This Is Not Investment Advice

Equities and Bonds Demand Balance Sheet Expansion, JPow Leans on Strong Labor Market . . . . . . . . . . Bitcoin Teases With Precision

An area where bonds and equities both seem to align is the pricing in and expectation of not just a 50 BPS cut in September but balance sheet expansion. Bonds however, are pricing in 2% GDP growth while stocks are expecting 8%+ GDP growth. Back in April and May this publication observed how the entire curve started rising as it was discounting stronger growth ahead. Treasuries were accurate back then as the hard data started rising. Now the hard data has been sliding and yields are declining. Will bonds be right again? Time will tell.

We do know that bonds are currently comatose and the most complacent and chilled out they have been since 2022 as provided by The Market Ear at Zerohedge.com:

Another way of saying it is that if a snapshot of Friday’s close in Treasuries is highly accurate in terms of projecting and discounting . . . . . . . . . . . . then the economy is about to tumble.

The auctions this week were terrible, longer duration bonds didn’t budge. Bonds are trading as if they have a guaranteed exit at a higher future price . . . . . . . . . . from the Fed?

Powell may like the labor data showing that ‘bad unemployment’ (laid off from permanent job for 12 months or more) is actually not showing warning signs and that perhaps a supply of labor is of more concern. If jobs aren’t filled the monthly jobs report will only pop so high and may decline here and there even if the economy is “holding up”.

Regarding direct impact on Bitcoin and Risk On/Off - not so sure about expecting/demanding both rate cuts and balance sheet expansion or so-called “money printing” to both arrive at the same time. They are distinct and separate though logically assumed to be aligned.

