This Is Not Investment Advice

The Market Right Now - Space

Recently the market has reacted very notably to some potential plays related to space and space exploration. I get it. This aligns with the broader concept of the ‘Melt Up’. We have private sector initiatives such as AI and the advancement of technology in general along with public sector initiatives to grow and protect one’s own nation adding to the already burgeoning space exploration economy. Makes sense and I can vibe with this.

Media Leaders on AI: Insights from Disney, ESPN, Forrester Research

The explosion of visual content is almost unbelievable, and creative, marketing, and ad teams are struggling to keep up. Content workflows are slowing down, and teams can't find the right assets quickly enough.

The crucial question is: How can you still win with the influx of content and keep pace with demand?

Find out on Jan 14, 2026, at 10am PT/1pm ET as industry leaders—including Phyllis Davidson, VP Principal Analyst at Forrester Research, and former media executive Oke Okaro as they draw on their deep media research and experience from ESPN, Disney, Reuters, and beyond.

In the webinar, "The Future of Content Workflows: How AI is Powering the Next Wave," you’ll learn:

The forces reshaping content operations

Where current systems are falling short

How leading organizations are using multimodal AI to extend their platforms

What deeper image and video understanding unlocks for monetization

Get clear insight and actionable perspective from the leaders who built and transformed top media and entertainment organizations.

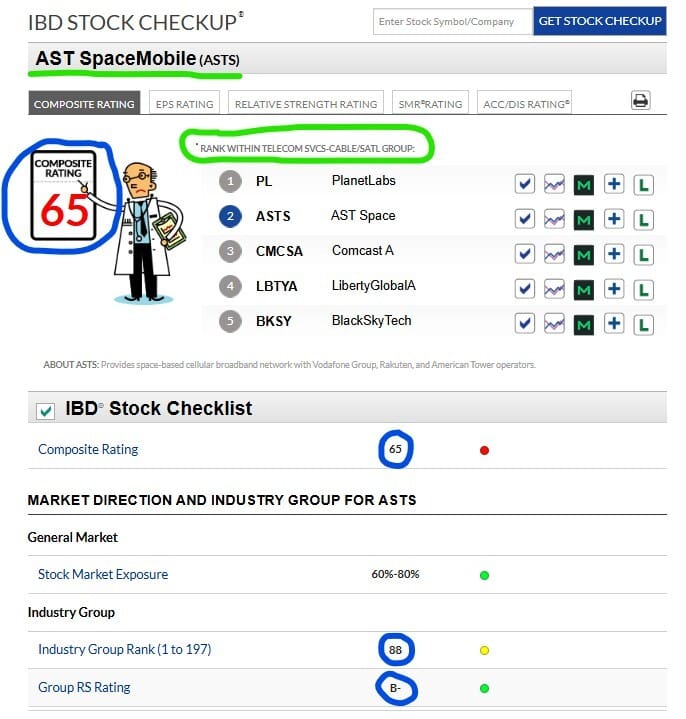

So where do we look? Let’s take it slowly and step back first and focus on the Industry Groups that cross paths with anything related to space and space exploration. Of course there are outliers but more or less the stocks we will target and discuss fall into one of the two groups shown here:

Aerospace - Defense

Telecom Services - Cable/Satellite

Before we consider individual plays here in my view it is important to fully grasp the context of Industry Groups. We know based off of several things . . . most importantly the work done over the years by Investor’s Business Daily . . . . . and which one can confirm individually via observation and analysis . . . . that winning stocks tend to move in groups and stocks tend to move in groups in both directions. The Industry Group is very important.

It is crucial in my opinion to grasp this and manage your expectations accordingly. Both of the groups here related to space have a lot of legacy “dead weight” in terms of the stocks included in the group. There are very mature and legacy companies that may not be able to grow at certain rates plus other dying businesses like cable and out of date and out of use defense tech.

Translation - if we make plays here the Industry Group itself might not be providing a ton of extra assistance. Conversely - a “uranium stock” can easily get scooped up for the ride when the Mining - Metal Ores group goes on a run. Hopefully this makes at least some sense. The groups may not hurt these plays but they may not be providing any extra juice (subject to any geo-poly events that suggest otherwise).

