This Is Not Investment Advice

Powell Holds Destiny of Fed In Hand at Jackson Hole . . . . . . . . . . . . Waiving Goodbye to Inflation Targets . . . . . . . . . Bitcoin Tries From Middle of Volume Profile and Fails

So - is this it? I have been projecting for years now that ultimately the Fed would waive away the “inflation target” and either ignore it or incrementally set it higher and higher (i.e. 3%, then 4%, etc.). I ask this now because if the Fed does start a rate cutting cycle in September, then it is doing so when the data is telling them to hold firm or even consider hiking.

Powell’s favorite portion of the inflation data is not declining. It seems to be gradually grinding higher:

Maybe that’s part of the bigger play here. The odds of a September cut seem to match Trump’s demands for a cut, but does that align with everything Powell has been emphasizing in an academic and textbook sense of the Fed’s dual mandate? If Powell stuck with what he has been saying all along, he would not only hold rates he might even lean hawkish. Supercore inflation is grinding higher ever so consistently.

Here is Core PPI:

So perhaps the show for us to watch is the Fed abandoning inflation targets which we predicted would happen years ago. Or, maybe they allow the market to glide towards a new target - say 4% Supercore YOY. Remember - for Option B (‘run it hot’, grow faster than the debt) to work they need Nominal GDP to grow faster than the UPB of the debt. Inflation is helpful to getting Nominal GDP growth.

Though tariff revenue continues to climb and presumably will climb further, we can see below from the July deficits for 2025 that the trend is still very much in play in terms of out of control spending and deficits:

So - the Fed “is supposed to cut” even though inflation could very well be grinding higher and budget deficits are back on the rise again (as if it were ever under control). This is a recipe for steepening the curve for sure and in the bigger picture is extremely bullish for Bitcoin . . . . . . . . . . but is this where we are and what the markets are backing as well right now?

Swap, Bridge, and Track Tokens Across 14+ Chains

Uniswap web app lets you swap thousands of tokens safely, in seconds. Open‑source, audited code and real‑time token warnings help keep you safe.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

MVRV Z-Score

This is an excellent tool from BitcoinMagazinePro.com - look at it in terms of being overheated or ‘cheap’ versus ‘expensive’ to keep it simple. You can see with the red strokes times where this metric shot straight up into overheated and expensive territory and with the green where it identified some deep value and a ‘cheap’ Bitcoin at times. Now? It’s kinda stuck in the middle and in my view does reflect where we are overall.

Bitcoin Fear and Greed Index

Bitcoin Active Addresses

The below depicts a 7 day moving average for the number of addresses that have either sent or received a transaction. This aligns with my unofficial and casual observations of a lack of retail uptake and overall lack of actual use of Bitcoin during this particular bull run, meaning not as much growth in actual usage yet to go with the value increasing over time (shown in blue):

Liquidation Heatmap - 2 Week Time Frame

MSTR Weekly

COIN Weekly

STX Weekly

Bitcoin Bottom Line:

Let the market tell/show us what is next

Despite zooming up to a new ATH and more drama being generated . . . . . . . . the Money Flow on the Weekly never turned Green and remains Red

$116.6Kish to $116.3Kish below current levels could be a launchpad or another failed support level time will tell, $114Kish and $110Kish sit below

As stated last week . . . . . . . . . . . might be tougher to build up the energy, momentum, and Money Flow trying to break to new highs and sustain from no man’s land inside a Volume Profile . . . . . . . does BTC need some more ‘drama’ and volatile action to test some levels and create more of a move????

Though not primary indicators . . . . . . . . . seeing the Money Flow and how MSTR, COIN, and STX are trading does not give me a jolt of enthusiasm towards opening a new levered net long Bitcoin position

Two blue circles on the Weekly chart above . . . . . . . . . . . . . . not the end of the world but not bullish . . . . . . . . . . . could linger as nagging issues on higher Time Frames trying to break out of here yet again if that were to happen

Though currently still Green, if the Money Flow flips Red on the Daily, then . . . . . . . . that $110Kish test more likely to come into play

Does Powell flush the inflation targets down the drain at Jackson Hole or not??????? I have no idea so sticking with the tools that are effective . . . . . . . . . .

