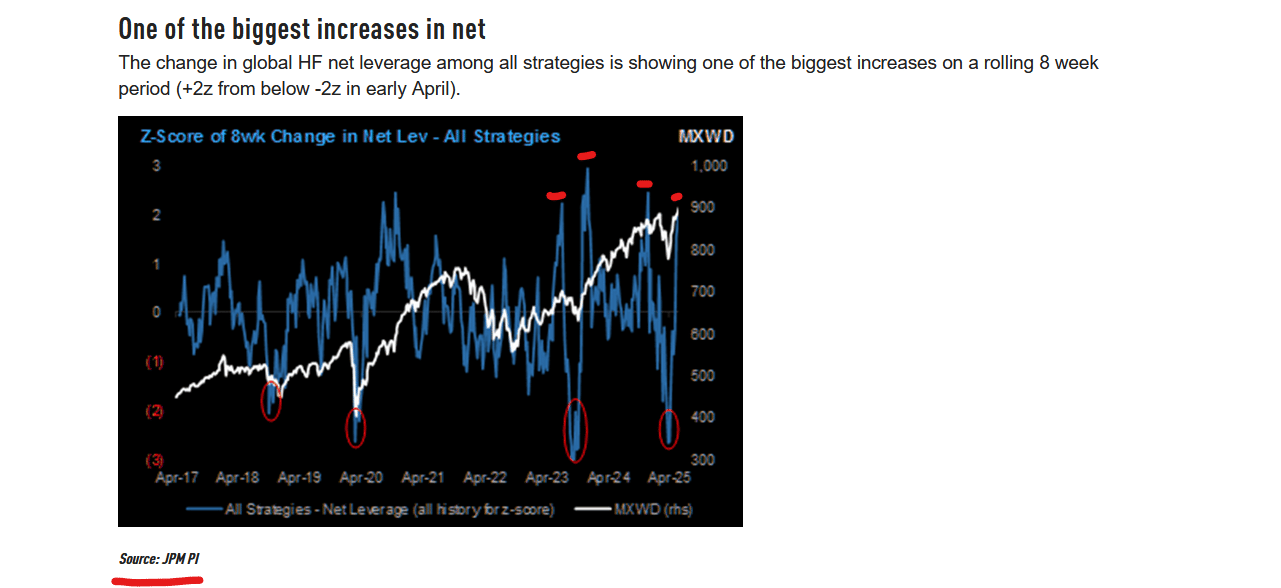

Hedge Fund leverage is scorching higher at a very rapid clip . . . . . . . and my senses are telling me as long as ES hasn't crashed yet this has likely been going even higher.

Interesting how macro surprises start to dive right in synch with this surge in oil:

Risk On/Off Bottom Line:

Transports veered off track when the lubes surged in price, not unexpected but a factor to monitor

Put/Call ratio strikingly low

When that Boomerang Nomura described loaded with catch up and chasing juice and getting back into positions approaches home base and/or equilibrium . . . . . . . . . . could be aligned with when the Buyback Beast seasonally stands down quite a bit - yikes

‘Melt Up’ well intact, equities need to cool down at some point (would be very healthy) but first another surge higher for the record books????? I do not know.

Volume and Money Flow will show us the way extra diligence on Lower Time Frames

France Eyes Bitcoin Mining

France considers using Bitcoin mining to optimize the grid and make use of excess nuclear energy - regardless of the timing or political path to actually getting to this . . . . . . . major big time signal.

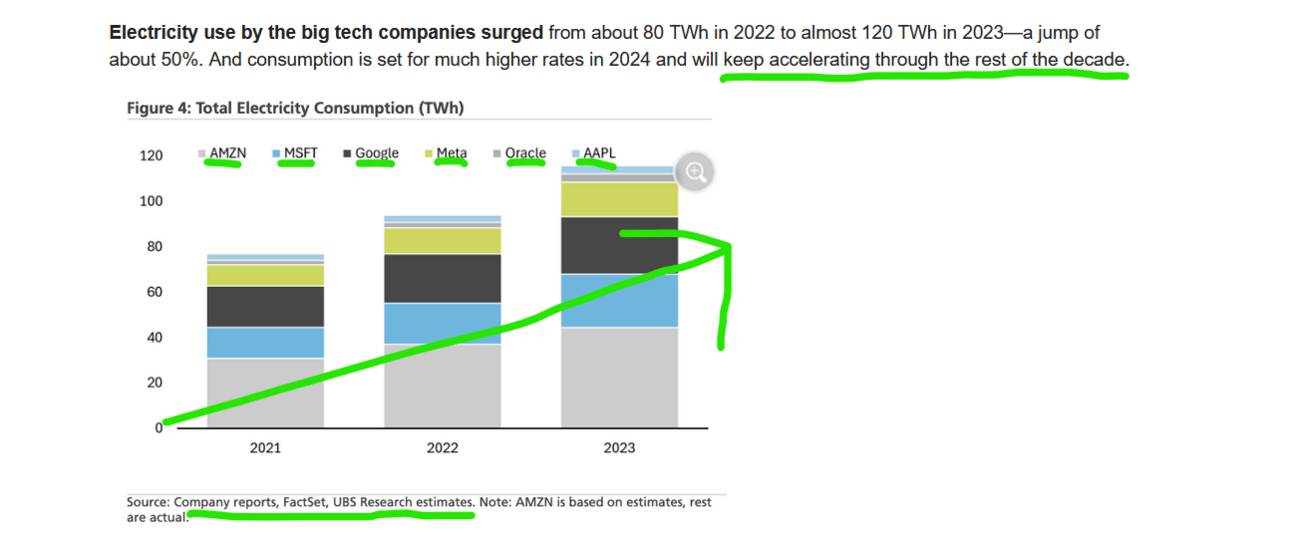

Big Tech Zaps ZAP

Big tech just one factor driving demand for more power and electricity specifically:

Mining Update

added 2x to long USD hedge and yes I realize I am going the opposite way of a whole slew of superstars

Still maintaining “straddle” long both Short BTC fiat and Long BTC fiat hedges, need confirmation to see which one to bury and which to keep

Alex Grey

The Great Turn