This Is Not Investment Advice

Let’s check in on some absolutely critical and explosive components of the ‘Melt Up’ - the IBD Industry Group Mining - Metal Ores. First allow me to update my stance if you will. I am still aboard the ‘Melt Up’ from a broad and sweeping concept point of view. I’m not talking about a rip in the Spooz for a brief period due to VOL nuances and investor chasing behavior. I am still, and always was, focusing on the “Mission Critical” and geo-poly and military connection to the need to enhance our ability to possess and project power both in terms of power/energy/electricity but also military power.

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

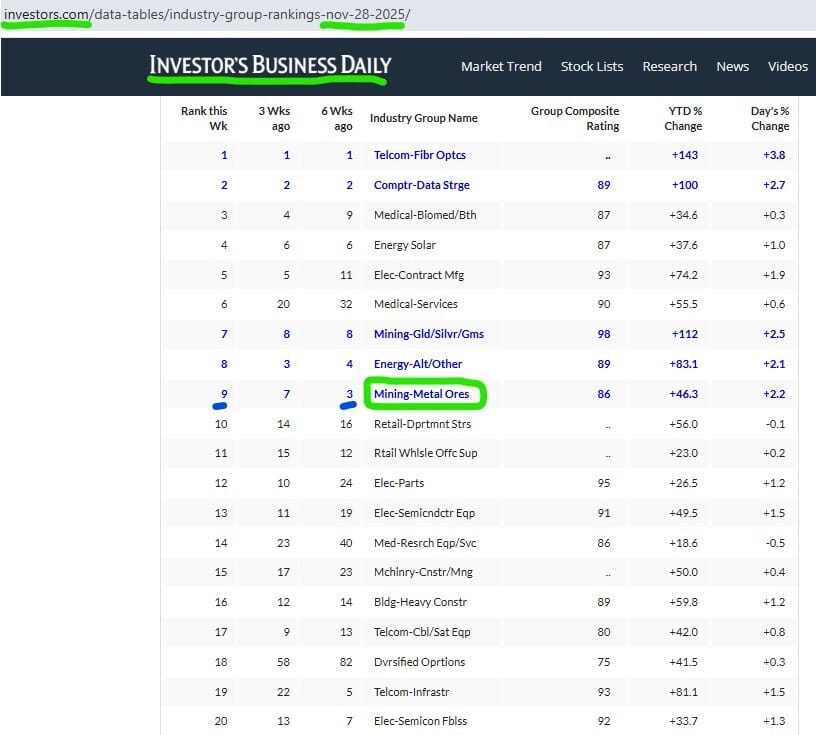

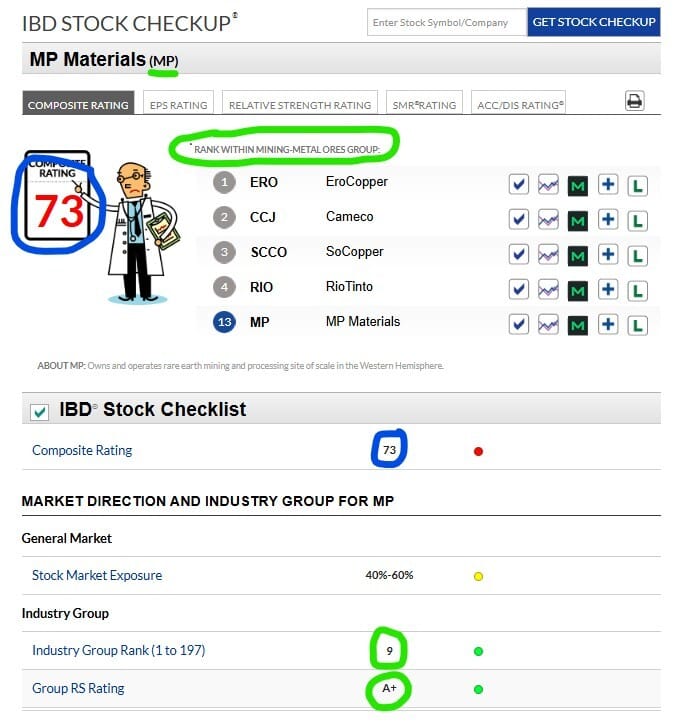

As shown above the Industry Group Mining - Metal Ores is still hanging in there and performing very well relative to the vast majority of the equity market. Digging a bit deeper though . . . . likely pretty fair to say the gains were somewhat front-loaded and the group recently lost some sizzle for sure. So what is going on and what should we consider doing?

