This Is Not Investment Advice

Quite the Wick Down for Bitcoin . . . . . . . Hedges Activated During Week . . . . . . ‘Melt Up’ Takes Biggest Punches Yet By Far . . . . . . . Is It All Over Now?

Rather than obsessing about bubble status and categorizations or opinions from someone on CNBC, we shall continue to do our best to view everything with an open mind while using the tools and assets we know are effective.

Last week we discussed getting more prepared for potential pullbacks and consolidation, and we certainly got some more corrective action this week. We’ll take a look at the damage and assess where we see things now throughout this report.

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it.

In that spirit - let’s look at the below chart and set of data from The Market Ear at Zerohedge.com:

I can appreciate the above chart and fact that on a relative basis this current rally led by tech and AI specifically has a much better profit and FCF backdrop. This plus the fact that real, actual infrastructure that is useful is also being built not entirely due to AI are two FA factors that certainly can support the ‘Melt Up’ on higher Time Frames. There are robust earnings supporting the market . . . . . . . . how much far beyond the earnings and FCF projections equity prices go is another question.

Worthwhile to keep in mind that there are actual earnings and cash flows driving this rally before getting gassed up to take swings against the ‘Melt Up’ at this time. Also of note is the trend change in Real M2 (meaning yeah the “central banks print money” but the metric that asks are you gaining ground?):

Some notes from Goldman on the ‘Melt Up’ and AI Capex:

A look at how much chasing here:

And the challenges of hedging trying to pick up pennies in front of a steamroller chasing VOL . . . . . . until the market dumps and it could then dump very hard and unwind . . . . . . meaning Friday could erode further and accelerate the further it goes . . . . . think of an unwind of how friendly the VOL slaying has been on the way up:

An update on some FA for Bitcoin that can also play a role with Risk On/Off as well, all of course merely my opinion and view:

Things like the Bank of Russia moves and Luxembourg are obviously bullish and push the envelope further in terms of Game Theory

Political changes in Japan and ensuing market reactions implying a BOJ and government to lean more in the stimulus direction . . . . . . regardless of the precise particulars this is more supportive than not of Risk On and Bitcoin - bullish

M2 . . . . . . . . . yes I keep beating this horse . . . . . . . . . see below again for an open minded and close look at the rate of growth currently of Global M2

Dilution . . . . . . . . I’m still on this as well check MSTR chart this isn’t going to go away the market can use various tools such as Implied VOL and derivatives to control action based on pending dilution and how much is capable of adding more assets versus paying bills . . . . . . . reality . . . . . and yes of course “this all goes away” if BTC goes vert but on that note I would say circle back to the Global M2 YOY % Change chart

Bitcoin Monthly

Bitcoin Weekly

Bitcoin Daily

Here is how Glassnode wrapped up a recent note:

Glassnode helps point out how profit taking has risen during this bounce from the $107-$109.5Kish Zone, but it is not yet at elevated levels more linked to local tops:

Spot Volumes poked above the August levels recently. This is a good sign in my view but one that needs to be sustained and extended . . . . . time will tell:

Global M2 YOY % Change vs Bitcoin YOY % Change

STX Weekly

STX Defi

Pro-rate and project for October and it is well below September in terms of Stacks Defi transactions.

MSTR Weekly

Bitcoin Bottom Line:

Let the market tell/show us what is next

We got the trend change last week or so (note published on that) and it certainly contained a feeling of Risk On dragging Bitcoin up for the ride ultimately . . . . . . . and then you can see the huge down move Friday when Risk On flipped . . . . . . . . the more Macro it trades the more Macro it trades . . . . . . in my humble opinion “mooning” is less likely in the near term than simply trying to chop/work through various Volume Profiles

That wick down to $104Kish could be viewed in a very bullish way . . . . . . but that assumes the Weekly close doesn’t make it look a lot more bearish . . . . . . . it all comes down to the Money Flow as stated in the update to the trend change published earlier in the week

Bitcoin DeFi isn’t dead . . . . . . . . . . it just isn’t accelerating consistently it gets going then fades . . . . . rinse and repeat for now

A Weekly close below $108Kish is very bearish . . . . . . . . . . conversely a Weekly close above $112Kish makes that wick to $104Kish look even more bullish

Monthly doesn’t look all that bad but Money Flow on the Weekly and Daily is Red . . . . . reality

Consider looking closely at the Red Circle on the right side of the Global M2 chart and ask yourself if that looks super bullish in the here and now

Risk On/Off

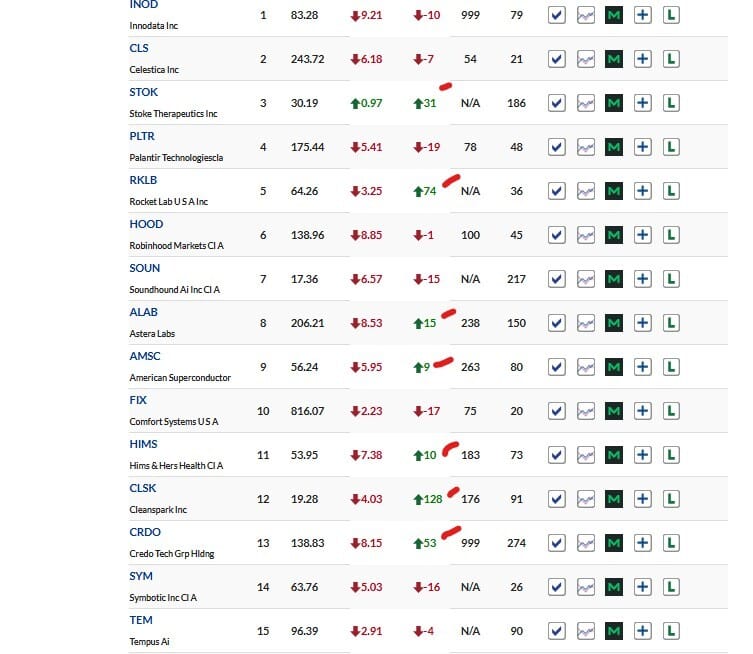

Here is a look at the Leading Stocks from IBD for Friday - seven out of the top 15 were under Distribution Friday:

