This Is Not Investment Advice

Fed Clears a Path to Policy Easing and YCC

Powell opened the door to a shift in policy from restrictive to more supportive. To me the biggest part was him laying out the nuances of the labor market challenges (labor supply down, what’s the magic number?) and noting the conundrum of trying to meet both mandates. He stated inflation was being persistent but that new data from the labor markets could cause them to shift nonetheless. Translation - he didn’t flush the 2% target down the drain but he did state he is open to having to ignore it if jobs get bad enough.

Here’s the 5YR Breakevens vs the 5 Year, 5 Year Forward Inflation Expectations:

Translation: since late June the market has been expecting incrementally more inflation on average over the next 5 years with the forward suggesting market sees less of a threat the five years starting five years from now. Policy error inbound? Time will tell. Rate cuts - longer rates rise - Yield Curve Control . . . . . . . how long will it take the market to sniff out this path?

The plan pursued by Trump and Bessent is to ‘run it hot’ and grow Nominal GDP faster than the unpaid balance of the debt is growing. Having some level of inflation is helpful to this objective. Powell is signaling he is opening up the Fed to formally align with Option B ‘run it hot’.

NVDA earnings and the coming trading days perhaps can help us answer a question. To now, seems like for this AI Bubble more chips = more good things and stocks go up. The question is for how much longer does the market and ecosystem try to solve this AI puzzle simply by buying more and better chips than the competitor next door. If this equation changes that’s a big problem for the Nasdaq. Color me suspicious as the economics of this emerging industry seem so lopsided in favor of burning cash I’m left wondering who makes any money here.

Regarding Bitcoin specifically . . . . . . . . . . in terms of FA things shifted a bit this week. As the global debt market terrors resurface (notwithstanding the markets being asleep currently but nonetheless a very bullish circumstance for BTC), the market is now preparing to potentially expose “Bitcoin Treasury Companies” just as MSTR wavers on its strategy. Saylor opened the door to diluting shareholders further to service debt and pay dividends and other stuff. The market might not just let that slide and ignore it.

I’m sensing a showdown between the muscle flexing Bitcoin Treasury Companies and the market. Market will engage in price discovery and give us more of a sense of what it truly thinks about these firms.

JGB 30YR Weekly

UK Gilts 30YR Weekly

MOVE Weekly

So perhaps lingering questions about Bitcoin Treasury Companies (should it persist and keep coming up) are countered by the brewing global bond meltdown as best depicted above by Gilts and JGBs.

On the one hand you have JGBs setting new highs on the 30YR, and yet the MOVE in the U.S. depicts how comatose and sleepy Treasuries have been here for many weeks now. One could argue Bitcoin should be gliding higher as JGB prices slide but it trades more like it’s trapped by the lack in movement from MOVE.

Toppy Observations

Flood of firms rushing to IPO in the crypto/NewFi/DeFi/TradFiBTC space all right here when the Nasdaq has already scooped up all the spare change hidden in couches and elsewhere

Bitcoin Treasury Companies perhaps flexing a tad bit too much in terms of how they purportedly have the existing financial system in a chokehold

The back office, built for founders

We’ve worked with over 800 startups—from first-time founders at pre-seed to fast-moving teams raising Series A and beyond—and we’d love to help you navigate whatever’s next.

Here’s how we’re willing to help you:

Incorporating a new startup? We’ll take care of it—no legal fees, no delays.

Spending at scale? You’ll earn 3% cash back on every dollar spent with our cards.

Transferring $250K+? We’ll add $2,000 directly to your account.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

