This Is Not Investment Advice

It’s All There For the Taking . . . . . . . Hedges Asking for Attention . . . . . . ‘Melt Up’ Shrugs Off Sluggish Seniors . . . . . . . Consolidation/Pullback Coming?

Earlier in the week ZeroHedge.com published another excellent and thorough dive into the AI Capex Boom and associated issues and challenges. To wit - the market will need massive help from the Private Credit space, and the equity for two leading signals is not doing so well thus far in 2025:

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

This brings to the forefront what I view as the credible, literal, and tangible obstacles worthy of close attention and focus. Anyone can say “AI stocks are too high” or “AI stocks are still cheap” or their opinion about AI stocks and the market’s relative value. That’s fine. In my view valuation metrics are not desirable timing indicators or triggers, and the market is going to do it’s thing no matter what your opinion is today, tomorrow, or a month from now.

Here are a couple things that are absolutely valid and important and worth tracking in my humble opinion:

Financing for the AI Capex Boom . . . . . . who is paying for all this . . . . . . . we already know we are past using FCF from hyper-scalers . . . . . . how will this $800B credit gap get filled if the Private Credit behemoths are already struggling?

Energy and Power Capacity and Infrastructure . . . . . . . when META or GOOG says “by 2028 we will be running/producing xxxxxxxxxxx giga-mega-supersonic-watts AI things” is this even possible . . . . . . . . can the market and society even produce enough power and electricity to meet the forecasts for “all the amazing AI stuff we’ll be doing by 2028” or whenever?

Critical Resources - same theme, is it even literally plausible to extract and use all the resources we will need to meet these insanely aggressive forecasts?

These are real questions because they focus on real, tangible, and literal things that need to happen.

However - as the market grapples with answering these questions, we could still have certain market conditions . . . . . . . . . . in other words there could be significant time where the market ignores these issues while remaining obsessed over AI growth before the projections fall short simply due to literal reality.

Regarding positioning and sentiment, from the same ZH piece:

As stated previously, UVIX will come back into play and might end up being extremely useful. From The Market Ear at ZH, as shown after a near vertical move in 2017 you can see the ensuing meltdown and absolute explosion in VOL:

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Cost Basis Distribution Map

From Glassnode, we can see where most of the action is taking place and has taken place:

