This Is Not Investment Advice

Is The ‘Melt Up’ Now Consensus?

Just something to consider, not ringing alarm bells (yet). If you recall, in mid-April I began opening up dramatically in my mind the concept of a new bull market emerging, not the same old yeah, yeah, yeah routine with the entire world revolving around Apple and Tesla. A new bull market. The ‘Melt Up’ aligns wonderfully with this with all of the various forces rowing the boat in the same general direction to include lighting a fire under fiscal spending globally and central banks generally easing and expanding the money supply.

Perhaps this is now “consensus” and The Market Ear at ZeroHedge has a few tidbits on this as well:

Is it a crime now to even consider the possibility of a pause or a pullback?

Furthermore - back in April we discussed not just jumping aboard (TiNA works well for moving in and out, careful with that leverage it swings both ways) but trying to find the top Industry Groups that will lead the charge in this new potential bull market.

Here is an example of that approach:

I like this group quite a bit actually. That does not mean I expect it to go up in a straight line and never correct or go down. The movement shown above in terms of climbing the rankings for Industry Groups at IBD though is part of what I am looking for. This group most certainly has the attention of the market which tells me the Money Flow is already there (yes we saw that a long, long time ago) and the focus and orientation is there. The market wants to be long this group. We want to identify and capture more of these. Power/Energy/AI/Bitcoin . . . . . . . .

Bitcoin Weekly

Bitcoin Daily

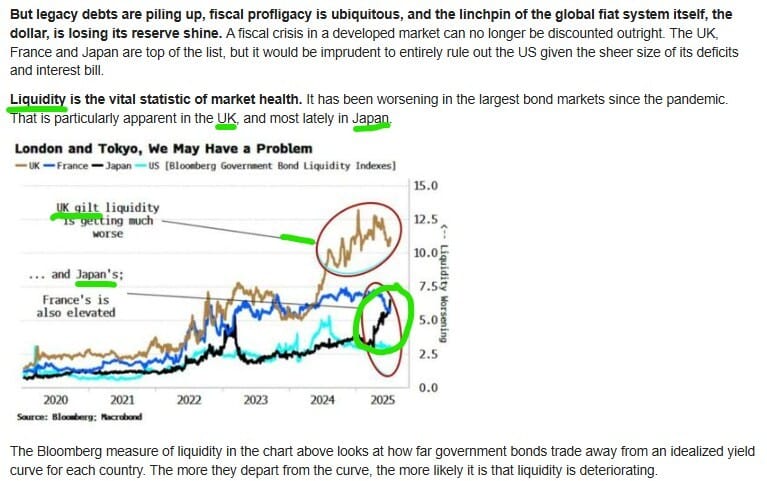

In another excellent contribution from Simon White at Bloomberg, White reminds us of a few of the huge, lumbering issues and factors hovering over credit - the types of things that don’t go away just because some slickster on CNBC says “you should buy a bunch of 30YR when they yield 5% because 5% is ‘good interest to get”.

Liquidity, as measured by deviations in trading from the market implied yield curve, continues to erode in you guessed it the UK . . . . . . . . . . . . . and more recently worsening conditions in Japan:

White also provides more insight into M1 growth and loan growth in China:

I won’t summarize or speak for Simon White but rather offer my own interpretation of these two recent contributions: A) China is cranking up the money printer, loan growth, and overall welcoming a growth posture, and B) the bond market liquidity is getting tighter in Japan and the UK . . . . . . . the two markets that appear the most likely to soon explode to higher yields on the long end. Both seem very, very bullish for Bitcoin to me at least. Again - this is FA and more of the mounting FA in support of Bitcoin. This data specifically may or may not have absolutely nothing to do with how Bitcoin trades now, this week, next month, etc. The FA is very strong currently and Bitcoin is a global CDS - in my opinion.

UST 30YR Weekly

Glassnode provides an update to the Cost Basis Distribution Heatmap which I personally view as helpful when looking at the Volume Profile for Bitcoin and Accumulation/Distribution:

Note above the key levels and zones identified by Glassnode - pretty similar to what has been covered and discussed here multiple times.