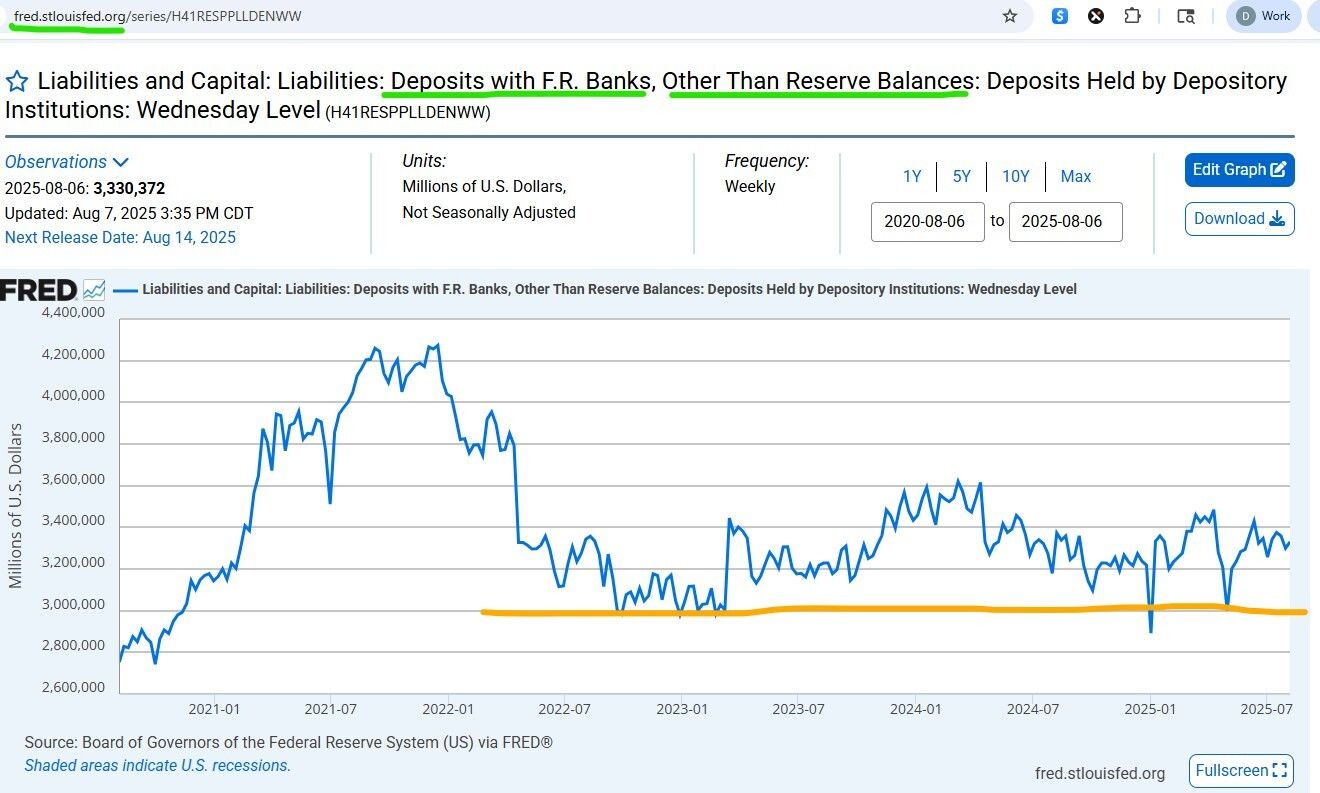

Clearly ‘rate cuts’ are a high priority topic of debate at the moment, but balance sheet expansion? Where’s the problem with liquidity?

Powell seems to like keeping an eye on this staying north of $3T, looks in the clear and has been:

In my opinion markets are jumping the gun a bit on QE. Bessent already laid out the plan to hammer the short end for a couple years (also note the Bills auction was MUCH more successful than the longer duration auctions). Financial conditions are extremely loose, no issues with reserves, yes RRP is winding down, and asset prices are at all time highs. And Japan is paying investors to borrow in Yen. And the Fed is going to turn on the money printer right now or soon?

Bitcoin Monthly

Overall and generally speaking this Monthly Time Frame chart for BTC looks bullish. We see volume declining since the election related strong move and a lack of explosion and momentum to the upside in recent weeks and months. But - can’t complain all that much with this in a general sense.

Bitcoin Weekly

Weekly chart in my view is reflective of the teasing going on right now - will it or will it not set a lower high again here in this $116Kish to $118.8Kish zone? Not entirely clear at the moment. Time will tell.

Bitcoin Daily

Do we keep setting these lower highs, or does something launch this above $118.3Kish and $119.5Kish and further to break free?

Glassnode offers insight suggesting the level just below $117K is providing stiff resistance from the recent cohort of longs entering over the last month or so:

So, according to Glassnode we have firm resistance at $116.9Kish and below we see that Short Term Holders (i.e. recent new longs) were once sitting flush all in profit (Red Ticks) but are now down in a range where they might chill and be happy . . . . . . . . or panic sell if we get the correction down to $110Kish.

Liquidation Heat Map - One Week Time Frame

From CoinGlass.com:

Bitcoin Bottom Line:

Let the market tell/show us what is next

Primary factor currently might be if BTC sets another lower high in this $116.8Kish to $118.3Kish area or if it somehow manages to get the Money Flow to plow through this and ultimately test the prior ATHs

From my standpoint it’s not providing an entirely clear or easy to decipher picture, in some ways its begging more longs to buy . . . . . . . . . just to pull the plug and go down to that $110Kish? Your call

Yes FA factors like 401Ks and mounting BTC buys by corporations are all great, but the facts remain we are simply not as of yet seeing explosive upside price action backed by surging Money Flow and Volume

In my opinion, the more bullish ultimate outcome would still be a launch from $110Kish to flush things out and clear the decks so to speak for a big, sustained move higher . . . . . . . . . . could be tougher to generate the energy and Money Flow from right here near the middle of this larger Volume Profile

Easy to say “what’s the big deal it’s not that far from an ATH” but that isn’t the point, the pivots from certain levels can produce big moves including moves lower . . . . . . do you want to find out what happens if it plunges below $109.5Kish????? You may not want to find out . . . . . . . . . . It would not take all that much to go down and test this just like it could certainly drift higher on lighter volume . . . . . . . if Nasdaq futures are up the usual few hundred points Monday AM maybe that nudges it up even more . . . . . . . but we SO FAR have been lacking CONVICTION in recent weeks to the upside

Will it or will it not clear $118.3Kish and move higher, if so that could be new ATHs . . . . . . . if not it’s not over but testing some key levels could be in play

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Risk On/Off

QQQ Daily

I realize the Nasdaq futures are up every morning at least 100 points or so. I understand the Nasdaq went up again this week. Simply viewing and analyzing with an open mind here . . . . . . . there has been more Distribution in these last two weeks than there has been Accumulation.

