This Is Not Investment Advice

Risk On Under Mounting Pressure

Here is the 4HR chart for Bitcoin:

Rejected yet again at $105.9Kish and trading sluggishly this entire week actually. Risk On as you’ll see below got hit a bit more this week, HYG notwithstanding.

JGB 10YR Weekly

BOJ does not have the situation “under control” in my opinion. Yes they have jawboned recently and basically said to ignore 30YR and 40YR (they know demand is essentially non-existent) and that they would taper the taper and focus more on the short end. Land values have been rising. There are ample data points to suggest Japan has moved out of deflation and that inflation is somewhere between 2%-5%. Some data indicates rice in Japan is soaring in price.

Again - why do I want to own Japan’s 10YR debt at 1.4% if inflation is way above that and even land values have started to crawl back? And what happens if the global economy warms up and a trade deal between Japan and America helps Japan’s economy?

This is one of those ongoing issues that ebbs and flows every so often and can kind of hide out behind the ever changing headlines and things impacting markets . . . . . . . . . . . . . . . but it hasn’t gone away nor has it been solved.

UK Gilts 10YR Weekly

Like most debt globally some recent relief, but the bigger persistent trend still intact despite the can kicking:

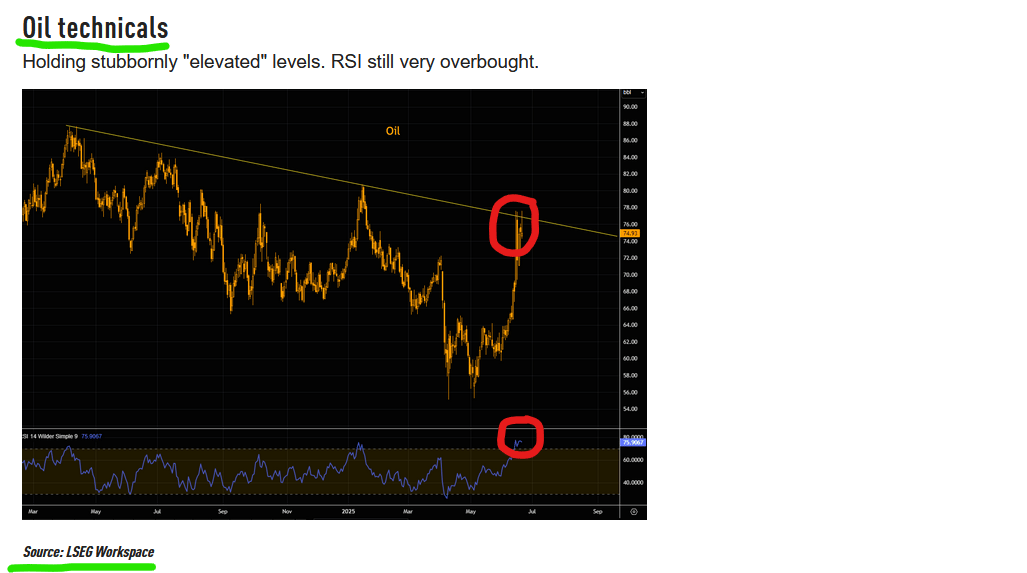

Oil as shown by The Market Ear at ZeroHedge.com still pushing to a certain point but not beyond:

Bitcoin Daily

BitcoinMagazinePro.com Long Term Holder Supply

Long term holders actually building up and digging in with this bounce from $74Kish we anticipated . . . . . . . . . . part of broader theme where the FA is as strong as it’s ever been . . . . . . . . but the day to day trading runs on its own beat.

MVRV Z-Score

BitcoinMagazinePro.com: Not trying to suggest it couldn’t go down again with the below, but rather to look at how by this very accurate metric it is still far below prior peaks and more “toppy” periods.

