This Is Not Investment Advice

‘Melt Up’ Mauls Shorts, Bessent Scores Big SLR Win

The ‘Melt Up’ was piling up the distribution days while BTC floated inside a box and Option B was deflating a bit into a flattener shall we say, then on Monday the markets got what they needed which was a new jolt. Well into ‘Melt Up’ territory here and I am certainly not stepping in front of it until the Money Flow tells me to start poking around more on that front.

Though breadth is getting thinner and thinner, there appears to be a large amount of chasing still underway. Let’s see how it goes.

Bessent Flushes Fannie, Buys Bitcoin?

Senator Lummis hints at Treasury dumping laggards in favor of coin, and if you recall we discussed how then brand new Treasury Secretary Bessent mentioned early in 2025 that the Treasury would “monetize the asset side of the balance sheet” later in the year. Well here we are heading into the 2nd half of the year.

Looks to me like High Yield Debt wants Bessent to be able to pursue his plans (Option B and the ‘Melt Up’) - Blue Circle on left is the election:

Fed formally announces changes to the SLR. Market sees this is one less obstacle standing in the way of BanQE and balance sheet expansion, hence the drift lower across the entire curve:

Bitcoin Monthly

Monthly chart still appears quite bullish. Money Flow is Green on this Higher Time Frame which is huge (explains a lot about how it’s just kinda hanging around right now and bounced sharply off of a front-running of $97K). Closing this current candle higher in the monthly range would be very good and a bigger green candle with much more volume in either July or August would be a big boost.

Bitcoin Weekly

Glassnode highlights that drop off in Spot Volume since the runups in January and February:

Glassnode also notes how perp funding rates annualized and the 3-month futures on a rolling basis kinda rolling over last few months . . . . . . . . . . translation less juice into Bitcoin and more chilling out and waiting:

BitcoinMagazinePro.com with the steepen/flatten looksie this is zoomed in your call you think BTC reacts to the yield curve? I do.

Bitcoin Bottom Line:

Let the market tell/show us what is next

It’s fairly obvious retail volume and conviction is more or less a non-factor and the participants with the big bankrolls are trading this just like they trade anything else essentially, $97K to $109.5K and all eyes on Money Flow

Important to perhaps consider . . . . . . . the longer it ranges and Macro-hugs the more of a Volume Profile that is built (which needs to be “worked through” subsequently)

A weekly close, preferably more than one in a row, above $109.5Kish in my humble opinion would reel in a LOT of Money Flow

$102K-$104K (that ole $103.9Kish) a key zone for any pullbacks before trying to attack $109.5Kish

$100Kish and worse $97Kish, breaks here and many players will at a minimum have shorts as hedges

To me it appears that the market is keeping Bitcoin in a wait and see mode on Lower Time Frames most are unwilling to go out and try and scrape pennies in front of a steamroller trying to be a hero . . . . . . . . . participants are waiting to react

Risk On/Off

SPY Weekly

Well there it is right there. Biggest Weekly Candle in a while and volume is much lower than the prior Red week. That is part of an overall excellent description of the ‘Melt Up’.

Kind of like Money Flow for the Spoos, here is a look from ZeroHedge.com about sell pressure appearing again recently after it evened up as of May 19:

That is how I have been generally interpreting things prior to this week. Money Flow and conviction were lagging last few weeks but the indices just go up, up, up . . . . . . . . . up.

Nomura is back with the Boomerang insight. They see the Boomerang charging like a freight train for another couple weeks. There may be something to this but the BuyBack Beast is winding down for a bit which is not insignificant.

From The Market Ear at ZeroHedge.com the econ data starting to bounce again:

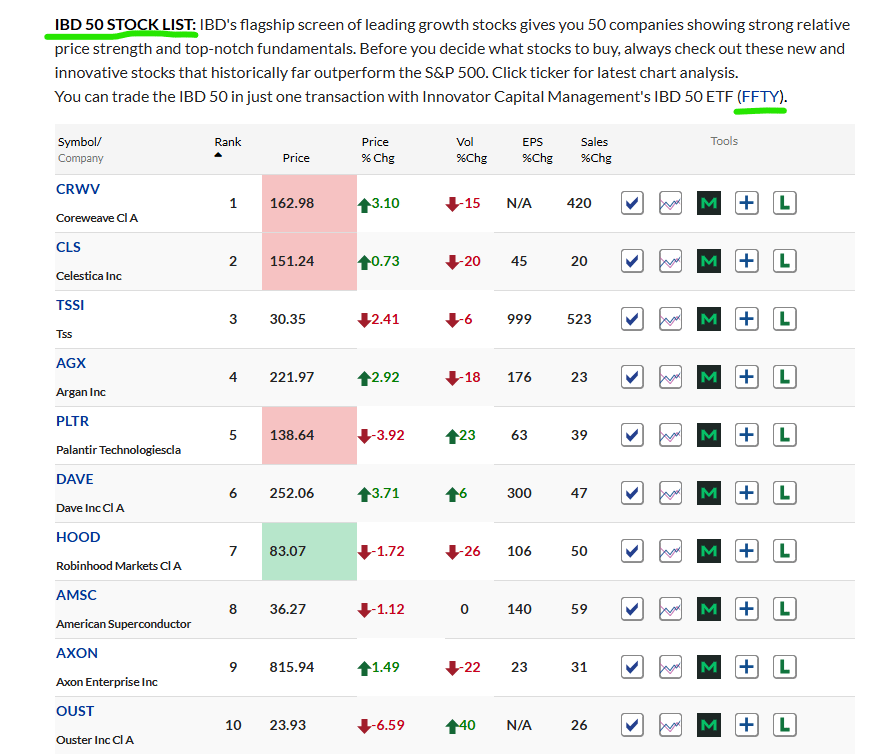

Investors Business Daily Top 10 stocks as of Friday 6/27:

Risk On/Off

The ‘Melt Up’ is exhibiting a high percentage of the Melty Uppy characteristics it should have

Watch the Money Flow and A/D like a hawk . . . . . . . . . . . senses are telling me most “don’t feel like selling” but if/when we correct they’ll change their minds real quick

Market can smell balance sheet expansion now that SLR is out of the way, POTUS keeps implying he’ll point the market’s attention to a Shadow Dove soon, and a modest reversal of the flattening tells me the market likes Bessent and Option B

Very important to get the curve as steep as is reasonable and here is why in my view . . . . . . . . the more growth the curve is discounting the more validation the market is giving to Option B and the ‘Melt Up’ . . . . . . . . meaning if Bessent is gonna pull it off he sure will need the support of the markets

ZAP, CCJ . . . . . . . . . . . Waiting on Copper?

Been watching this one and others to add to a Core AI/Bitcoin/Power/Energy position. Will likely add when I see the right setup but at a notably lower amount than CCJ and ZAP.

Helpful Report On Mining in Africa

Catch it here from African Bitcoiners:

BitcoinMagazinePro.com Update

Excellent video here highlighting some very relevant and important points:

Mining Update

No current straddles, will assess if/when we enter a new zone/range for expansion of Volume Profile and Value Area High/Low (straddle the highs and lows) - candidates are $109.5Kish, $115-$120K, $130-$137K and conversely the $95-$98K zone and $90Kish. My shorts would be bigger and bigger at $95-98Kish and then $90Kish if needed

holding long USD as hedge/trade, though lightened by half to toss some more elsewhere LT plays

SEP IRA - already have one, created new one with same firm holds personal IRA 100% BTC, use mining proceeds to feed SEP IRA (single member LLC)