This Is Not Investment Advice

Powell Prudence Hovers as Risk On Takes a Few Hits Along the Way . . . . . . . Bitcoin Down Into a Familiar Volume Profile . . . . . . . . Can The Wall of Worry Keep the ‘Melt Up’ On Course?

Last week I discussed how the Fed Meeting actually made things more bullish for Risk On on Higher Time Frames perhaps if one is willing to consider all options . . . . . . . . . and how this connects to the Fed moving from Restrictive to Neutral rather than “the Fed is easing and printing money”. Powell prudence in a way is a lot more bullish.

Build better audiences in minutes, not weeks.

Speedeon's AudienceMaker gives you instant access to 1000+ data points to build and deploy audiences across 190+ platforms like Meta, Google, TikTok, and Amazon.

No data team required. Pay as you go. Request a demo and get a free customer analysis, so you can find more just like them!

Emphasis there on Higher Time Frames. We saw some turbulence this week for sure, and in my view there is still inbound turbulence coming in multiple waves at some point that will be a lot worse in some cases. Bigger Picture, look at Monthly and Quarterly charts for example, one can possibly envision a bullish setup. Fed isn’t even neutral yet. Loans are getting gassed up. “Real rates are negative on the 1YR” the eye in the sky dangling carrots. I have some very bearish outcomes as possibilities as well . . . . . . . but I am open minded and certainly am not going to underestimate the ‘Melt Up’ or attempt to step in its way until it is a wounded fighter wobbling in the ring.

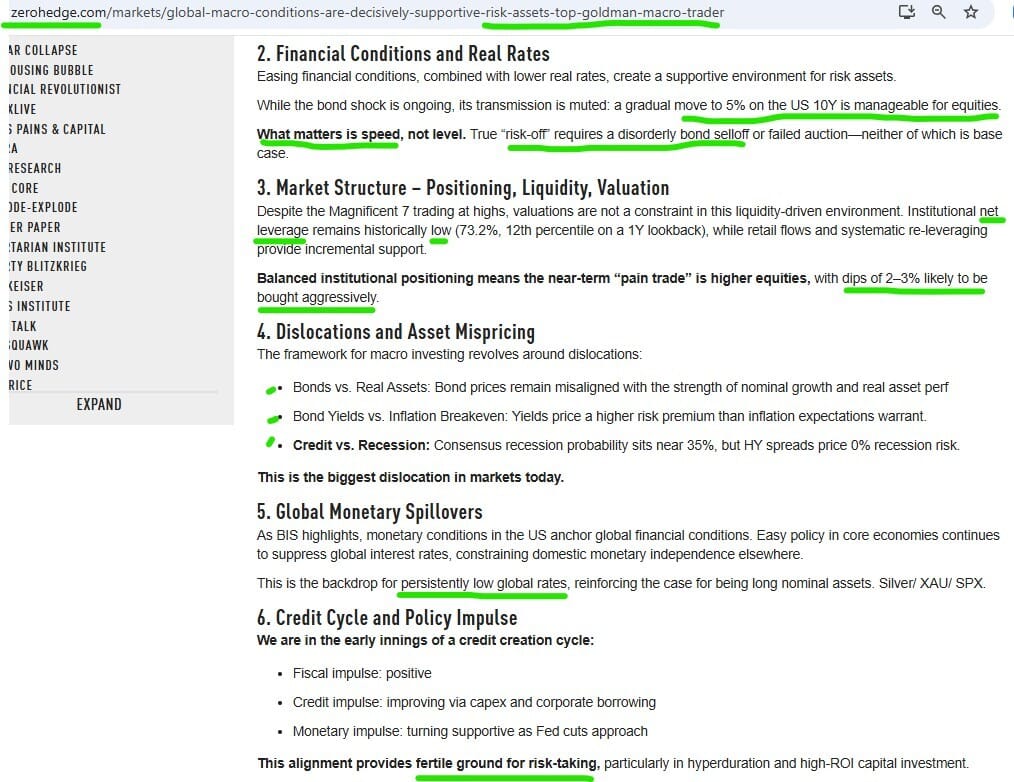

Notes from Goldman earlier in the week:

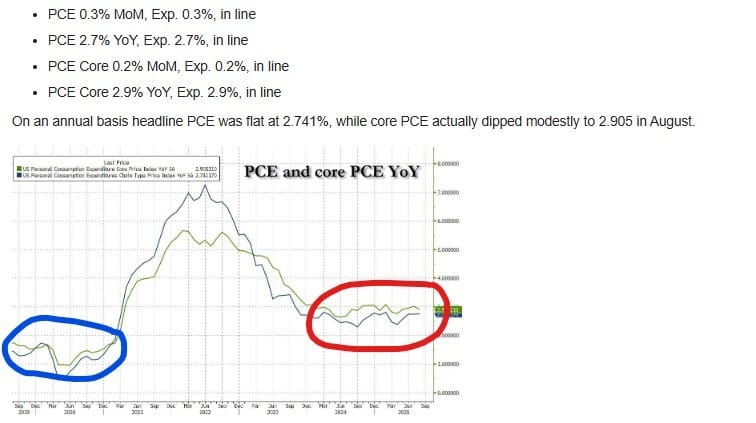

Here’s the inflation data from this week:

