This Is Not Investment Advice

Bill Signed, Full Speed Ahead Option B and Blending In ‘Melt Up’

As shown below, the ‘Melt Up’ from the standpoint of equities has gained steam and is somewhat settling in to this new mode, while bond VOL disappeared (until this shortened week) and Bitcoin languishes inside a box again. As the market fully absorbs the big bill and very real possibility of the labor market and economy improving let’s just see how long until Bond VOL returns in a bigger way.

Though far from the only thing driving Bitcoin action, we simply can’t dismiss Bond VOL and the steepen/flatten dynamic while fully acknowledging that the FA continues to get even better and stronger.

UK GILTS 10YR Daily

Note the huge swings in recent sessions with yields grinding higher again:

JGB 10YR Weekly

During the week got within 10-12 BPS from pressing new local recent highs for this cycle:

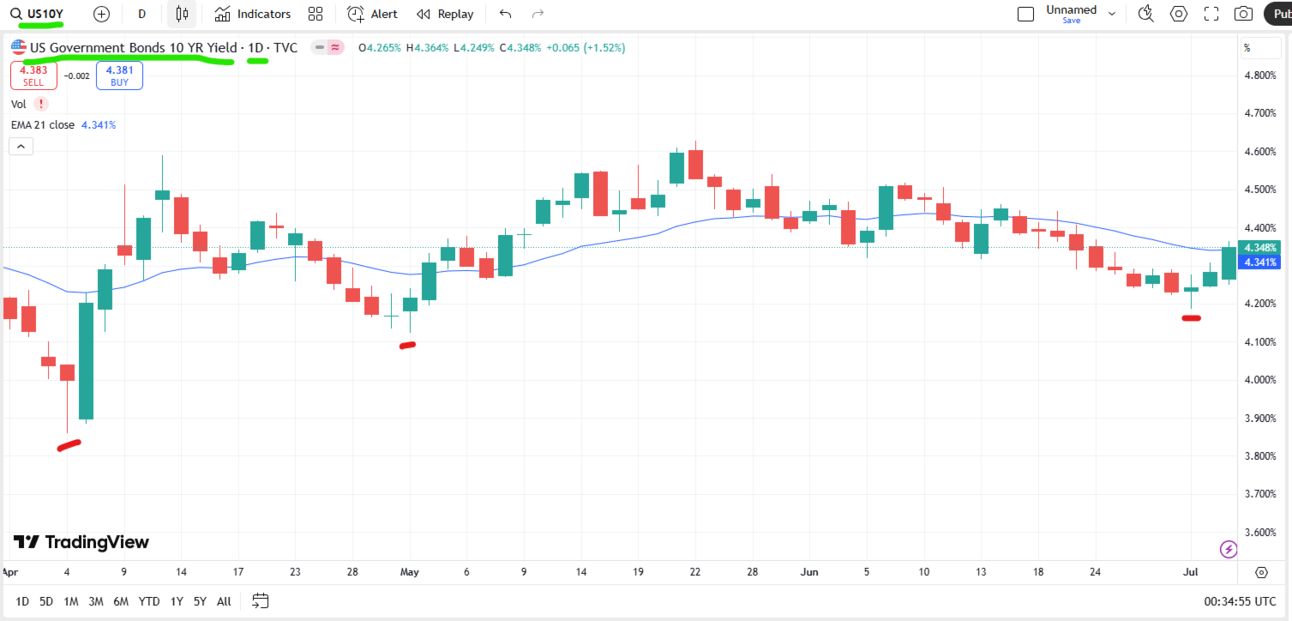

UST 10YR Weekly

Another higher low set for the 10YR? Time will tell:

The point here looking at JGBs, Gilts, and UST is to avoid overlooking the fact that these structural problems still exist and all we have seen is in effect can kicking and the ebbs and flows of trading action. In the UK they just had a session with huge turnover and almost a 40 BPS range on the Gilt. Yields are creeping higher in Japan again. In America, we see a nudge higher as well and this is with a small oil shock to dent growth, BOMO appearing, SLR, and Trump constantly guiding the market to the Shadow Dove. Bond VOL is not gone forever.

Looks like even more participants are starting to grasp the implications of Option B and the ‘Melt Up’:

Bitcoin Monthly

Note the change in Monthly Money Flow to Red. That June candle was modestly bullish but the month continued a trend of lackluster volume since the burst from $74Kish.