In the mining notes I’ve put out the $130K-$137K zone as an area of focus - one where I would expect at least some type of rejection. Here’s Glassnode:

To get a sense of the relative movement of coins being sold over time by long term holders, we can take a crack at the Bitcoin Magazine PRO Supply Adjusted Coin Days Destroyed:

Liquidation Heat Map - 2 Week Time Frame

Bitcoin Bottom Line:

Let the market tell/show us what is next

Current weekly candle is significant as we already have volume running well above the prior couple of weeks, down (Red) is not the end of the world but ideally want this closing well into the upper half of the range . . . . . . . . . i.e. weakness on Lower Time Frames is “bought up”

$121.6Kish, $118.5Kish, $115.8Kish, $114.5Kish, $110Kish

Curve steepened this week but JGBs teased more downside and floated most of the week

We have an aggressive breakout . . . . . . . but we aren’t mooning . . . . . . . can’t even put together two straight weeks of strong gains even with Risk On soaring . . . . . . . . . at the risk of being accused of not worshiping Bitcoin enough I’m left with “the more macro it trades, the more macro it trades”

A scenario with a sudden and strong surge to the mid to upper $130’s appears entirely plausible to me, but so does a test of $110K . . . . . . . . . . part of me sees us back in that very similar wait and see mode as we were when working with the prior Volume Profile

If these “god candles” are out there, where are they?

If Bitcoin is “destroying the old regime” then why are so many Bitcoiners focused on public equities and/or going public, watching stocks, etc. . . . . . . . . looks to me like Bitcoin and TradFi are merging

Risk On/Off

QQQ Weekly

QQQ keeps roaring ahead, three of the last four weeks look bullish on the surface. Money Flow is there and volume has been picking up.

High Yield Debt has come off its highs in the last couple of weeks but it isn’t breaking down as of yet:

Risk On/Off Bottom Line:

QQQ is powering ahead with good volume and Money Flow behind it currently . . . . . . . yes of course this can change but for me personally I am not overlooking this or minimizing this freight train’s significance

Junk Debt has consolidated a bit and gotten a tad bit wobbly, but thus far it is hanging in there

My senses are that many are “staying long but getting more ready to sell”

A scenario is percolating in my mind . . . . . . Yields Up, Stocks Up, Dollar Up . . . . . . . all at the same time

Curve steepened this week, Powell trial balloon was launched again . . . . . . . . . we saw a steepen and lower USD reaction but I keep the drama off to the side and focus on the action . . . . . . . very aware of Powell drama but not obsessing over what may or may not happen

Mining - Metal Ores, Electric - Contract Manufacturing, Computer Hardware - Periphery (Quantum) . . . . . . . . . . what other groups are moving and what do we need to do about it now

We still have a lot of powerful forces (Copper, Silver, Bitcoin, IBD Leading Stocks, QQQ behemoths) that look quite bullish on Higher Time Frames especially, this is not something to ignore

A million reasons why we should correct . . . . . . . . . . I am dabbling UVIX to hedge/protect

If All These AI Firms Are Worth So Much, When Is It Showing Up in GDP?

Though I view a solid chunk of Buffet’s success as highly connected to grift and poisoning the public with garbage (Coca Cola, McDonald’s, etc.) - he is absolutely right about market values and GDP. I mean, come on, at some point there has to be output from all of these companies each worth $20B+ allegedly.

I’m aboard the ‘Melt Up’ train conceptually as you know (since mid-April btw), but the market will demand the ROI more and more as each quarter passes. I’m not saying the ROI isn’t there just throwing up a flag about how private AI firms with little to nothing to show are already supposedly worth more than half the companies trading in the S&P 500 for years now.

UEC Weekly

CCJ Weekly

QBTS Weekly

Mining Update

Purchased more machines, paid in cash (early July modest acquisition)

No current straddles, will assess if/when we enter a new zone/range for expansion of Volume Profile and Value Area High/Low (straddle the highs and lows) - candidates are $109.5Kish, $115-$120K, $130-$137K and conversely the $95-$98K zone and $90Kish. My shorts would be bigger and bigger at $95-98Kish and then $90Kish if needed.

$115-$120K as per the above under evaluation

holding long USD as hedge/trade

UVIX nibbled on position currently

Subscribe to our brand new YouTube Channel

Alex Grey

The Seer