Looking above we can see that both of these groups have been declining in the last 6 weeks - a period of time where the ‘Melt Up’ has been evolving itself. They aren’t crashing or plummeting per se but important to know how they have been doing lately.

We will expand and evolve this over time, but here are two plays on the Watch List now:

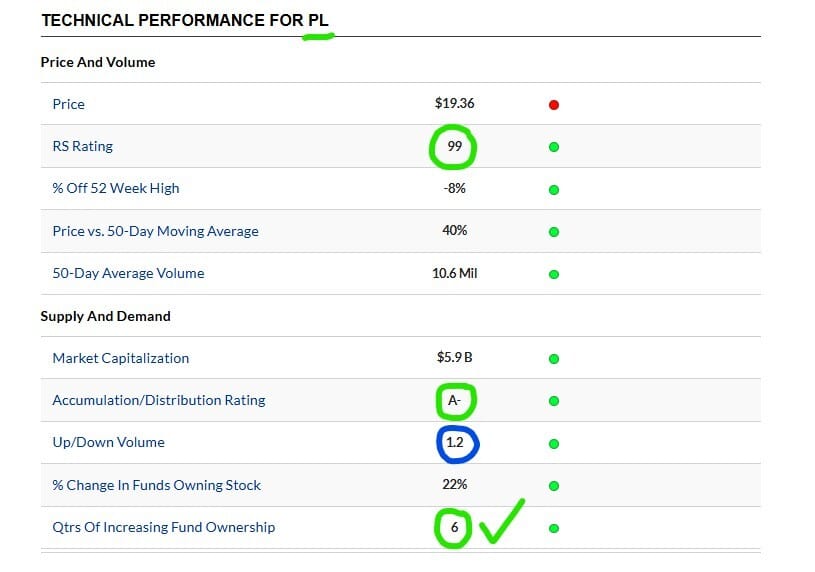

PL

Before diving in first some perspective. Here is a stretched out Weekly Chart:

PL Weekly

Thoughts and observations:

Stretched out Weekly Chart above . . . . the overall story, trend, and pattern is appealing . . . . . went public in 2021 so market will view this as “new” and full of opportunity . . . . most importantly looking at the Volume in the first couple years compared to now we can see that the market is most certainly paying a lot of attention to PL now . . . . if the market doesn’t care then why should we . . . . the market cares and is paying attention . . .

$16.42 to $20.99 . . . . . just in the last two weeks . . . . great that it is getting the attention but also shows you how much it could easily drop quickly . . . . let’s see how things go overall before doing anything impulsive . . . .

