This Is Not Investment Advice

Liquidity Drains While Everyone Dreams of QE, Bitcoin and NVDA On The Ropes

Risk On and Bitcoin attempted to get a little action going this week, and yet again it was lacking in conviction, volume, and Money Flow. Consequently, Bitcoin sits in a very key zone while NVDA dangles above the critical $170 level.

Here is what was published last weekend:

Swap, Bridge, and Track Tokens Across 14+ Chains

Meet the Uniswap web app — your hub for swapping, bridging, and buying crypto across Ethereum and 14 additional networks.

Access thousands of tokens and move assets between chains, all from a single, easy-to-use interface.

Trusted by millions, Uniswap includes real-time token warnings to help you avoid risky tokens, along with transparent pricing and open-source, audited contracts.

Whether you're exploring new tokens, bridging across networks, or making your first swap, Uniswap keeps onchain trading simple and secure.

Just connect your wallet to get started.

Credit - longer duration bonds showed some slight signs of slipping a bit on the week, but considering the weak auctions yet again the market again somehow managed to hold it together. ZeroHedge.com released a report on a looming massive cut to the jobs data thus forcing more easing.

AI Trade - NVDA didn’t tell us to seek cover and hide but perhaps didn’t nudge the market to increase the growth rate expectations.

I still see the two biggest roadblocks being what was stated there: A) longer duration yields and inflation expectations, and B) the AI Trade and in effect NVDA. However - there is a 3rd factor to further expose now which is always the biggest factor hovering over markets: liquidity.

See notes further down on the TGA and correlation with the Spooz and Nasdaq.

The 5YR Breakevens cooled off a tad this week but the trend is still quite clear since late June. Market sees inflation mattering more now and over the next few years and is ho hum about longer term inflation - i.e. sniffing out ‘run it hot’. It can both be true that tariffs are not yet directly causing persistent inflation and that the market is sniffing out the next cycle of inflation upcoming regardless of tariffs or who the President is or isn’t. The 70’s experience where inflation zoomed up, calmed down a bit, then zoomed higher again.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

From Glassnode:

Also from Glassnode.com - here we look at a form of max pain and can see that the current drawdown has been nothing so far in terms of max unrealized losses:

SOPR - above 1.0 means coins moving in profit. Below 1.0 coins sold at loss and the lower it goes the more likely it captures capitulation. Sure enough - currently we straddle that neutral 1.0:

Liquidation Heat Map - Two Week Time Frame

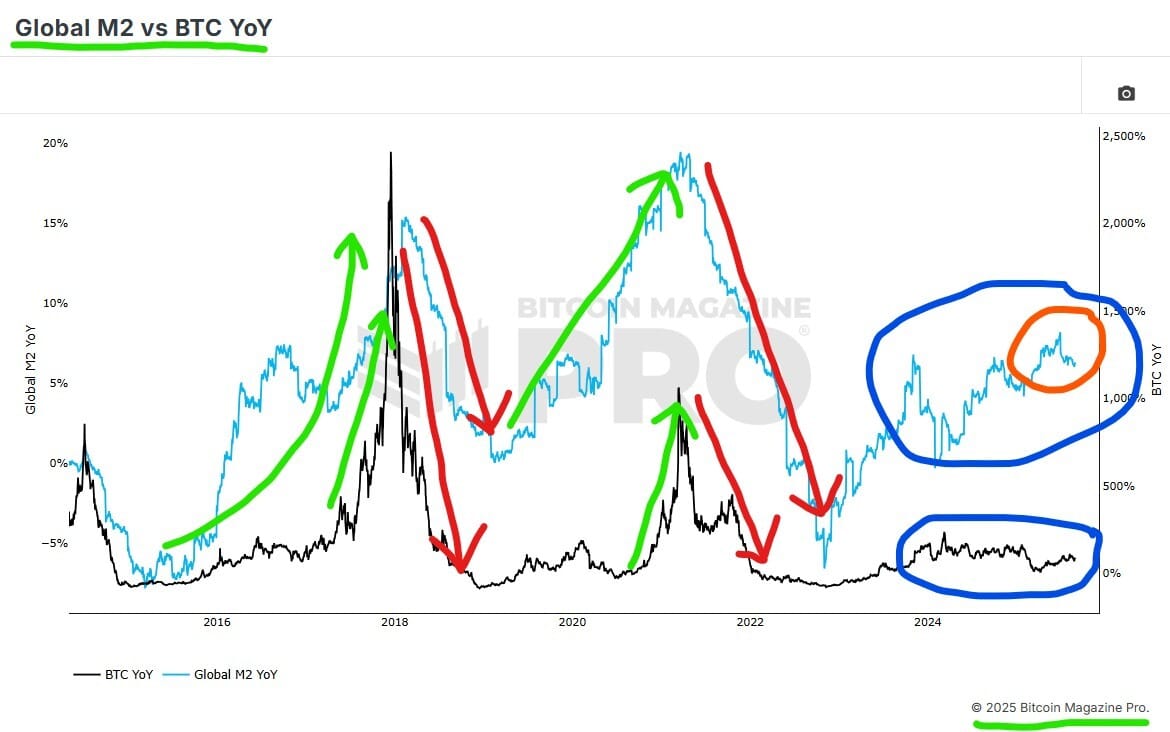

Global M2 YOY % Change vs Bitcoin YOY % Change

Again - inside the Orange Circle. Global M2 is actually trending down over the last few weeks and months. Yet - nearly everyone remains glued to this “M2 chart and Bitcoin” expecting a “god candle” any day now.

