This Is Not Investment Advice

Debt Gorges on Bleak Jobs Data, Generals Run and Hide While Indices Glide . . . . . . . . Risk On Asks Do We Really Want a 50 BPS Cut?

Entering the week among other things we had awareness of looming liquidity challenges while watching NVDA/AI/$170 and credit. Bonds were blissfully carried higher by 4 doses of very weak labor data, so let’s see what happens when inflation comes back on the radar. NVDA dove through the $170 level and closed below it on the week, but like the indices it wasn’t a violent or aggressive plunge by any means. The elastic band continues to extend in the same direction . . . . . . . . . . . .

The labor market is very weak. GDP just grew at 3.3% (apparently) for an economy almost $30T in size but it can only create 20K jobs a month? My senses are that we saw a shift this week from a potential labor supply crutch to a labor demand issue. Awesome - “now the Fed will have to cut a million times” . . . . . . . . . . . . but yikes no jobs being created with some inflation and possible rate issues means bad economy and earnings growth.

Swap, Bridge, and Track Tokens Across 14+ Chains

Meet the Uniswap web app — your hub for swapping, bridging, and buying crypto across Ethereum and 14 additional networks.

Access thousands of tokens and move assets between chains, all from a single, easy-to-use interface.

Trusted by millions, Uniswap includes real-time token warnings to help you avoid risky tokens, along with transparent pricing and open-source, audited contracts.

Whether you're exploring new tokens, bridging across networks, or making your first swap, Uniswap keeps onchain trading simple and secure.

Just connect your wallet to get started.

Here is the private payrolls data from ADP showing a clear trend that while job losses may not be accelerating, job growth remains very weak:

We discussed the pros and positioning, and after playing catch up with the ‘Melt Up’ there appeared to be some cautious shuffling of the deck to play a tad bit of defense perhaps. That might be over, Hedge Funds are back in chasing hard (more excellent work from The Market Ear at ZeroHedge.com):

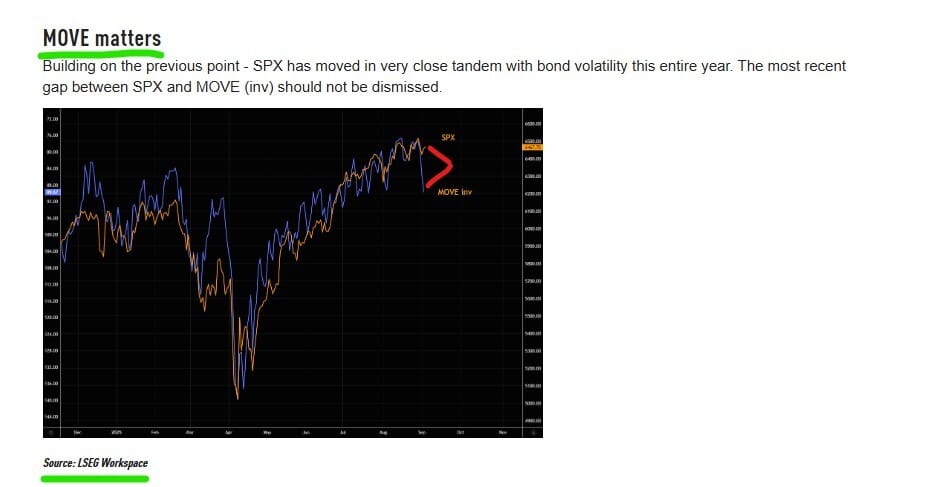

Spooz tends to not like it when Bond VOL wakes up from one of its long naps:

So - let’s see what happens. NVDA and some other players within the AI Trade seem to be fading off a bit, but yet the indices still refuse to break down with any authority. Bonds are happy as can be (for now) gorging on a crappy labor market, and volatility still remains very low relatively speaking for credit and Risk On. The data is starting to suggest more and more of economic weakness (rate cut expectations back up towards 100%, confirming credit market moves as we pointed out weeks ago) and a few cuts in 2025 . . . . . . . . . but where is the growth if there are close to no private sector jobs being created?

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Glassnode summary from this week:

Looking at the Long Side Premium data from Glassnode - the market does not look overheated with speculative excess. The premiums shown reflect the hourly interest longs are willing to pay to hold positions. As shown, we are below levels seen at big tops previously and close to the 300K neutral level.

Pi Cycle Top/Bottom indicator below, another excellent tool from BitcoinMagazinePro.com:

Global M2 YOY % Change vs Bitcoin YOY % Change

Note the update to the data set in this chart comparing the growth rate of Global M2 to the growth rate of the BTC exchange rate. We had a pop up in M2 growth followed by another drop - so the net result is about the same choppiness in the growth rate of Global M2.

Liquidation Heat Map - Two Week Time Frame

Note the significant amount of liquidity sitting in that same zone but as deep as $106Kish.

