This Is Not Investment Advice

Market Seeks Out Exposure to NDFIs . . . . . . . Bitcoin Breaks Very Major Support . . . . . . ‘Melt Up’ Coiling to Repel Loan Fraud . . . . . . . Bond VOL Doesn’t Seem Concerned . . . . . Crucial Hard Assets Consolidate and Settle

Here is the QQQ 4HR showing last Friday’s dump and the fairly muted reaction this week hugging the 21 EMA:

Here is KRE 4HR which in my view shows more Volume selling than buying recently for sure:

This week’s action brought QE chatter back to the forefront as well, so let’s take a look at RRP and Reserves.

Reserves at the moment seem fine (8/25 last data point well above $3T), and we can see the widely accepted dwindling down of the RRP:

Recent Bank of America Fund Manager Survey shows the current allocations to gold and “crypto”:

As shown . . . . . in the right here and right now . . . . . . . . . the main decision makers driving institutional money are not all that exposed to Gold at this time with “crypto” being almost entirely ignored. Yes - one can say “well look at all that money that will pour in” but that ignores that RIGHT NOW, within their framework, they are simply not necessarily aggressively leaning into Bitcoin. You can criticize their decisions and judgment but it is reality right now.

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Weekly - Expanded With 50 EMA

Bitcoin Daily

Observations from Glassnode on the current levels and scenario:

Global M2 YOY vs BTC YOY

Again - not sure if I can or have emphasized this enough . . . . . . . . if you look inside the Red Circle you can see that the rate of change of Global M2 in recent weeks and months does not align with the “all the central banks are money printer go brrrr so Bitcoin will moon to $1M next week” narrative:

Liquidation Heat Map - Two Week Time Frame

Bitcoin Bottom Line:

Let the market tell/show us what is next

Regarding FA . . . . . . . . . . . one might argue two recent jawbones were bullish in Powell talking cessation of QT formally and the administration teasing helicopter money . . . . . . . . and then the final budget numbers suggested no reason for Bessent to back off from the Flex . . . . . . meaning nothing indicated DIRECT action on Balance Sheet Expansion being soon or near . . . . . .

Dilution brings a stench and still hovers over BTC in my humble opinion . . . . . . has nothing to do with Bitcoin itself . . . . . . . . a strategy like the one employed by Strategy requires Bitcoin to run like Ghostzapper (G1 Winner at five different distances to include toying with field in Breeder’s Cup Classic) essentially perfectly at all times speed/pace/distance/stamina . . . . . . . unrealistic . . . . . . yet the market can corner/predict movement . . . . . . . . . almost as if the market is seeking some sort of justice for anyone claiming to have solved some sort of puzzled path to utopia that everyone else for decades missed

Getting somewhat of a bounce off of the $103Kish/$104Kish from prior Volume Profiles but we already have the break below the absolutely crucial $107Kish/$108Kish

Weekly closes below the $108Kish and $104Kish and ultimately the 50 EMA on the Weekly continue to pound the bearish drumbeat

A chance at another swing for the fences in the short and intermediate term if we somehow got a Weekly close in or above the $111k-$113K range

Would need a reclaim and break above the $120.6Kish to get very bullish on Higher Time Frames to attempt to get the Money Flow on Higher Time Frames really cooking . . . . . . yes it looks far away right now and is based on current Money Flow

What’s the NEW catalyst on the margin????

More importantly from whom and from where will the Money Flow arrive to get the bullish action back on track on Higher Time Frames? Retail? Black Swan new buyer? Until some new and major impulse arrives in my humble view expect more working and chopping through various Volume Profiles . . . . . . Money Flow seems to be highly accurate

Spending notable amount of time in a 92/93 to 107/108 zone and Volume Profile can’t possibly be shocking to anyone at this point, is it?

Absent a crisis that draws in intervention I’m not seeing how Balance Sheet expansion happens anytime before late 2026 at the earliest . . . . . maybe I am wrong . . . . . . . again adoption and actual usage is a more worthy effort than exotic treasury strategies trying to re-invent corporate finance . . . . . . maybe I am wrong but for the life of me I still don’t see how it happens unless Bitcoin constantly outruns the dilution