$119.5Kish and $120.6Kish brings the MOMO and MF back in my view

From last weekend:

Risk On/Off

AI CAPEX as we’ve discussed here many times is on quite a roll. What exactly are firms, and the economy in general, getting from all of these capital expenditures and massive investments? Let’s look at some data from Soc Gen on Free Cash Flow Yields that appeared at ZeroHedge.com:

As shown above, a “normal” range for Free Cash Flow Yield, for the S&P is somewhere in the 3% to 4.5% range. FCF Yield depicts Operating Cash Flow minus CAPEX and then divide it by the market cap. As shown above, ever since the “AI Arms Race” started the Mag 7 is watching FCF Yield slide below the levels achieved, earned, and demonstrated by businesses functioning in the economy for years and even several decades for many. AI might be cool and sexy right now, but math is math.

Now let’s look at AI CAPEX relative to earnings:

Here’s what really, really jumps out at me . . . . . . . . . . this AI bubble, like many other bubbles in the past, is tempting/teasing you to lump everything into the “it really is different this time” bucket. The way it looks to me at the moment is that we are approaching a point where this AI stuff better really knock the socks off of the world and blow the economy away with how awesome and amazing it is. The CAPEX is eating away at the profits and FCF of the world’s most profitable companies.

I’m not saying I am against AI or hoping it crashes. I am saying that it better deliver in a very big way. We are in the largest equity bubble of all time, but that’s not the worst part. The worst part, and the scariest, is how concentrated it is. The “AI Trade” correcting hard or even worse starting to unwind and reverse could topple the equity markets in general.

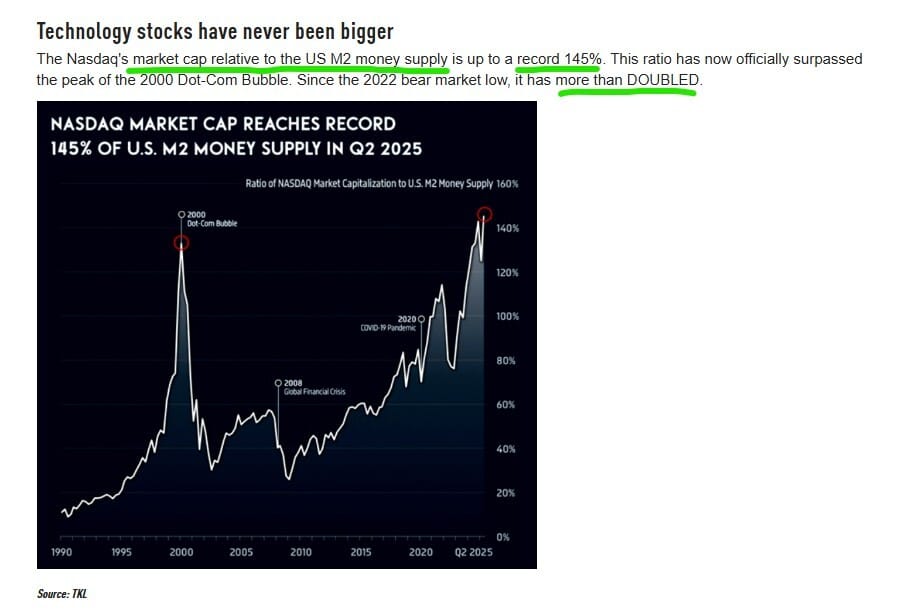

Let’s look at the Nasdaq market cap compared to M2 Money Supply. This is very, very important as we all have at least several times made a connection between Bitcoin, ‘crypto’, and M2 and in particular global liquidity. Seen below, the Nasdaq is now clearly at the highest level ever relative to M2 or ‘liquidity’ if you will. In other words - with respect to ‘Money Printer go Brrrrrr’ the Nasdaq is ALREADY way above its highest levels ever!