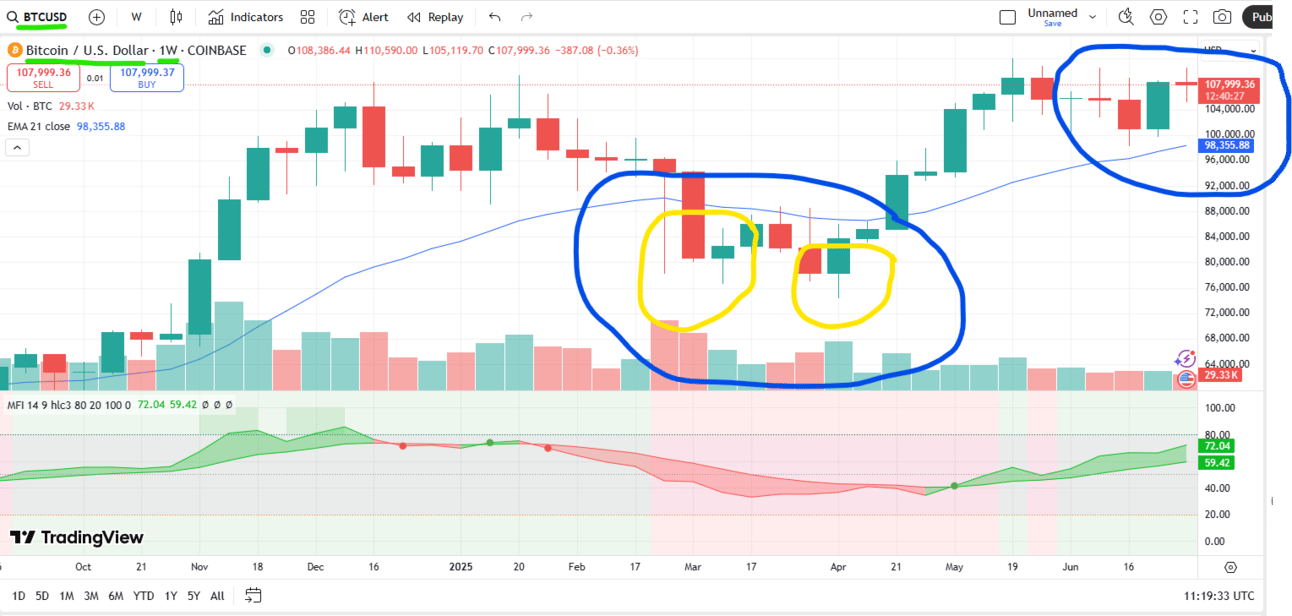

Bitcoin Weekly

The Weekly still looks quite bullish in terms of Price and Money Flow . . . . . . . . . volume very lackluster especially in recent weeks.

Bitcoin Daily

The Daily highlights what I viewed as a very bullish bounce off of the $98Kish level but when back inside the box just kinda more ho hum action:

Here is the steepen/flatten dynamic over the last month I have been highlighting provided by BitcoinMagazinePro.com:

POTUS continues to try and point everyone towards the Shadow Dove looming in the background, but some recent strong economic data is lowering rate cut expectations and causing a selloff in the 2YR. The Long End really benefitted from the threat from oil to economic growth so let’s see how it shakes out. Either way, to me it seems pretty clear Bitcoin reacts to this dynamic. A steeper curve is validation for Option B and the ‘Melt Up’ and reflective of healthy growth expectations and more supportive of Risk On. BTC seems to react to this pretty consistently. Bessent talking more ST issuance and even less LT issuance only flattens it more potentially. However - with the big bill now signed let’s see how long it takes the long end to start running some new calculations.

