This Is Not Investment Advice

AI, Bitcoin, and the ‘Melt Up’ Go Hand in Hand . . . . . . . . . IBD Industry Groups Help Identify Which Stocks Win

A major component of the ‘Melt Up’ framework includes the rare occurrence of various governments and institutions actually rowing the boat in the same general direction. Society needs upgraded and better infrastructure. Electricity and the associated infrastructure is a major hot spot.

Interestingly - even if AI fails or falls short of its promise there is still a need for these upgrades. Both AI and Bitcoin add fuel to the fire that is spending on energy and power infrastructure.

The assistant that scales with you

Great leaders don’t run out of ideas. They run out of hours.

Wing gives you a dedicated assistant who plugs into your workflows – calendar, inbox, research, outreach, and ops – so execution never stalls. Wing can:

Onboard in days, not months

Run the day-to-day so you don’t have to

Adapt as your business grows

With Wing, you buy back time without adding headcount. More focus for strategy, more follow-through on priorities, and a lot fewer “forgot to send” moments.

So - who stands to benefit the most from this spending and shift in focus by governments and the private sector?

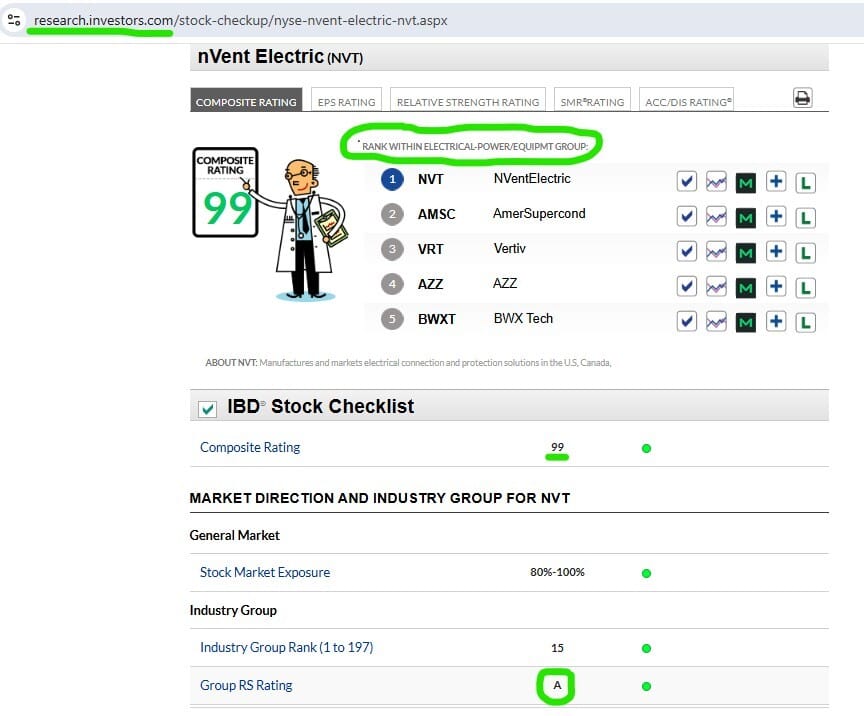

In my humble opinion - using the Industry Groups tools and data from Investors Business Daily can be extremely useful and helpful when searching for winners. IBD already executed and presented tons of data on groups. I look at it this way. Getting long a stock in an Industry Group that is struggling is a low value bet to me. The group is performing poorly and if I’m long a stock within the group, then I am saying that I will be the one to beat the odds and find the odd winner in a poorly performing group. Not a play for me personally.

Conversely - if an Industry Group is performing well, then many if not most of the stocks in the group have the legitimate capability and potential to perform well in the short and intermediate term. More importantly, if a group is hot and getting hotter, then that means the Money Flow and Accumulation is focused there as well, and this is what we are seeking. Groups can show you macro trends about where the money is moving and being spent in the economy.

Here are the Industry Group Rankings from Investors Business Daily after the conclusion of trading on 9/15:

We can see ‘Mining - Metal Ores’ and ‘Telecom - Fibre Optics’ in there, but the below shows the two groups we are primarily discussing here:

Electric - Contract Manufacturing

Electrical Power/Equipment

Let me add a bit more context however. These groups are very intriguing to me far beyond “the AI Trade” though that is relevant at the moment as we all understand. If you look you’ll see these stocks performing well long before the Trade War meltdown February through April. They didn’t just respond primarily during the ‘Melt Up’ (new bull started in April 2025 or Wave 5 we don’t know yet).

Globally there exists a problem with power and energy. We need more of it and we need the economic and regulatory policies to align with the pursuit of abundance. Meanwhile - we have this in America:

Plenty of blame to go around. Investors and the market don’t care. This creates opportunity.

Here are the top stocks currently in the Industry Group Electric - Contract Manufacturing:

I am currently long FLEX, but not any of the others at the moment. Here is the weekly chart for the #1 stock CLS:

Here are the top stocks currently in the Industry Group Electrical - Power/Equipment:

In my view - AZZ is intriguing. Let’s take a look.

It’s not the cutest puppy in the lot currently, but the market is a discounting mechanism among many other things. We want to know if the market is grabbing this group forward because it knows the operating cash flows and earnings are getting pulled higher in the AI Trade along with the solid base already established.

Looks plausible that institutions are moving in here the Acc/Dis rating is solid and fund ownership is growing. Let’s see what the chart is telling us.

AZZ Weekly

AZZ Daily

I’m interested and on alert. Looks like it is chilling out to me currently on the Daily with the MF bouncing back and forth. Looking further back on the Monthly Chart we can see that AZZ has been growing and building a nice foundation for a while.

Are the current market conditions pulling AZZ forward and projecting that growth will accelerate? Totally plausible, and I like the firm foundation underneath it already.