Bitcoin Bottom Line:

Let the market tell/show us what is next

The Money Flow on the Weekly has been Red for over a month now, never flipped Green even with the head fake new ATH

Can’t emphasize this enough in my humble opinion . . . . . . . . at this precise time Global M2 is not rising at the margin . . . . . . . . . let that sink in

Bitcoin entered and currently trades inside the zone we identified and targeted a long time ago: $107Kish to $108.7Kish . . . . . . . . difficult to view a break below here as bullish . . . . . . . . liquidity sweeps below on the table of course . . . . . . . . will it consolidate in here and work up a bullish move? Time will tell . . . . .

Action on Lower Time Frames crucial at this crucial spot and moment

$114Kish a ceiling that would need to be broken

$104Kish

$95-$98Kish

$92Kish

The treasury companies and MSTR in particular are not Bitcoin, but not a good look to have more pressure added into the mix

There could be a very, very bullish bounce from here, but we do not know if that is the case as of yet . . . . . . . . *Money Flow on LOWER Time Frames*

Will $107K-$108.7Kish provide a base for The Great Turn

Risk On/Off

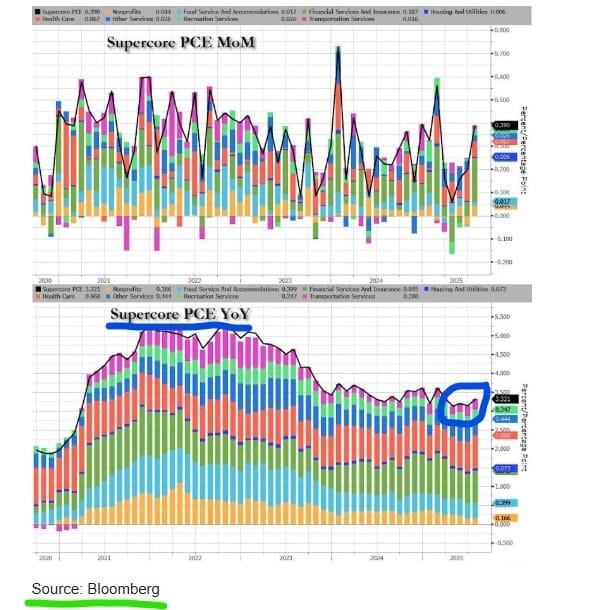

From ZeroHedge.com here is a look at the inflation reading this week - Supercore PCE:

Some level of inflation is helpful to Option B ‘run it hot’ . . . . . . . . . . . . but the Net Interest Expense issue is a national, economic, and financial security threat. Looks like Trump is trying everything he can to ensure he has enough votes to dramatically steepen the curve to lighten the load on the Treasury. The issue here with regard to Risk On/Off and Bitcoin is ‘when’ . . . . . . . . Powell runs until May and the political/legal theatre takes time to run its course. Remember - rate cuts do not equal balance sheet expansion.

ZeroHedge.com captured some interesting notes (shown above as well) from one of Goldman’s top traders regarding liquidity:

RRP has been winding down now for a while. In my humble opinion - still see bank equities as the best signal for possible meltdown issues caused by RRP if any. Let’s take a look at the TGA (i.e. Bessent’s checking account):

Go and check longer term charts for the Spooz and Nasdaq. From the above, the Red Arrows show periods where the TGA is very hungry and needs to buff up the balance in the checking account so the bills get paid (and the Treasury makes a LOT of payments OUT). The Green Arrows show a flush TGA being drained and in effect adding liquidity to the markets. Incidentally - Spooz and Nasdaq fell during the prior two Red Arrow periods and rose nicely during the Green Arrow periods.