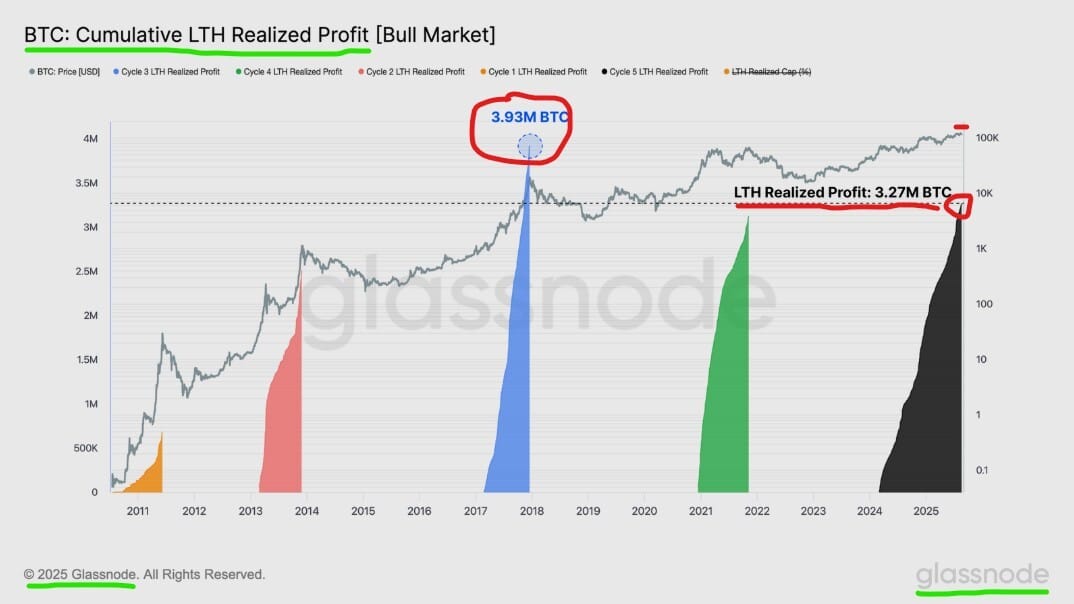

Very interesting chart from Glassnode shown below - looking at the Realized Cap Net Position Change. This shows that the two rallies back in 2024 had greater increases in capital inflows month over month than this move in 2025 has - less capital being injected into Bitcoin on a relative basis.

Although I don’t adhere myself to any specific “cycles”, during this “cycle” if you will the number of days or amount of time where the coins circulating were in profit relatively comfortably has been comparable to prior periods. The profits haven’t “felt as much” because as of right now Bitcoin has not risen as much on a percentage basis as it has previously.

Glassnode says we are near the end of this bullish cycle not the beginning as the long term holders have already cashed out more coins than they have in all but one prior major top.

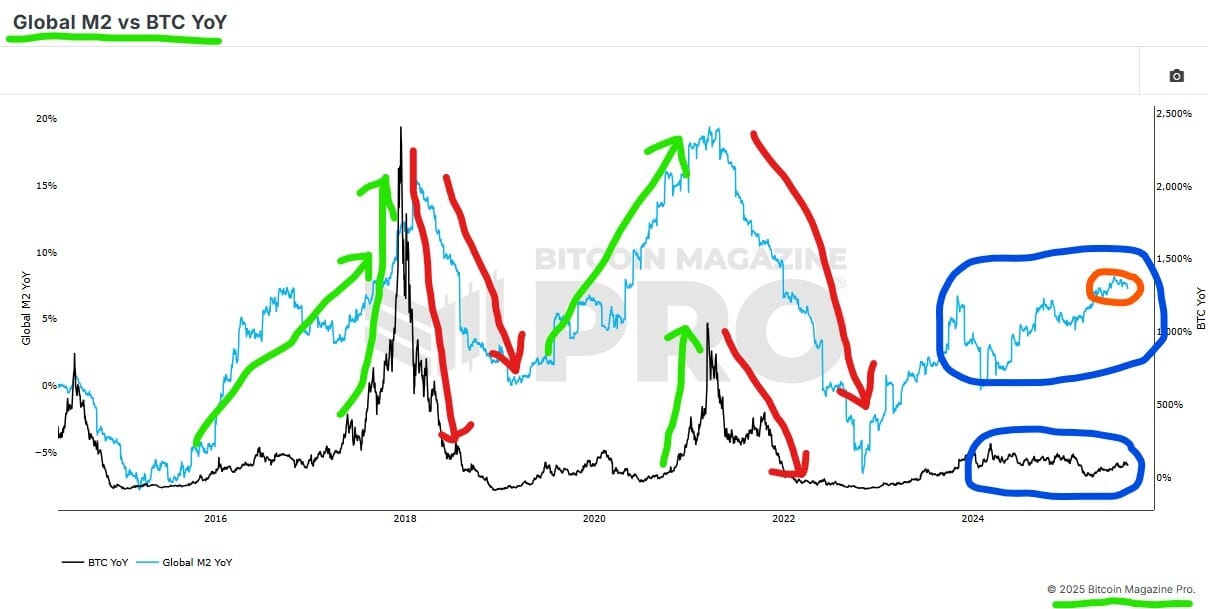

Global M2 YOY % Change vs Bitcoin YOY % Change

Let’s take a look yet again at this chart. As stated multiple times previously - in my humble opinion it is far more useful and constructive to look beyond just linking the Bitcoin exchange rate to the raw, aggregate amount of Global M2. It appears to me at least that the real correlation is with the rate of change in Global M2 rather than simply the aggregate amount of Global M2. Look below and see inside the Blue Circle (specifically inside the Orange Circle) how growth in Global M2 is bobbing up and down in recent weeks and months . . . . . . . . . kinda sounds like Bitcoin huh?