Bitcoin Bottom Line:

Let the market tell/show us what is next

That’s a nice chunk of liquidity sitting back inside that $107Kish to $108.7Kish zone and below it even . . . . . . . . . . . . . . . . . exchanges in part exist to match buyers/sellers

MSTR not entering the Spooz

Need a break above $114K/$115Kish to get the market energized again bullishly

Yes we got the bounce off of $107Kish but the pattern remains of low conviction, low volume, low accumulation, and tepid Money Flow

We have seen BTC diverge from, tail, follow, lead, or otherwise correlate with GLD/SLV . . . . . . now we have GLD/SLV in a major breakout with BTC/NVDA/MSFT declining as QQQ/SPY still float higher and refuse to even correct meaningfully

$104Kish

$95K-$98Kish

$92K

The Money Flow on the Weekly is Red and has been for over 6 weeks now, never went Green during this time

Note the Monthly Candles heading into the election in 2024, closing well in the upper half of the range . . . . . . . . compare that to the recent Monthly Candles we have now . . . . . . . . . . . the simple fact is that in recent months and weeks we have not seen buying conviction and Money Flow turn up and stay up on Bitcoin

As projected here about three weeks ago, some Bitcoin Treasury companies are under very heavy pressure now in the market

As challenging as it may look in the near term, literally one legit bullish week could change everything . . . . . . . . but is Bitcoin sliding as Risk On is also rolling over?

Risk On/Off

Both equities and credit are now locked and loaded sky high on giddiness pills regarding rate cuts. Bessent’s plan clearly lays out a very strong emphasis on Bills and the short end for a couple more years. Liquidity might be rattling but reserves are fine. I’m still failing to see where we have imminent balance sheet expansion.

Stocks want the rate cuts so badly apparently they are more than willing to demand them and survive on them even if the economy can’t create any jobs? Time will tell.

SPY Daily

Risk On has had some challenges recently when the Treasury Secretary needs to beef up the checking account balance:

Just a thought . . . . . . . Wave 5 Top followed by rough going with higher rates and inflation hitting margins/earnings?

NVDA Weekly

MSFT Weekly

MSTR Weekly

AGX Weekly

HYG Weekly

Risk On/Off Bottom Line:

Risk On starting to realize more that ramping rate cut expectations does not align with improving growth prospects or earnings prospects per se . . . . . . . . . . . realizing all that climbing higher and higher is getting closer to a cliff

Money Flow on the Weekly is Red for NVDA and MSFT (about 15% of the Spooz) . . . . . . . . . . . . . and yes the “so what” response from perma-bulls is still in play but basic mathematics dictates that yes Spooz can advance without them but doing so in a sustained manner would be near impossible . . . . . . . and then of course we can always see a few more “stick saves” for these behemoths but didn’t we already see the party with the MSFT shooting star on their amazing earnings?

HYG hanging in there though the MF is waning, SPY doesn’t look so bad, the indices on Friday and Wednesday just wouldn’t go down with authority . . . . . . . . . . . . . yes NVDA/MSFT/BTC anchor currently but not crazy to see yet another swing for new highs in the near future . . . . . . . . in some ways feels like last gasp attempts (Wave 5 action?) to keep it going

We need to see, in my view, at least one day where the indices are down big on big volume and close at or near the lows of the day . . . . . . . . . . . . until then the magic wand and ‘Melt Up’ win with ES getting picked up every time it drops a couple points

CTAs maxed out already, hedge funds back approaching max leverage, as the corrections come and go in a flash looks like some pros are back to chasing hard

Of course there are a million reasons why we should again correct very sharply, but in the here and now the major averages are still being bought up bullishly throughout the week almost refusing to go down in any meaningfully way . . . . . . . . that bubbly ‘Melt Up’ impulse is still there for now in my view . . . . . . . . high volume down days closing at the lows to me still the biggest signal with leaders getting hit hard to see if changing in short term

NVDA/AGX/MSFT/MSTR/BTC all have Money Flow Red on the Weekly . . . . . . . . . . reality . . . . . . . . market has to figure out how to get those moving again and continue marching higher . . . . . . a tall task

Still have net long exposure and core positions but maintaining very high degree of caution with trades

Bitcoin Rewards to Boost The Industry

Recently here I covered a handful of data points and charts related to adoption. I don’t see us in a ‘crisis’ situation but I do think individual user level adoption is sluggish. Let’s face it, the price hasn’t risen sharply for a handful of weeks in a row for quite some time now. Nothing has really sucked back in retail.

Coinbase and Gemini and others soon will have Bitcoin Cashback Rewards Credit Cards on the market. This is an angle that could have legs. More people receiving Bitcoin as a reward could lead to more people handling it or even generating transactions. More people receiving Bitcoin Rewards means more service providers have to buy Bitcoin at certain intervals. Whether they buy as users transact or when they try to redeem or somewhere along the way . . . . . . . . . Bitcoin Rewards products and services will put a bid under Bitcoin. Kind of like 401K allocations expanding equity multiples.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: sold another 15% or so of that stash so total about half sold, this one vicinity $114Kish. Total about half of mining stack converted to fiat and earning. UPDATE: sold another 5% or so at $112Kish. More than half sold total.

If the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. Watching any bounce from $107Kish very closely. Could long or wait for yet another lower high then long SBIT again but with an even bigger position. Added some modest SBIT again this week need protection if we fail to get above $114Kish in the short run.

UVIX sold some Tuesday but still holding remainder.

UUP

TBT

Matthew Wong

The Watcher