Here is the IBD Big Picture after this week:

Here are the Top Industry Groups after trading action on 10/10:

QQQ Weekly

QQQ Daily

HYG Weekly

HYG Daily

NVDA Weekly

CLS Weekly

Bouncing around the Top 5 or so of ALL stocks rated by Investors Business Daily (think about that, compared to all other stocks), this Leading Stock from a very important Industry Group (Elec - Contract Manufacturing) looks like it could break out again:

AGX Weekly

EME Weekly

LEU Weekly

AMPX Weekly

UEC Weekly

FLEX Weekly

MP Weekly

Risk On/Off Bottom Line:

Is the ‘Melt Up’ all over now? Is this it for Risk On? Everyone wants these answers . . . . . . . in my humble view the ‘Melt Up’ and ‘run it hot’ are not derailed at this time though there has been notable damage and a major wake up call issued

Bearish view is Friday was a follow through punch after the warnings we tipped off from HYG starting two weeks ago and that it will get worse . . . . . . . . conversely the bullish view is that Trump’s jawboning simply accelerated and reset (RSI, etc.) multiple things and got the QQQ to do some price discovery vis a vis 21 DMA and 50 DMA and possibly rebuild a nice little setup . . . . . . . . . . .

Trump’s jawboning no doubt adds even more emphasis to how critical Uranium and Rare Earths are and I would even add “mission critical” in general . . . . . . . POTUS not risking the ‘Melt Up’ unless it has to happen to get warfighting materials and resources . . . . . reminder Trump is Commander in Chief

Anticipating that 2%+ down day and we got it for sure

QQQ 50 DMA 584 and 21 DMA 597 . . . . . . said here previously touching the 21 DMA not a big deal now we are between the two would imagine market resolves this bouncing between the two and we assess the signals given . . . . . will Risk On bounce from the 50 or play with it and ultimately plunge below?

This publication has consistently, and will continue to do so, analyze/use credit and junk debt for our purposes . . . . . . in fact we signaled two weeks ago a head’s up on HYG and interesting how now everyone and their grandmother is yapping about HYG

HYG under distribution that picked up from where we signaled and the Money Flow is Red on the Daily and the Weekly . . . . . reality

Still not the time to tee up some shorts against the ‘Melt Up’ specifically and directly thumping your chest . . . . . . will publish a post on shorting and when in my humble view it comes into play

On Thursday went Short SAM (this is not fighting the ‘melt Up’ direct see prior posts - alerted this on socials)

Leading Stocks were hit in general on Friday but in aggregate and looking across say the Top 20 IBD Industry Groups . . . . . . Leading Stocks were not slaughtered

The indices all suffered meaningful Distribution this week no doubt about it

In my view the coming trading week is an inflection point . . . . . . . . either the ‘Melt Up’ fights back or we mess with the 50 DMA and close below it on the Weekly

Added to a few late Friday

Two most recent Stick Saves I can see were the Iran one and the ORCL bonanza . . . . . . getting NVDA above $170 also in there perhaps . . . . .what’s next? We are at war in multiple different ways . . . . . reality

He’s back. Interestingly . . . . . . . after snuggle time with the other kids ends the male puma goes out on his own several hundred miles away to establish his own territory. Bait might appear. Prey will appear. Is it prey he should attack? Or is it prey that will potentially bring more trouble? Either way he makes the decisions on his own.

Mining Update

Please consider these are positions specific to a mining business I control via entity. I might be active long/short BTC direct and/or TradFi to hedge/trade with/against the mining business exposure.

Sold BTC vicinity $122Kish, about 30% of the stash held from mining was sold, sitting in cash earning. Current posture is very heavy cash, zero short term credit balance. UPDATE: Little over half of BTC stash from mining sold over last handful of weeks as described right here. Monitoring very closely now to potentially sell more . . . . . . breaks below $108Kish and weekly closes below $112Kish are major signals.

If/when the Money Flow for Bitcoin turns Green emphatically on the Weekly, I have lots of bullish options. I could buy spot, buy more machines, long BITU, long forward hash, and/or hold onto mining rewards for a considerable amount of time before converting to fiat. My posture will change based on the Weekly and Monthly Money Flow. If both are Green, then all tactics deployed to hold BTC as long as possible before converting any to fiat. If just the Weekly turns Green then start leaning into this strategy. UPDATE: The Money Flow is Green on the Monthly and Red on the Weekly so defensive posture resumes. I am very heavy cash, all the bills are paid, and zero short term credit. I can get more aggressive but am not as of just yet.

SBIT - used and sold for profit SBIT a couple times recently we got the push below $111K, a new lower high, then the move down to the $107K to $108.7Kish zone we anticipated for a long time now. UPDATE: Added some SBIT early in week.

TBT, UUP

Bitcoin and Finance Charts, Trading, Investing

Bitcoin, Stock Market, Bond Market, Alternative Investments - this channel provides analysis and insight on what is happening in the financial markets from a unique perspective and point of view. This is NOT mainstream analysis. We look at Bitcoin, equities, bonds and how it all fits together. Chart reading, fundamental analysis, technical analysis . . . . . .check us out and learn and have fun.

www.youtube.com/@BitcoinandFinanceChartsTrading/videos

Alex Grey

Oversoul