The market was living in the Blue and now it lives in the Red. That is reality. Inflation can be sticky and prices tend to show resistance to downward movement (in other words, you don’t get to “recoup your losses” generally with inflation). Regarding Powell Prudence and Risk On . . . . . . . . . . . there is a firm foundation to launch the ‘run it hot’ and ‘Melt Up’ and grow Nominal GDP. Equities are a claim on Nominal GDP.

My senses are still more inclined to think the ‘Melt Up’ remains on track as opposed to being knocked off course at this precise time.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Profit Realization Peaks

Good points made here by Glassnode as we look back at patterns and see that generally speaking after a few profit spikes the market cools down within the context of “prior cycles”. Whether we are currently “in a cycle” or not regardless . . . . . . there have been 3x profit spikes already:

Only the 2017/2018 vertical move saw more coins dumped by long term holders:

Global M2 YOY % Change vs Bitcoin YOY % Change

Pi Cycle

Bitcoin Fear and Greed Index

Liquidation Heat Map - Two Week Time Frame

Bitcoin Bottom Line:

Let the market tell/show us what is next

Money Flow on Higher Time Frames like the 2 Day, Weekly, Monthly just hovering waiting to surge into the Red . . . . . . . . . . or not? Yes things are “on edge”

Hasn’t had a bullish week since early July

Maybe this is one way of looking at the current situation . . . . . . . is the market currently fighting for block space? no . . . . . . . . . . . is the market currently fighting for uranium, rare earths, and other “mission critical” resources? yes . . . . . . . .

Dropped off the heavy options baggage Friday

Needs to break $115.6Kish convincingly with energy and Money Flow . . . . . and even then it could still continue on and set yet another Lower High and come back below $107Kish . . . . . . and this all assumes it can muscle up moves higher dangling in the middle of Volume Profiles

$111.2Kish and $112.9Kish could both also be new Lower Highs as it is obviously wrestling with the very familiar $109.5Kish which opens the door to testing $107Kish again and even going for the liquidity beneath it

Bullish options in the short and intermediate term still exist . . . . . . in my humble opinion best chance of success is the sooner the better and the bounces need to be very aggressive from either $109.5Kish or $107Kish . . . . . . .

Perhaps focusing on adoption, transactions, address usage, node count, etc. would be more productive than playing this game that will always end with Bitcoin needing to outrun the dilution . . . . . . . wow gonna need pace/speed/stamina/distance running at all times perfectly there was only one Ghostzapper

Risk On/Off

“Until tech credit spreads crack” . . . . . . . . . from The Market Ear at ZH:

Could view the below bullishly as well . . . . . . . . still a lot of doubters so grinding higher while “climbing the wall of worry” plus seasonals and big time chasing not out of the question in my view . . . . . .

Net HF leverage is modest, there is even retracement from Mag7 and MOMOs, and the overall positioning looks as follows according to some analysts:

QQQ Weekly

QQQ Daily

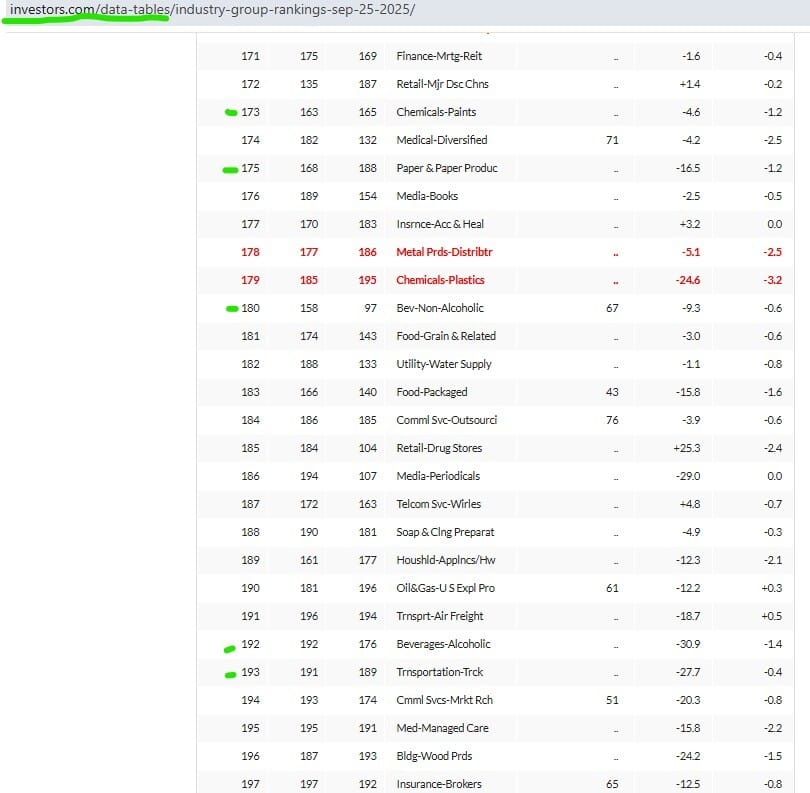

IBD Top Industry Groups

HYG Weekly

IBKR Weekly

Not the worst Risk On/Off proxy in the world.

EME Weekly

AGX Weekly

NVDA Weekly

LEU Weekly

Risk On/Off Bottom Line

At this time not interested in taking a swing against the ‘Melt Up’ . . . . . . . . . . . the fighter is still very juiced and amped up

A few days of selling and some distribution but again not meltdowns

Friday was not a spectacular day by any means but a day that perhaps keeps things chugging along

Equities can’t go up unless they go down . . . . . . . you know in a very broad and general sense . . . . . . how else would they fill Volume Profiles and tap Value Area Highs and Value Area Lows?

Junk debt took a breather but still appears in solid shape in my view

If you’re worth $500B then why are you raising money . . . . . . . . . I know, I know growth requires investment, etc. but no FCF at all and worth half a trill . . . . . . . . . . .1000x revenues is the new 10x revenues

Is it all just a contest between seeing either Spooz 7500 and 500 basis points on the 10YR or Spooz 5900 and 390 basis points on the 10YR?

Perhaps some participants have shifted from being very ready to sell and cash to “let’s see if this has some legs”

Maybe the street can compare say the relative cost to a telecom of sending and storing an email in 1995 compared to the relative cost to OpenAI of someone telling chatGPT to do something . . . . . . . . . where does this scale or is it always more costly to “do more stuff”

Sprinkled more in this week

QQQ had a big fat Red Volume bar on the Weekly but closed in the upper half of the range with the Money Flow flipping to Green on the Weekly

NVDA doesn’t look all that great but not terrible either it’s dragging around $4T+ . . . . . . . broad AI related stocks still holding up well in most cases

Leading Stocks took some lumps but when viewing across the entire space not notable damage or spreading across multiple leading Industry Groups

Upside bias remains in my humble opinion until credit whispers in our ears or the indices are down big on big volume closing at or near the lows of the day with Leading Stocks getting hit hard on big volume

“Until tech credit spreads crack” . . . . . . . .

Checkups After Turbulence

FLEX Weekly

AMPX Weekly

UEC Weekly

Hedging the ‘Melt Up’ - A New Look Perhaps

I don’t make predictions. Money Flow. Accumulation/Distribution. Price/Volume. Solid tools that work. I’ve been flummoxed with how to hedge this ‘Melt Up’. I am currently using TBT and UUP and understand why and have used others, but yields and equities (and the dollar) could all rise together . . . . . . to a certain point. VOL can have its moments but the machine can suppress VOL seemingly for a lot longer than you can keep trying to buy it . . . . . . . . though UVIX will come back into play at some point.

I’m kicking around an idea to essentially gang up on the laggards, but not the laggards that are also “defensives”. If Spooz dove 10% the so called “defensive” stocks might actually kick in a counter trend mini-rally. I’m trying to isolate stocks that are performing poorly but more part of a secular decline rather than being out of favor currently and “defensive” (such as health care or oil related). Find these types that are also at resistance or trying to climb above resistance with a RS between 10 and 40. A RS of say 4 means it’s too late to short it. Let’s look at the bottom of the barrel IBD Industry Groups:

Alcohol may be inside a secular downturn. We’ll take a look at SAM in another post. Risk On gets too juicy and insane maybe I’ll short SAM or a few with similar setups. Market continues to rip the duds should not move much higher. Market tanks the duds should tank even worse.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: sold another 15% or so of that stash so total about half sold, this one vicinity $114Kish. Total about half of mining stack converted to fiat and earning. UPDATE: sold another 5% or so at $112Kish. More than half sold total. UPDATE: sold more this week $115K and $113K

If the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is still not convincingly staying either Green or Red on the Weekly so shifting accordingly. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. UPDATE: Modest SBIT this week but not an entry as desirable as I would want. Let’s see what happens off of $109Kish.

TBT, UUP

Alex Grey

The Soul Finds It’s Way