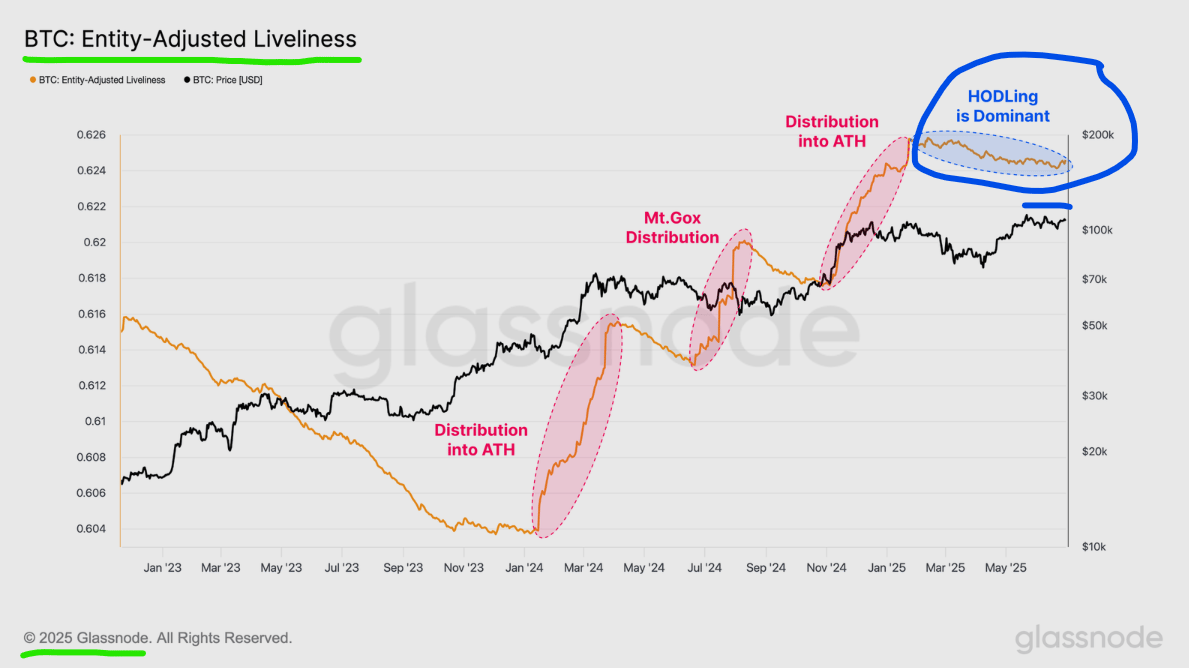

As discussed previously and depicted here by Glassnode - many kinda hanging out and waiting and holding on these last couple months since the bounce from $74Kish:

Stablecoin guns look loaded up with ammo now:

Great data from BitcoinMagazinePro.com looking at the YOY change in Global M2 and associated YOY change in BTC. Needless to say, it’s more than just “all the central banks are pumping” and rather the rate of change in Global M2 that drives the much larger moves in Bitcoin. In other words . . . . . . . . the market already knows “the story” about Bitcoin for the most part . . . . . . money printing hedge against incineration of your purchasing power . . . . . yeah yeah yeah . . . . . at the margin the market is looking for the change in growth of M2 globally.

Might be useful to keep the below in mind. The January/February turbulence has some similarities to now. Bitcoin just kinda hung around in a range on lighter volume and then ultimately declined perhaps partly due to apathy and trading urgency and buying simply waning. Sound familiar? Back in March as well Bitcoin front-ran the box we targeted $74Kish-$78Kish and bounced . . . . . . . . only to go back and truly test that zone and get a proper and very bullish response from it.

Now - we just front-ran $95Kish-$98Kish very aggressively. It only touched $98.3Kish overnight briefly then took off. Do we need to go down and truly test that zone and truly flush out more weak hands with some scary wicks to top it off? Time will tell. It is possible.

Bitcoin Bottom Line:

Let the market tell/show us what is next

Though the FA continues to improve and the charts don’t look terrible, there is a very real possibility of a correction looming and soon, Money Flow Red on Monthly, lack of volume, that drifting and “hanging around” waiting to get smacked down . . . . . . . not unlike March/April where BTC tested the correct and appropriate Volume Point of Control but did it not once but twice with the second version more intense

That said there is close to nothing stopping this from really running if we get at least 1x Weekly close above $109.5Kish and some volume and MF comes to back it up, already teased this a couple times

$109.5Kish, $105.9Kish, $102Kish-$104Kish, $100K, $97K

Risk On/Off

How high can it go? Who knows. One thing purportedly holding Risk On assets back from an American standpoint is this alleged shunning of US assets and of course the explanation that assets aren’t rising it’s merely the dollar falling. There is always truth to looking at any asset priced in any currency and seeing a relationship between falling unit of account relative value and an increase in the asset value denominated in the same. Does that explain all of this though from The Market Ear at ZH:

Leverage, while still at high and “stretched levels” has cooled off a tad and stands at a level not as insane as it has been in recent weeks - a bit more reasonable now:

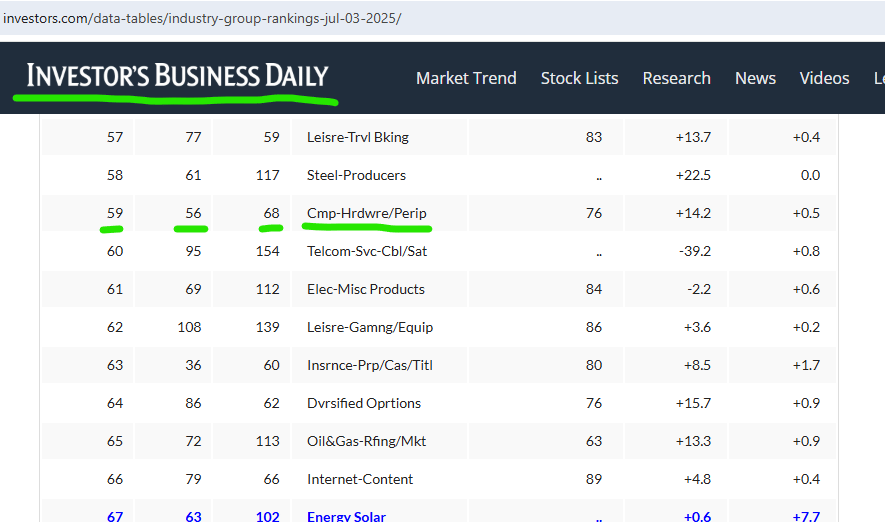

The IBD Big Picture view:

