This Is Not Investment Advice

The Market Right Now - Telecom Services Cable/Satellite

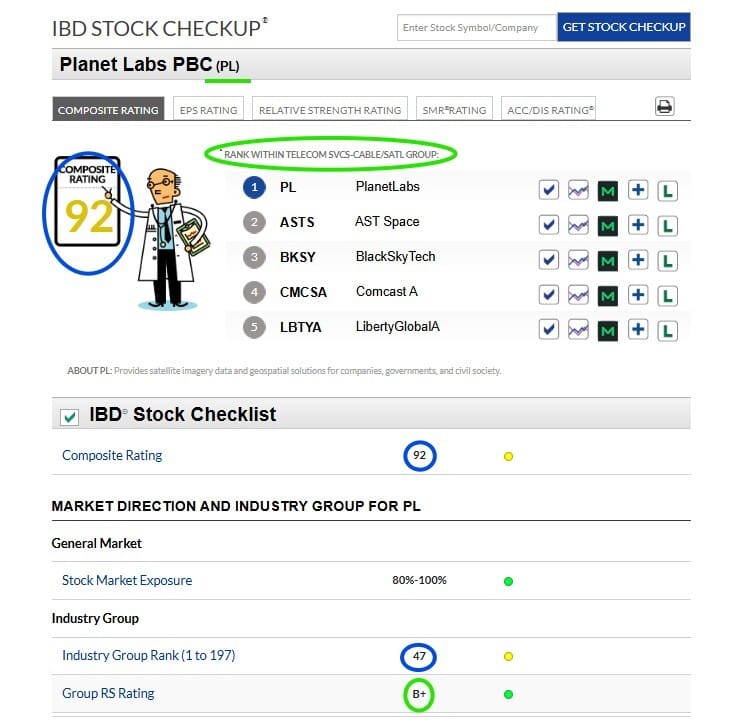

There are actually two primary Industry Groups capturing the satellite action portion of Space with at least two more groups impacted as well that we know of based on Watch List behavior. Here are the two main groups:

Telecom Services - Cable/Satellite

Telecom - Cable/Satellite Equipment

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

The other two groups where we already see an impact are the following:

Telecom - Fiber Optics

Aerospace/Defense

So, we need to keep track of all of these. The focus of this report is the following group shown here in the most recent rankings from Investor’s Business Daily:

Here are the three stocks on the Watch List most impacted by “if Space becomes a thing” . . . . .

PL

ASTS

OPTX

This report will focus mainly on PL. Here is a video where I go through in very fine detail essentially EXACTLY how I am looking at Planet Labs right here and right now:

PL Weekly

ASTS Weekly

Thoughts and observations:

If Space becomes a thing . . . . well looking at market action that is most certainly appearing more likely by the day . . . . also noticed multiple “space stocks” launch into orbit last few sessions . . . . . in my humble opinion it is very prudent to be careful out there . . . . . would say extended weekly charts give a lot of perspective . . . . . male puma chases every potential piece of prey he’ll miss the most important ones while others live the good life . . . .

PL look at last quarter revenue growth . . . . it is “only” growing at 33% clip right now . . . . my senses are already sniffing out a rare earths and uranium conundrum here . . . . market is a discounting mechanism yes indeed . . . . PL may in fact be entering a phase where revenue growth accelerates . . . . we don’t know yet . . . . but how fast can they even literally grow . . . . . meaning it takes more than just them to grow they need customers . . . . how fast “can Space grow right now” . . . . something to consider before market prices the stock as if revenue is growing 3x YOY now when it isn’t . . . . .

Again . . . . . prudence and caution at all times warranted . . . . expect major volatility along the way . . . . big time . . . . .

All that said . . . . need to be open minded about all potential outcomes . . . . in my view the action on the Weekly Chart for PL is very, very, very bullish . . . . my personal plan of attack is to most certainly hold on when a stock displays a breathtaking explosion higher on increasing Volume . . . . reality is PL currently has Accumulation/Distribution Rating of A+ with Up/Down Volume of 2.00 . . . . and funds have been jumping in more and more for seven straight quarters . . . . in my humble view we do in fact have market alignment on this one . . . . .

Expect major volatility . . . . . in my humble view the market is already emphatically telling us PL is a “Space winner” if not THE winner . . . .

My posture . . . . . holding both PL and OPTX for sure . . . . willing to add more on downside volatility to both but PL more so . . . . open to entering ASTS (nice deal there with DoW) if the market gives me a legit chance and tells me to do so . . . . . if/when market corrects meaningfully along the way I would entertain adding very significantly to PL . . . . .

If Space becomes a thing . . . .

75% of stocks follow the overall market trend . . . . in a major Risk Off move everything changes . . .