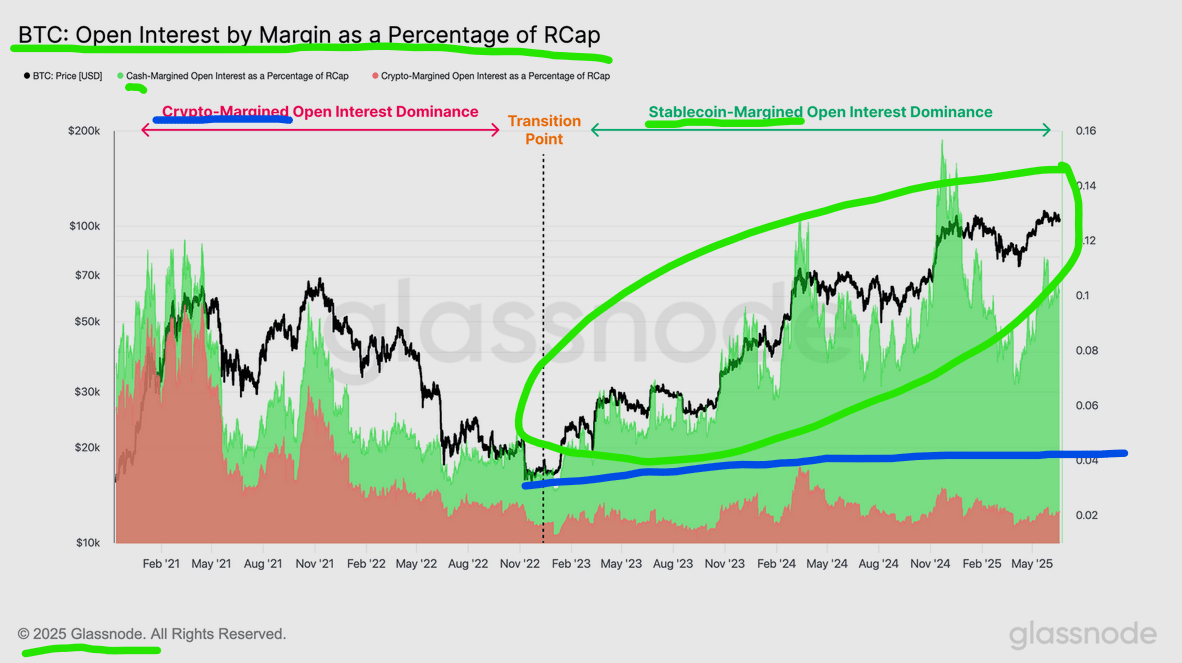

Very interesting data here from Glassnode showing the shift to cash based margin from ‘crypto’ based margin and the market action since.

Bitcoin Bottom Line:

Bitcoin is showing notable weakness on Lower Time Frames to include the Daily, $97K could certainly come into play

Absent some significant movement on Bond VOL it’s more likely BTC will play even more footsie with ES/QQQ (which are showing some signs of concern)

Long Term Holders and the FA continue to strengthen . . . . . . but the action on the exchanges determines the exchange rate at any given moment in time

By not running with that first move past $103Kish the result is now more and more of a Volume Profile is built in this new range which in my view keeps BTC more aligned to Macro (in other words it ‘gets stuck’ trading like Macro no mooning until proven otherwise)

‘Melt Up’ and all the other FA favoring still very much there, unless JGBs blow up or some other event stimulates BTC directly in the very short term it appears to be under pressure

Risk On/Off

QQQ Daily

Distribution days keep piling up, but it won’t go down meaningfully.

SPY Daily

More distribution than accumulation for sure of late and Money Flow Red on the Daily:

HYG Daily

Actually hanging in there tough and finished the week strongly:

Without the AI Stocks and sector the equity market would be in quite a bit of trouble. The goal is not to try and be clever and predict a crash in AI Stocks but rather to ponder what happens when they pause and correct? What supports the broad markets?

Risk On/Off Bottom Line:

new leadership groups may be brewing and percolating, but ES and Risk On in the here and now has huge reliance on the AI Trade, if it even pauses then what? What if it corrects?

Noted few times now and a few days ago . . . . . . . . . Hedge Fund leverage truly sky high and overheating, cash levels down to levels generally seen more with tops, Boomerang of playing “catch up” and overbuying to get back to positioning drying up at some point, and BuyBack Beast taking the drugs away . . . . . . . . . . even the ‘Melt Up’ needs more than a breather at some point

BTC showing more weakness over the weekend

Semis got smacked back a bit, oil could be under pressure possibly pressuring energy stocks even more

Money Flow on Lower Time Frames not looking bullish, but HYG holding up so far

If ES doesn’t get something to bump it higher very early in the week there are plenty of things pulling it towards retracing maybe up to 50% of the move from April lows or more

Bitcoin Layer 2 In Action

Got this email recently. Not vouching for or against this exchange as over the years I have worked with multiple different service providers. Kraken is now pitching “BTC Rewards” and earning on BTC. It pays out in the Babylon token. Babylon claims to be a Bitcoin Layer 2 solution.

I’ll repeat what I have said a few times before. I am not a “shill” or trying to “pump” the L2s. All I’ve been saying is that Bitcoin is the fertile ground and capital will naturally flow to building on Bitcoin. It’s picking up steam.

Mining Update

Already trimmed some TiNA small gain and remainder on high alert hopefully not a huge gap down Monday but that would not shock me actually

holding long USD as hedge/trade, some remainder short Nikkei as hedge

Straddle in play, if $97K comes will do the exact same thing using that pivot but larger play