This Is Not Investment Advice

BOMO Blasts Short End, No End In Sight for AI Capex Seemingly . . . . . . . Market Not Buying Option B

In the very short term and here and now, yes I would say the market no longer buys the Option B growth story outside of the AI CAPEX boom. Tensions building between the U.S. and Russia are helpful to bonds in the short run, but I’m sensing there is a bid under bonds now tied to fading the Trump economic recovery. Outside of AI related business, the market wants proof that there is an actual broad based recovery underway.

Transports never made new highs:

My USD Hedge/Trade

Holding firm here. Hedge value in part, in my humble opinion, from that it could continue rallying in a Risk Off break/pause/correction. TA is the best part though. EURUSD way over it’s skis and apart from a wakeup call on defense spending, the EU is committing a lot of economic self harm in some ways because it has to. Absent the real hammer from the BOJ, JPY flat or weaken not a crazy idea in my view. The whole world and especially the “experts” all lined up short USD.

The weakening dollar (which I could still see overall) is also a component of Option B, currently faded by the market.

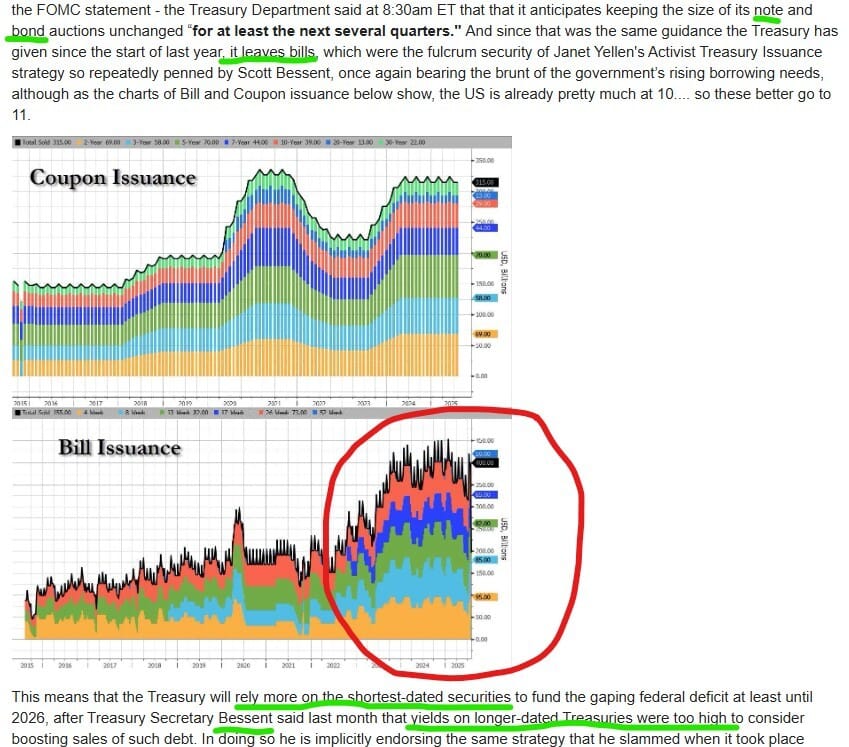

Bessent Throws In Towel On Long End

ZeroHedge.com recapped the update provided by the Treasury to debt issuance this week.

Translation: BOMO even more in play to hammer the short end of the curve to kick the can until BanQE and ultimately YCC is unleashed in earnest. More confirmation of how sensitive the long end of the curve is and the importance of the shape and configuration of the Yield Curve. When will it be public the entity status and relationship between the Treasury and Fed? Merging? Already happened?

My projection thus far of rates rising on the long end with a flat to dovish leaning Fed appears off in the very short run. I’m thinking of two possible scenarios or a combo of the two that might put a bid under the long end (buying BTC would be the best way in my view):

A) Market sees the updated auction schedule and plan to boost BOMO and thinks that nibbling on the long end absent any increases in the already digested schedule is viewed as a positive

B) Market is seeing the Option B economic engine thus far as having more bark than bite

Yields did not set new local lows as of yet, worth noting.