AGX Weekly

Argan has been a big component of the AI Trade. Excellent look by IBD at how this AI stock has struggled in August:

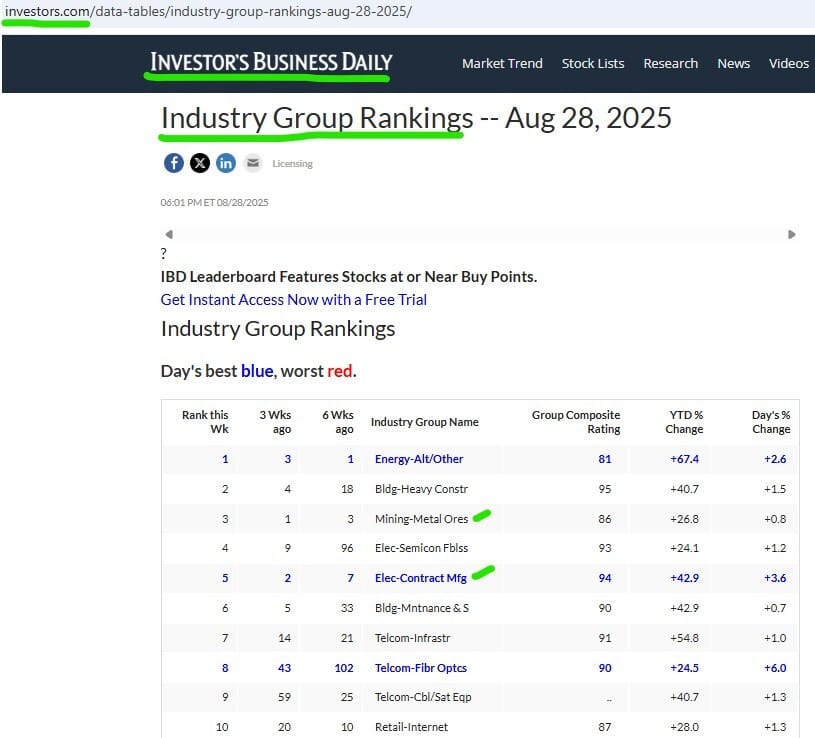

NVDA didn’t kill the AI Trade yet in my view nor did it give it a big boost, and that action in AGX is very telling in my view. Nonetheless - two of our key Industry Groups are holding up quite well. This is important whether the market is in a rally or correction, perhaps more so when in correction. We want to see Relative Strength.

IBD Industry Group Rankings

HYG Daily

QQQ Daily

MSTR Daily

NVDA Daily

NVDA falls below $170ish with authority that could be big trouble for Risk On in general.

Risk On/Off Bottom Line:

Positioning from the Pros is not at extreme levels . . . . . . . . my take they pulled back to position in a more cautious manner . . . . . . . . yes also they have ammo to deploy

Liquidity is draining while Risk On still thinks it’s raining free money

Fed cuts 50 BPS and then what for longer duration? In my view LT yields could very well rise significantly and perhaps step in front of equities and/or put the boot on the neck

It may sound ridiculous, but with 2% of the firms representing over 40% of the value in the Spooz . . . . . . . . . NVDA above or below $170 is a very big deal

IBD maintains an 80% or more exposure but routinely notes chinks in the armor, our top Leading Groups are holding up but also getting smacked down when they try to get the rally going again

Junk Debt still hanging in there relatively firmly for now

Those that work very closely to the internal plumbing noting some tightening of the flow of money, not to be dismissed

Precarious, unique, historic position/time for Risk On . . . . . . . . . . . . maintaining a cautious and defensive stance on trades . . . . . . . . on core positions waiting for better times to add more

HYG signals bull, NVDA/QQQ/MSTR signal extreme caution warranted

MSTR and Bitcoin Treasury Companies

In my view the treasury companies are not doing anything wrong. Investors have to make their own decisions. My concern is not in any way with prudently adding Bitcoin to a balance sheet. My concern is with strategies like the one employed by MSTR during times when Bitcoin isn’t “behaving” the way it needs to behave for the strategy to work with the fewest obstacles possible. If Bitcoin is ripping every year and generally trending up, then everyone is happy the stocks are doing well. During times when Bitcoin is choppy, sideways, bearish and trending down, or otherwise not performing well enough . . . . . . this is where issues arise in my view.

Bitcoin needs to advance at such a rate and with a relatively predictable amount of consistency such that a MSTR approach can essentially outrun the dilution. I think it is possible the market reduces these premiums over time. The market will simply look at derivatives and other instruments to use implied VOL to anticipate future price action. If Bitcoin isn’t ramping wildly then the premiums trend towards zero in my humble view. The market will know when more dilution to pay the bills is forthcoming.

This has absolutely nothing to do with Bitcoin itself, but it’s obvious MSTR is very strongly linked to Bitcoin.

Hyperliquid Hype

Keeping an eye on Hyperliquid. Building some momentum let’s see what the charts say.

HYPE Weekly

HYPE Daily

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: sold another 15% or so of that stash so total about half sold, this one vicinity $114Kish. Total about half of mining stack converted to fiat and earning.

If the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. Currently - no SBIT or BITU. Watching any bounce from $107Kish very closely. Could long or wait for yet another lower high then long SBIT again but with an even bigger position.

UVIX been avoiding for a while but added back in late in week.

UUP

TBT been nibbling now holding bigger position.

Alex Grey

The Great Turn