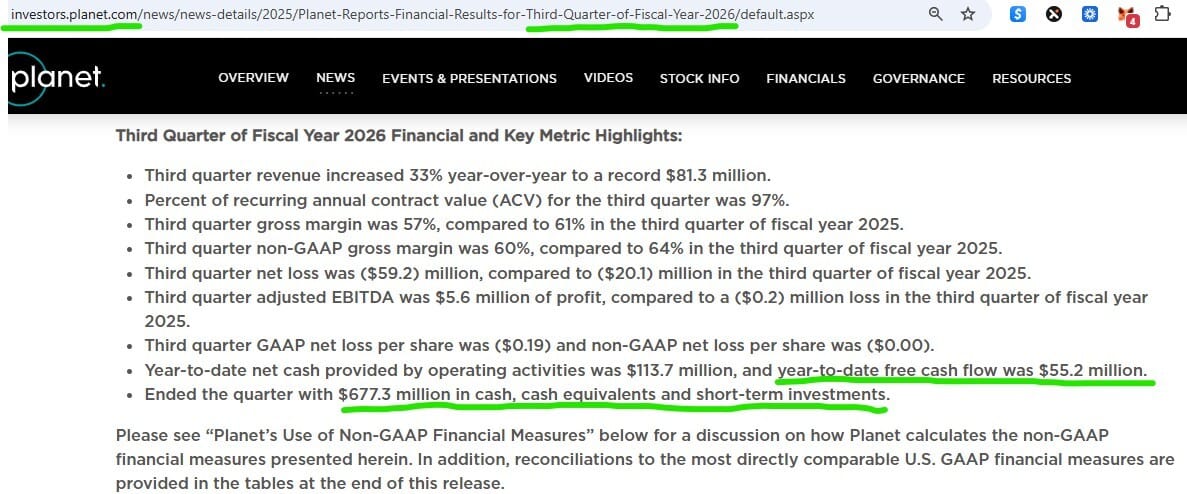

New, young, growing company but also generating positive Free Cash Flow that is growing alongside an enhanced Balance Sheet . . . .

Historical earnings are somewhat modest but we see the RECENT surges in earnings surprises and estimates rising . . . . market is a discounting mechanism among many other things . . . might be entering game time for real now just as the SpaceX hype will rise to obscene levels presumably in 2026 . . . .

Up/Down Volume currently rated decently at the moment . . . . but Weekly Chart shows pretty clear pattern and trend of Accumulation and we see 6x straight quarters of more funds creating/holding positions . . . . the larger players are moving into this one . . .

Definitely interested in this one when using a very long term perspective with the highest of Higher Time Frame outlooks . . . . if/when “Space” becomes a big thing no reason why the market would not place this one prominently it is beyond hype and speculation and generating real results now . . . . linked up with Google and positioned for the ProSec movement in the U.S. and beyond . . . . . .

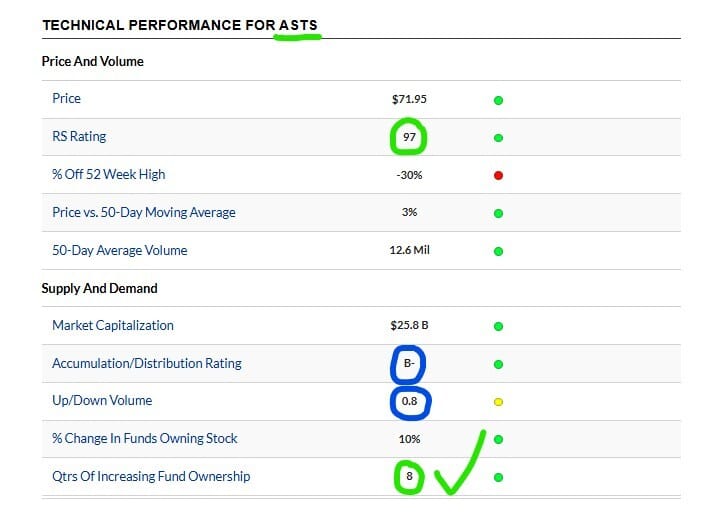

ASTS

Before diving in first some perspective. Here is a stretched out Weekly Chart:

ASTS Weekly

Thoughts and observations:

10 Week EMA $68.78 . . . . . stock has traded between $61ish and $93ish just in the last two weeks . . . .

Stretched Out Weekly Chart . . . . stock went public in 2021 and we can see by looking at Volume the market is definitely paying more attention recently . . . . market likes “new” companies that have potential for explosive growth . . . . this would fit that description in my view . . .

Space based broadband network for mobile connectivity . . . . logical progression

Spending time below 10 Week EMA twice since August and two ugly Weekly Candles included in there plus the wild swings lately . . . . patience and paying attention might be extra important for this one for any considering it . . . . .

Earnings released recently 11/10 and around that time the stock sank from $70ish to $51ish . . . . perhaps it reinforced how much cash they are still burning and need . . . . but the market also sees that revenue start to percolate and is seemingly in a battle here between the looming revenue and cash flow growth and the realities of the intense nature of this business in terms of CapEX and securing deals, licensing, etc. . . . . .

Definitely interested here . . . . not seeing any reason to rush . . . . if/when “Space” becomes a thing or more of a thing this one will get acted on in my view as it does have a lot of progress, is still considered new, and lays out a path the market can absorb and respect . . . . . investors ask “how do we play space and mobile communications” . . . . this might be the top or close to the top answer . . . .