STX Weekly

COIN Weekly

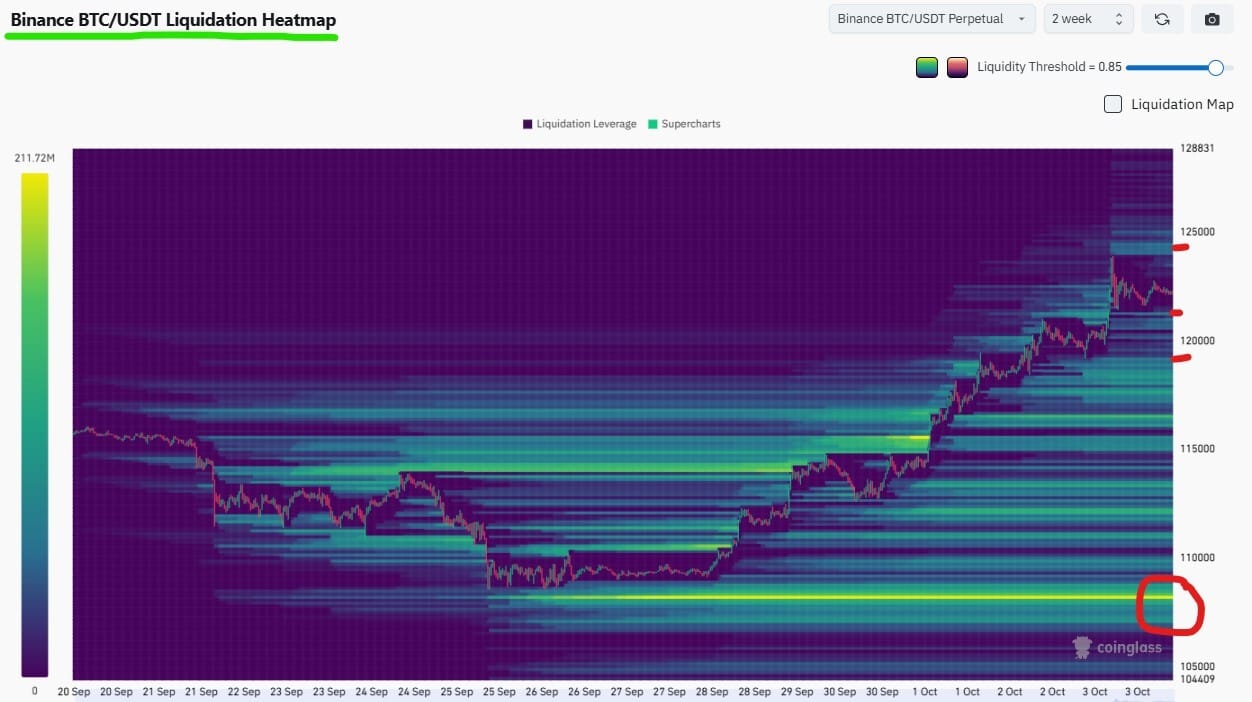

Liquidation Heat Map - Two Week Time Frame

Bitcoin Bottom Line:

Let the market tell/show us what is next

After flatlining for a bit the fairly aggressive bounce off of the $107-$109.5Kish zone is certainly a positive and the trend change noted in prior report with Higher Lows and Higher Highs . . . . . . . . . this is positive no doubt and deserves emphasis

Needs a Weekly close above $120.8Kish in my humble opinion . . . . . . this is important

$119.9Kish and $118Kish perhaps doors that open up a test of $107Kish all over again

In my humble opinion FA top 3 still 1) Global M2 YOY % growth, 2) Bessent Flex and supply of Treasuries, and 3) stench of dilution hanging around .

Money Flow on the Daily Green and looks pretty solid . . . . . . . Money Flow on the Weekly is Green technically but very wishy washy there is obviously not yet a strong surge on the Weekly Money Flow . . . . . . . . . . . . . if Green and juicy it takes the boot off the neck and allows more upside flex/movement

Potential for a quite bullish Weekly Candle right now . . . . . . will it happen?

COIN not out of the woods nor is MSTR, STX is very flat and uninspiring still

Rotations from GLD/SLV???? . . . . . . . FOMO and chasing from Wall St??????? All possible and positives

Risk On/Off

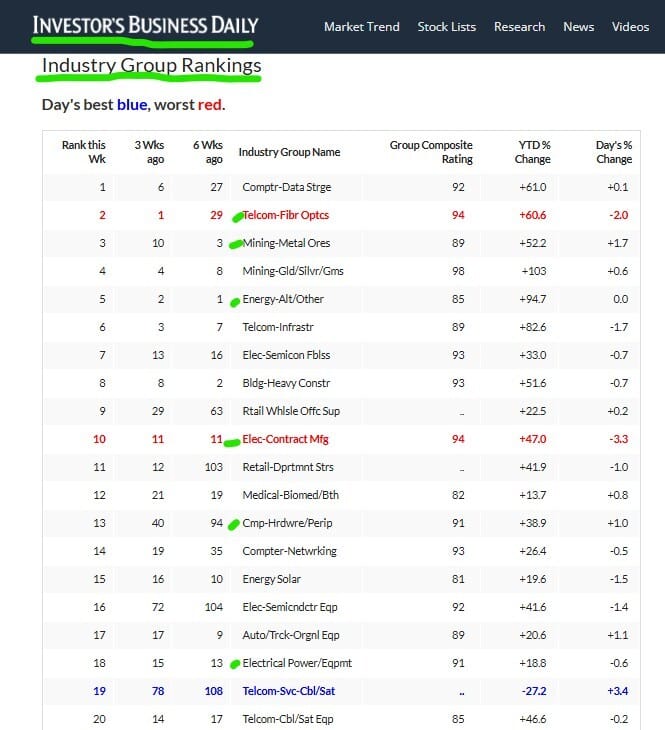

Here are the Top Industry Groups from Investors Business Daily after the conclusion of trading this week:

Some more from Goldman on sentiment and positioning:

QQQ Weekly

QQQ Daily

AGX Weekly

NVDA Weekly

HYG Weekly

HYG Daily

EME Weekly

IBKR Weekly

LEU Weekly

AMPX Weekly

VIAV Weekly

Risk On/Off Bottom Line:

Bigger Picture . . . . . higher Time Frames like Weekly and Monthly . . . . . . . I don’t make predictions . . . . . . . . however there is this sense I’m having of the possibility of real insanity . . . . . . . if the market knows we simply can’t produce/generate/create the power/energy/stuff to even come close to where some say we are going . . . . . . . . then does it send near vertical the equity that is at least capable of providing the tools/services/materials to try and close the gap?????? . . . . . . . . in other words does the Daq at some point go near vertical as the market scrambles to try and justify HOW and by WHOM all this work will get done . . . . . . . . only leading to an epic crash and subsequent recovery and another swing for the fences? If so the IBD Industry Groups likely have a lot of answers . . . . . . .

Been a long, long time since a 2%+ down day . . . . . . . . this streak will end in my humble opinion

In my view still not an appropriate time to take swings against the ‘Melt Up’

Not the worst time in the world in my view to tighten up your hedging tactics whatever those may be . . . . . . . .

Atlanta Fed forecast north of 3% GDP, the PCE 3%ish . . . . . . . it’s enough to leave Risk On salivating over booming Nominal GDP (equities are in essence a claim on Nominal GDP) where GDP grows on top of the inflation baseline supporting it thus reinforcing the ‘Melt Up’ and ‘run it hot’ strategy . . . . . . . . . yet the dreamy visions notice some clouds with half of the consumer economy in shambles, credit contagion floating, and not exactly flourishing manufacturing and transports

Junk Debt is below the 21 EMA and Money Flow is Red on the Daily and the Weekly . . . . . . reality

Two Leading Industry Groups (Telecom - Fibre Optics and Elec - Contract Manufacturing) AI related were among the worst performing groups Friday

Only so many stories or White House visits for stocks like ORCL, AAPL, TSLA . . . . . . . yet their slight moves, sneezes, and nudges impact the indices big time which impacts ES, potential direction, sentiment, etc. . . . . . . blessing and a curse can create choppiness

Some high fliers and Risk On plays like Interactive Brokers still appear very strong on Weekly Time Frames but QQQ still Red on the Daily Money Flow trip to the 21 EMA would not be outrageous . . . . . . . . . NVDA is trying

Banging in my head getting louder for the lower 50% of consumers by spending power . . . . . . . . . . . already multiple weak points and now a few lenders getting torched . . . . . . . . contagion fears already reaching JPM . . . . . . . could also be catalyst for Fed to get to Neutral faster

Senses are pushing me towards the Pain Trade remaining the ‘Melt Up’ melting up ever higher while missing it begrudgingly . . . . . . . . . . still quite plausible pullbacks welcomed and appreciated by new longs

Friday was another session where Risk On “could have” or “should have” plunged with that mid day dive . . . . . . . . . . but it did not

Expecting gyrations and we’ve had a few strong weeks here in a row more or less . . . . . . . . but in my humble opinion upside bias remains on Medium to Higher Time Frames until credit whispers in our ears or the indices are down big on big volume closing at or near the lows of the day with Leading Stocks getting hit hard on big volume

“Until tech credit spreads crack” . . . . . . . . . . .

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: Little over half of BTC stash from mining sold over last handful of weeks as described right here. No more recent selling.

If/when the Money Flow for Bitcoin turns Green in the weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is Green on the Monthly and technically Green on the Weekly but squishy at the moment. Will be watching the Weekly close vis a vis $120.8Kish and Weekly Money Flow to assess if SBIT used. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. UPDATE: No SBIT currently.

TBT, UUP

Matthew Wong

Meanwhile