UEC

UEC Weekly

NB

NB Weekly

MP

MP Weekly

CRML

CRML Weekly

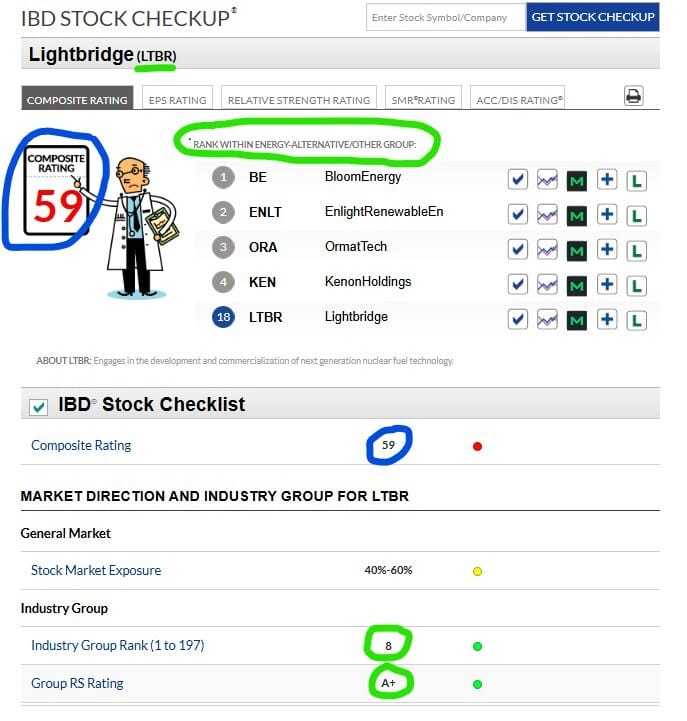

LTBR

LTBR is part of a different Industry Group: Energy Alternative/Other. The firm owns/controls nuclear fuel technology.

LTBR Weekly

Thoughts and observations:

Still seeing the main challenge here is that the entire world knows that we as a society are finally embracing nuclear/uranium . . . . and the entire investing world knows about Rare Earths being “mission critical” . . . . and that leaves us wrestling with the challenge of the market getting excited but revenues and cash flows are still 2-3 years out or 5+ years out in some cases . . . . . how long and how many times will the market play games up and down trying to time and discount when the explosion will occur . . . . . .

These equities and two Industry Groups tapped (Mining - Metal Ores and Energy Alternative/Other) appear to me to be doing what I see the entire ‘Melt Up’ doing which is to take a step back, take a deep breath, and recalibrate and come back to the market and investors with reasonable and plausible projections and forecasts . . . .

CRML is the least intriguing to me I might put it off to the side . . . . . . . that monstrous Shooting Star might take months to overcome and work through and it appears to me the market is more enamored with the others . . . . maybe I am wrong . . . .

I currently do have exposure to NB and UEC . . . . my entry on UEC is very juicy and NB is a work in progress . . . .

The more I wrestle with it and think it through we simply have a very unique situation . . . . we have options and solutions where the firms do possess the highly valuable and desirable assets . . . . . . . but full monetization and exploitation might be years away still . . . . . . yet though others can join nobody or nothing could displace the position these firms have (in other words NB has the goods period end of story but when is the money coming?) . . . . so the value and especially longer term value is there but we play cat and mouse now and perhaps for a while longer with the timing . . . . . . .

LTBR and NB intrigue me the most from a VERY longer term perspective and the absolute Highest of Time Frames possible (years, decades) and here is why . . . . . LTBR can collect tolls across nearly the entire uranium space . . . yes sure others will eventually get Niobium but NB’s lead on Niobium PLUS the two most valuable Rare Earths is real and could be there for a very long time and they will get in the battery/magnet and refinement business AND the project discussed is less than 5% of the land they own/control . . . .

Maybe Bitcoin is the guide and a modified DCA merits attention . . . . back in 2013 I knew nothing could likely ever truly replicate or replace Bitcoin but it was at times very grueling waiting for the rest of society to catch on . . . . . . kinda like here LTBR might be the sexiest stock in the market . . . . from 2030-2035 (guessing here for argument’s sake) . . . . but if you hammer it now how much pain and how long are you waiting . . . . . so maybe some boring old DCA and simply using the 10 Week EMA (shown on all charts above) as a guide might be useful . . . . . 75% of stocks follow the overall market trend . . . .