Bitcoin Bottom Line:

I don’t make predictions . . . . . . . . but for the record I don’t see this as “the top” though it could end up being a local top should volatility ever return again along with downside pressure . . . . . . . . . . . . essentially no top to any fiat exchange rate vs BTC but that doesn’t mean straight line up

Perhaps the two recent ugly weekly candles are countered by a quite bullish one immediately following the second real ugly one

The sweep down below $112Kish I sold SBIT (a hedge) just didn’t appear that it wanted to go lower, so is this sweep “enough”? Will this produce the bounce we need to make and sustain new highs?

On lower Time Frames might be useful $115.6Kish and $116.4Kish - below here makes it tougher to ride that bounce theory train

$118.3Kish and $120.8Kish - for this bounce to play out very favorably, turn the $116.4Kish into support and then chip away at these two levels mentioned right here

Even if it sets ANOTHER lower high here in this Volume Profile AND goes down and tests $110Kish and $107K/$108Kish . . . . . . . it could still be very bullish ultimately and working up for a real big move . . . . . . are you confused yet and aware and willing you might need to watch more of the market slugging this out????

In my opinion, the rate of change of Global M2 is a factor and the subdued nature of US Treasuries has temporarily quelled this urgent sense of concern about sovereign debt . . . . . . . BUT looking at Japan and the UK those concerns are globally flashing warning signs . . . . . . . . perhaps perplexingly both UST and BTC are sleeping through this for now

Concerns rise if it sets another Lower High and breaks $107Kish and ultimately plays with that $95-98Kish

One can’t help but observe that equities and ETH are reflexively showing more bullish momentum and explosiveness than Bitcoin is currently

$125.9Kish, $130Kish

Risk On/Off

Market did actually see a sharp spike in the Put/Call Ratio on these last two dips we have been projecting and discussing . . . . . . . interesting. Could view this bullishly within the context of the ‘Melt Up’ in that despite the dips being brief there was some element of shaking out players and capital.

QQQ Daily

SPY Daily

HYG Daily

NVDA Daily

PLTR Daily

Risk On/Off Bottom Line:

It’s entirely possible the correction and consolidation we have been expecting and seeking for a healthy cleansing and refreshing just happened already . . . . . . . . . . market ultimately decides . . . . . . . . . quite common in bubble environments and this ‘Melt Up’ the dips get front run and bought up before a healthy correction/consolidation even takes place . . . . . . . . my approach and mind is open to this as time will tell

Market was already giddy about Powell anyways and I still don’t really see how/what some type of new stimulus from here is even more bullish than the Nasdaq taking more spare change out of circulation than at any point in history . . . . . . . . but nonetheless in the short and intermediate terms path of least resistance could very well be up

NVDA earnings, labor, inflation . . . . . . . . . otherwise the standard ‘ramp it and camp it’ until PLTR and NVDA tank?????

Now that Powell is open to the idea of accepting inflation in favor of supporting a struggling labor market (if that data confirms) maybe the focus is now on the 2 major roadblocks A) credit . . . . . as long as bonds don’t tip off inflation/policy error, and B) as long as the math somehow magically still works that everyone must buy more chips to make AI work . . . . . . . then equities strong upside bias

But will bonds end up throwing some big punches . . . . . . . . .

HYG big bullish move Friday, PLTR and NVDA trying to get a little rally cooking and it looks plausible, SPY Money Flow Green on the Daily . . . . . . . . . . you can put a few pieces together here and see how the ‘Melt Up’ can certainly keep swinging for the fences and new highs

If Fed cuts cause longer duration yields to spike (which is quite possible in my view), that might take some time so in the interim the ‘Melt Up’ marches on??????? This is plausible

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Deployed a modest and simple way to further hedge and improve profitability with the mining business. Paid about 80% (the rest with cash so still zero ST credit balances) of the monthly costs directly with BTC thus avoiding the slippage from converting (spreads are insane) and all TradFi fees and obstacles. I’ll consider this every time BTC is a certain amount above the typical EMAs like the 21 day. This occurred around $118Kish.

Did the above again in advance for coming month about 75% of the expenses direct with BTC between $117K-$122K . . . . . . UPDATE paid all the bills this month the remainder on Friday vicinity $117Kish

Sold BTC, about 30% of the stash held from mining was sold, sitting in cash earning

Long SBIT - most likely plan is to hold until $110Kish if applicable or sell, long UBIT if it clears $118.3Kish and holds above firmly, did not hold above this past week . . . . . . . . . . . . . . UPDATE sold SBIT for profit Friday AM

UVIX always an option

TBT nibbled a bit more

Matthew Wong

Night Crossing