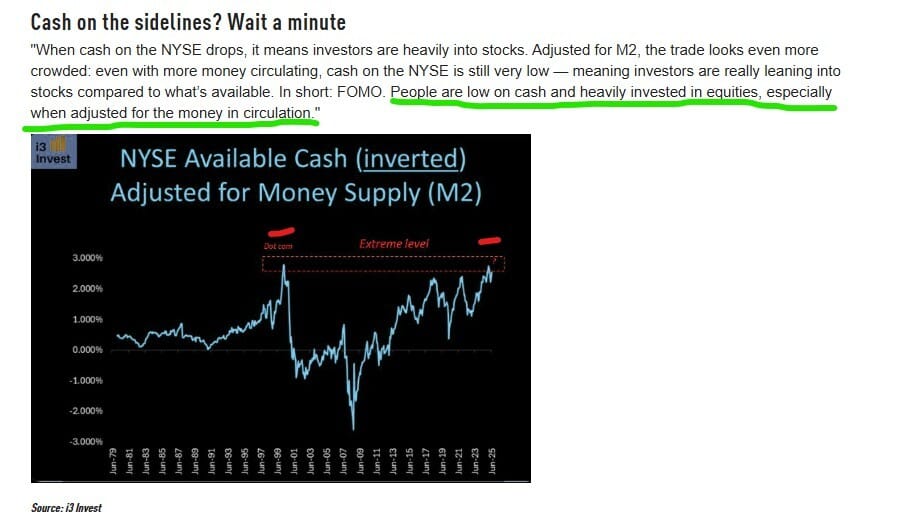

As shown below, relative to the amount of money in circulation, there has only been one other time in history when this much of that cash has already been plowed into stocks.

It strikes me that with say the internet and email, the world was jumping onto a new platform for distributing information and commerce. Just sending the email was the very much welcomed innovation not arguing about the contents of the email. With AI - the “success of AI” seems at least in part in the eye of the beholder and up for debate enough to that we may avoid consensus.

Capacity utilization has not yet really turned the corner:

QQQ Daily

NVDA Daily

Risk On/Off Bottom Line:

Expectations for pure bliss, rate cuts, and a tsunami of Dovish love are so sky high now my senses keep telling me over and over to maintain a level of caution and a defensive posture . . . . . . . . . . . biggest equity bubble of all time . . . . . . . . . . . . if it is this big and continues it will encounter some tests and price discovery on the way

Yes it could go straight up and Nasdaq futures could be up 700 points Monday AM that is possible

As of right now we simply are not seeing conviction, volume, and Money Flow - at the margin and relative to the current levels - increase and build momentum . . . . . . last couple weeks of churning and relying on one big name per day to hold up the entire thing

As discussed I trimmed many positions and am still net long and on board the bigger and broader concept of the ‘Melt Up’ . . . . . . . . . . . . but I am much more interested in adding at a better time and to see how this shakes out here

What could Powell even say or do from the bullish side not already expected by equities given the price action?????????

Buybacks and Retail FOMO/MOMO no doubt about it they support this rally in the short term . . . . . but is that enough?

Insane levels of concentration in the AI trade, Treasuries, and Accumulation/Distribution and Money Flow keep whispering in my ear

Some attractive groups are at least leveling off and even declining so far in a relatively healthy way

If forced to chase or add exposure, we can do that . . . . . . . . preserving capital #1

In mid-April it was “Trump’s tariffs will cause inflation and kill the economy” and in mid-August it is “whatever, don’t worry AI will improve productivity so much the market is still cheap” . . . . . . . . . . . in mid-April I got a LOT more bullish when there was nothing left to be bearish about (at the margin) . . . . . . . now what else could possibly be created to be even more bullish at the margin????

Indonesia Eyes Renewables to Stack Bitcoin

Apparently the government of Indonesia is open to the idea of using their abundant energy resources to mine Bitcoin and possibly start a Strategic Reserve. Bullish obviously for Bitcoin and for the buildup of Game Theory related to stacking at the highest levels to include Nation States.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Deployed a modest and simple way to further hedge and improve profitability with the mining business. Paid about 80% (the rest with cash so still zero ST credit balances) of the monthly costs directly with BTC thus avoiding the slippage from converting (spreads are insane) and all TradFi fees and obstacles. I’ll consider this every time BTC is a certain amount above the typical EMAs like the 21 day. This occurred around $118Kish.

Did the above again in advance for coming month about 75% of the expenses direct with BTC between $117K-$122K

Sold BTC, about 30% of the stash held from mining was sold, sitting in cash earning

Long SBIT - most likely plan is to hold until $110Kish if applicable or sell, long UBIT if it clears $118.3Kish and holds above firmly, did not hold above this past week

holding long UUP as hedge/trade

UVIX nibbled in and out position more (fyi I could be in and out of UVIX this coming week)

TBT nibbled a bit more

Alex Grey

Contemplation