SPY Daily

Similar situation for the Spooz:

IBD The Big Picture after Thursday shows some of what I view as the biggest challenges currently for equities. The whole world knows about the AI CAPEX explosion and stocks related to it are already way, way extended beyond proper buy points. Others are being muscled up and dragged up to manufacture a buy point almost. IBD sums it up:

Stalling, as determined by Investors Business Daily, was prevalent in the Nasdaq on Thursday:

From ZeroHedge.com comments from Nomura:

Equity investors nearing euphoric expectations of zero chance of a weakening economy and the Nasdaq will go straight up according to them until tech credit spreads crack:

Risk On/Off Bottom Line:

Treasuries are saying we might run into some economic turmoil in the short to intermediate term, stocks don’t seem to care

I’m not sold the market will get what it is demanding when it expects it to arrive in terms of cuts and QE

Bond auctions longer duration were awful this past week, bonds didn’t budge, do bonds expect an auto-buyer like the Fed as an exit?

Just analyzing the facts . . . . . . equities in general have seen more Distribution than Accumulation in these last two weeks . . . . . . . . almost a scaled down version of “Railroad Tracks”

Yes I realize that “because of AI optimism on Monday” or “because AAPL said something nice” that Nasdaq futures could be up 500 points Monday morning, but again just reporting what the data is telling me and the market . . . . . . . . . there could very well be yet another “stick save” to jolt stocks into Jackson Hole and beyond

CPI, PPI, retail sales this week, Jackson Hole soon, then Fed Meeting in September . . . . . . . . equities are priced as if all of these checkpoints will provide the perfect ‘Goldilocks’ data point, jawboning, rate cuts, etc. - I’m not particularly enthusiastic about taking on those expectations at current prices

Have you noticed the use of more gimmicks recently? AAPL gets its own promotional week with tariffs and White House exposure, the new Dove announced just as equities are dumping towards the lows for the day . . . . . . . . “AI optimism” the crutch holding up futures nearly every day, attempts at the ole ‘ramp it and camp it’ . . . . . . . . . . just observations

I would personally be much less cautious if longer duration rates were grinding higher because growth is so robust . . . . . . . . what we have now are yields plunging in response to the econ hard data coming back in

With the econ data pending this week after the last two weeks (more selling than buying overall) we might find out if people are forced to chase more or if some price discovery in BOTH directions occurs

Watching a Top Stock Potentially Become Very Attractive

The more boring this is and the more patient you are, in my opinion, the higher your chances are of being successful.

I’m intrigued by FLEX. I like the Industry Group a good amount as well: Elec - Contract Manufacturing. Let’s check in on the group:

Clearly the market loves this group as well. In this recent consolidation for equities and ‘Melt Up’ on laughable volume, this group is holding up exceptionally well.

Let’s check out FLEX:

For my own personal decision making, and in my opinion, FLEX is staying on my radar. The Accumulation/Distribution is very strong compared to the average dud, but it is not exceptional at the current moment. The price action shows it has consolidated very strong gains recently, but the Industry Group is holding up very, very well.

If the market overall is in the right condition and FLEX gives me a credible and legitimate entry point - I could very well get long.

An ideal setup would be a correction in equities overall but not a crash with FLEX declining a modest amount further on lighter volume with the Industry Group RS holding up.

Fed Issues Paper on Gold Revaluation

Not entirely a surprise here, as Bessent openly discussed monetizing the asset side of the balance sheet earlier in the year. Now the Fed has published research on revaluation of the Treasury’s gold. Proceeds here if completed could be used to add to the Strategic Bitcoin Reserve and will most likely end up in the TGA (Bessent’s wallet). Bullish for Bitcoin and bullish for further use of QE-lite via TGA. Bearish for the onset of actual QE as it would imply Bessent is even more flush and can focus on the short end for even longer perhaps.

EO Bitcoin in 401Ks/IRAs

Certainly adds to the 9/10 for FA.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure. Obviously owning mining rigs is a massive net long position (and personally as well) so I am not “cheering against” BTC but rather managing business.

Deployed a modest and simple way to further hedge and improve profitability with the mining business. Paid about 80% (the rest with cash so still zero ST credit balances) of the monthly costs directly with BTC thus avoiding the slippage from converting (spreads are insane) and all TradFi fees and obstacles. I’ll consider this every time BTC is a certain amount above the typical EMAs like the 21 day. This occurred around $118Kish.

Sold BTC, about 30% of the stash held from mining was sold, sitting in cash earning

Long SBIT - most likely plan is to hold until $110Kish if applicable or sell, long UBIT if it clears $118.3Kish and holds above firmly

holding long UUP as hedge/trade

UVIX nibbled in and out position more (fyi I could be in and out of UVIX this coming week)

TBT nibbled a bit more

Matthew Wong

Unknown Pleasures