Risk On/Off

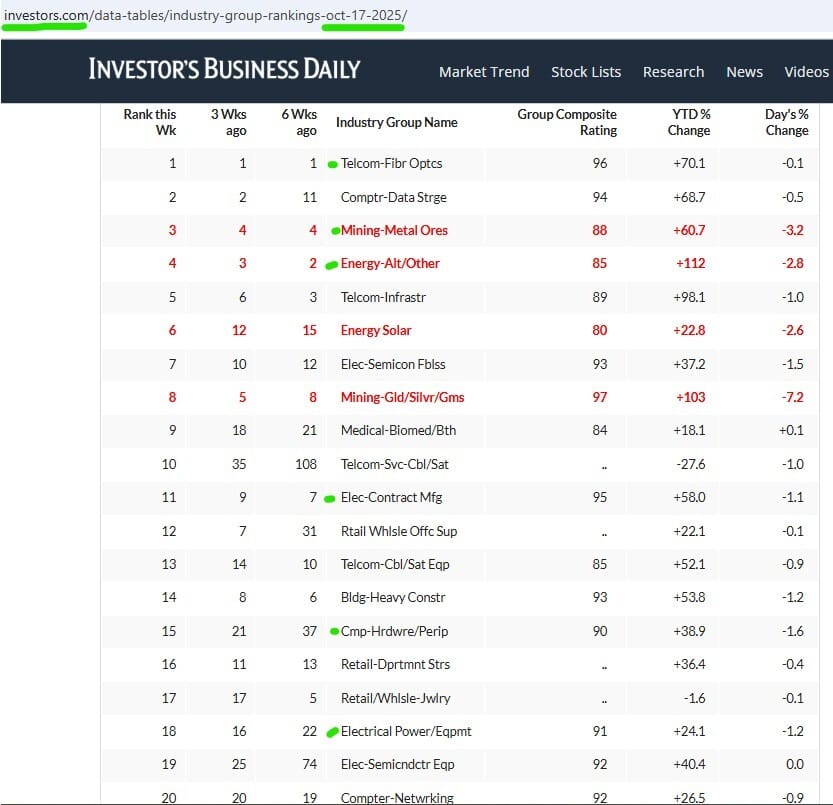

Here are the top Industry Groups ranked by Investors Business Daily after the close of trading this week:

Buybacks are rounding back into more bullish form just as we head into the thick of year end vibes:

QQQ Weekly

QQQ Daily

HYG Weekly

HYG Daily

IBKR Weekly

NVDA Weekly

AGX Weekly

EME Weekly

FLEX Weekly

AMPX Weekly

Will be watching closely we have a shooting star on the weekly. Got very bullish news on actual product distribution and actual future revenue and then Lithium related stocks got hit hard late in week when the Feds opted to pull plug on one Lithium endeavor in favor of rare earths. Was not a dismissal of Lithium but seen that way initially.

In my view this business is actually getting ready to take off like a rocket.

MP Weekly

NB Weekly

LEU Weekly

Risk On/Off Bottom Line:

“Until tech credit spreads crack . . . . . . “

Which banks have the most exposure to NDFIs and CRE and the market will monitor like a hawk . . . . . .

Mainstream financial media may paint Friday with a bullish brush of “all is well now” . . . . . . . . . . yet in my view the silence on Friday regarding credit and potential fraud was deafening . . . . . perhaps under counsel’s advice?

KRE and the equity price/volume action on the two biggest private credit players tell me this is not small and not going to vanish quickly . . . . .

So far . . . . . . . . . CRE group in SoCal ultimately leads to multiple lenders thinking they had first position on the lien and ooops here we go and the missing billions from the auto parts linked entities with receivables and other exotic financing . . . . . . . . the message I am getting is it is messy and could be a lot bigger than what we have seen thus far we already see two sectors autos and real estate . . . . . .

One of things that makes me even more hesitant to swing against the ‘Melt Up’ is that Leading Stocks . . . . . . let’s use the IBD 50 . . . . . . . continue to hang in there . . . . . . and there are perhaps a couple hundred more fighting to get into the IBD 50 meaning there are legitimate growth opportunities and businesses out there . . . . new leadership as the indices by simple and literal math are forced to drag around behemoths (the MAGfatcats)

On that note on Friday it was not Leading Stocks leading the indices higher which makes the low volume bounce even more suspect in my view from the perspective of Lower Time Frames

Both QQQ and HYG look . . . . . albeit not amazing . . . . . but capable on the Weekly to get the ‘Melt Up’ cranking again but undecided as of yet on the Daily but not pushing away from the 21 EMA . . . . in either direction

Though Equity VOL has spiked and remained elevated MOVE yet again plummets to new local lows by the end of the week

In my humble view my senses are telling me this is a matter of how well the ‘Melt Up’ can absorb and/or shrug off the credit issues . . . . . . . not sure these loan fraud and collateral questions just vanish anytime soon more of a lingering nag where market persistently seeks out and destroys the perps . . . . . . how much will this impact Daq, rare earths, Leading Stocks????? . . . . . . likely in direct relation to how ‘systemic’ it is considered and any direct impacts on liquidity (some movement in SOFR this week)

Ignoring KRE (understood unrealistic and unwise) and the ‘Melt Up’ in my view looks like it has been chopping and churning and actually gearing up to potentially rip . . . . . . . this loan fraud thing might not appear all at once so does the Daq just sit there and wait for all the dirty laundry to come out or attempt to continue on and fend off anything that does not lead to systemic risk . . . . . . . . . other end of course is the uglier it gets the more likely we see intervention if Liquidity and Market Functioning are at risk . . . . . which comes first intervention or a total private credit meltdown?

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: Sold almost entire Bitcoin stash for the mining business. Very heavy cash earning.

If/when the Money Flow for Bitcoin turns Green emphatically on the Weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is barely Green on the Monthly and Red on the Weekly so defensive posture resumes. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

UPDATE: SBIT holding.

TBT, UUP, SKRE

Matthew Wong

Autumn Nocturne