We’ll see what happens this coming week.

Here’s a look at what the mega-builders plan to spend on AI CAPEX looking over the next handful of quarters by way of The Market Ear at ZH:

Translation: for the time being though the end user activities may be highly frivolous . . . . . . . firms like MSFT and META are cleaning up and will continue to feed the AI Beast with about half of their operating cash flow.

Bitcoin Weekly

Bitcoin Daily

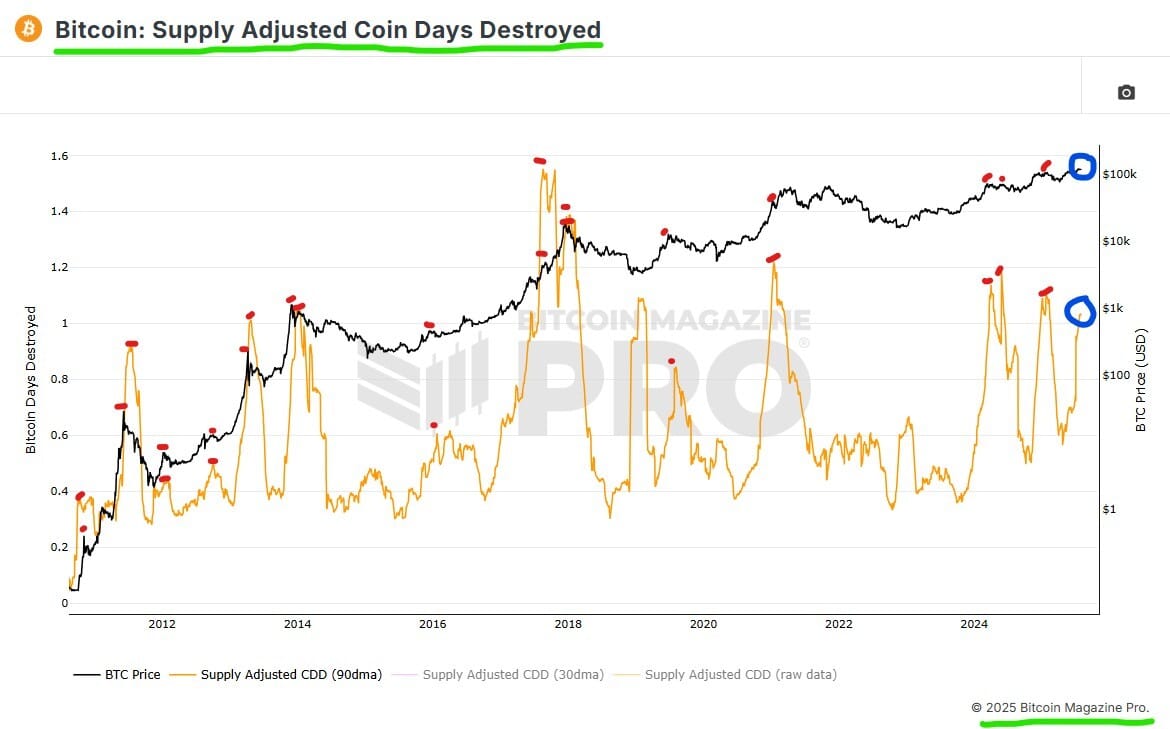

From Glassnode:

From BitcoinMagazinePro.com and shown here repeatedly:

Liquidation Heat Map - Two Week Time Frame

Not a ton of liquidity waiting below in the immediate range to potentially support a bounce at the levels shown.