Risk On/Off Bottom Line:

I’m ready either way but senses are sticking with the ‘Melt Up’ and the potential for explosive upside moves - it’s clicking more with my alarms going off in early April about a new bull market emerging with new leaders and a new set of forces driving it

Bill signed to include $5T increase to the farcical “Debt Ceiling” . . . . . . . . . . . shouldn’t take a genius at this point to see that Option B is a full bore GO and the goal is to grow as fast as possible and spend a ton of money along the way

Volume is putrid, Money Flow is so so, but more leaders are breaking out and more new leadership groups are climbing the rankings - these are bullish signs

Always preparing for a turn of events and monitoring potential hedges/trades for when (not if) we have sharp corrections

Quantum Computing - QBTS Update

As discussed building this one up. QBTS raised $400M in cash at a whopping premium and the market seems to like it. Let’s see how the Group is doing:

The Industry Group is hanging in there and climbing a bit this last week. Here’s how the Weekly Chart looks now:

Uranium Powerhouse Plans Bitcoin Reserve

Kazakhstan, home to more than 40% of the globe’s Uranium by some accounts, is looking to establish a Bitcoin Reserve as reported in BitcoinMagazine.com. How long until the Uranium stocks start stacking and/or implementing a Bitcoin Treasury strategy?

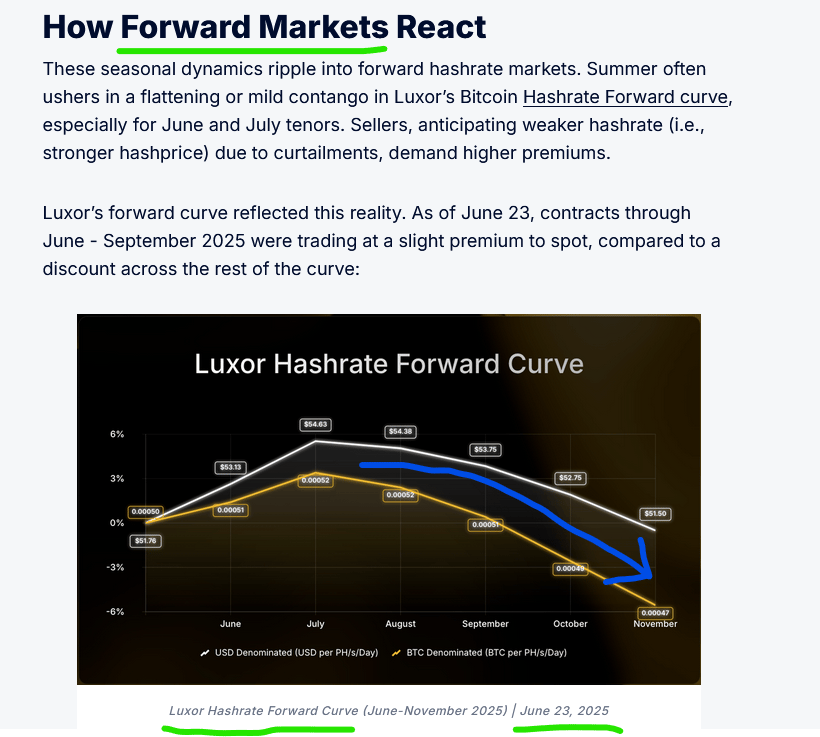

Hash Rate Forward Curve

IBD Top Groups Plus Most Intriguing

The below depicts the Top 20 IBD Industry Groups as of this shorter trading week. Though always digging, here are the three (one shown in the Top 20) that intrigue me the most currently:

Electric, Contract Manufacturing

Mining - Metal Ores

Computer Hardware - Periphery

Stacks Simmers

Here’s one spot where a Stacks enabled Stablecoin is showing up - liquidity pools:

STX Daily

Mining Update

No current straddles, will assess if/when we enter a new zone/range for expansion of Volume Profile and Value Area High/Low (straddle the highs and lows) - candidates are $109.5Kish, $115-$120K, $130-$137K and conversely the $95-$98K zone and $90Kish. My shorts would be bigger and bigger at $95-98Kish and then $90Kish if needed

holding long USD as hedge/trade, though lightened by more than half to toss some more elsewhere LT plays