Bitcoin Bottom Line:

Let the market tell/show us what is next

Are your diamond hands strong enough to handle a Diamond Being according to Mr. Grey

As discussed last week, risk of Ether fizzling out and Bitcoin falling below the Volume Profile . . . . . . that is exactly what happened

Red on the Weekly Money Flow

Note multiple hedging actions taken below for mining

If Risk On enters and stays in a correction, even a fairly brief one, that increases the odds Bitcoin tests $95-98Kish in my opinion

Curve steepened but bonds put in such a Risk Off manner BTC pivoted to follow QQQ

As of this current time and environment, there is no “mooning” on the horizon in my view absent a Black Swanesque type of new, large, and public buyer emerging . . . . . . . at least 3+ chances to accelerate and take off and it simply did not do it

Note more subdued action recently as well for Silver and Gold (less tension and anxiety about credit issues)

Risk On/Off

Is everyone beyond all in already? Who is going to buy these ATHs right here?

QQQ Daily

Selling definitely picked up as the week wore on, closing well down in the bottom half of the weekly range:

HYG Daily

Junk Debt is now Red on the Daily Money Flow and experiencing some Distribution:

As discussed, the TA is not falling apart bombastically just yet, but there are MULTIPLE large warning signs flashing. To wit - from The Market Ear at ZH:

Hedge Funds are all in . . . . . . all in. Missed most of the ‘Melt Up’ and still trying to jam a full year into this rally.

CTAs will get collared for indecent exposure if they expose themselves any more than they already have.

Highest level in history of Enterprise Value to sales.

The IBD Big Picture to wrap up the week:

Risk On/Off Bottom Line:

A switch to Risk Off can’t possibly be a shock at any time, equities have gone straight up for several weeks

We don’t make predictions here and we avoid time based instruments 99% of the time (simply too tough to beat the time decay in my view) . . . . . . . . we aim to view with an OPEN MIND the information and tools we know that are effective

Following up on last weekend’s point . . . . . . . market is simply running out of excellent stocks to buy at proper buy points . . . . . . they are all already up huge . . . . . . . and look at MSFT vertical

Market already knows all the good and amazing stuff about AI and the infrastructure needed to support it . . . . . . . it’s asking where is everything else that will propel GDP growth? Reminds me of the Trade War in April I started getting a LOT more bullish when I asked what else could possibly disappoint on tariffs - opposite here in effect

I added to UVIX, TBT, and UUP all week, trimmed some positions by more than half, and added other hedges noted below

If NVDA and MSFT even take a breather . . . . . . . . . . .

It’s not that Friday was a meltdown as it wasn’t . . . . . . . . but we are seeing some more Leading Stocks get hit and the indices close near the lows multiple days in a row - distribution

My senses are strongly leaning that despite how foolish the market might make me look in the next few sessions, taking decisive and direct defensive action is the prudent move now

At this point leaning it is an opportunity to refine your shopping list while building up cash, not a meltdown as of yet . . . . . . . how the indices behave around certain key levels, etc. will be key . . . . . . will Leading Stocks settle inside attractive buy points or will equities in general simply plunge and reset?

Rollercoaster year . . . . . . . prefer avoiding underestimating how quickly most might sell

Coinbase Makes Its Way Across TradFi Sector - JPM

Coinbase is partnering with JP Morgan to further Bitcoin adoption. We just saw this take place with PNC Bank a week or so ago.

Stacks Strokes Subtle Strength

Stacks, perhaps a barometer or proxy for cranking up the Risk On magnitude within the Bitcoin bull market, is grinding away as shown by Signal21 here:

STX Weekly

Not yet Stacks says:

Mining Update

Deployed a modest and simple way to further hedge and improve profitability with the mining business. Paid about 80% (the rest with cash so still zero ST credit balances) of the monthly costs directly with BTC thus avoiding the slippage from converting (spreads are insane) and all TradFi fees and obstacles. I’ll consider this every time BTC is a certain amount above the typical EMAs like the 21 day. This occurred around $118Kish.

Sold BTC, about 30% of the stash held from mining was sold, sitting in cash earning

Long SBIT, built position Thursday and Friday AM

holding long UUP as hedge/trade

UVIX nibbled on position more (fyi I could be in and out of UVIX this coming week)

TBT nibbled on position more

Subscribe to our brand new YouTube Channel

Alex Grey

Diamond Being