This Is Not Investment Advice

Just The Data and Tools We Know Are Effective - An Assessment of AI Stocks

Altman seems to shrug his shoulders at the $500B OpenAI valuation and intent to keep spending and burning cash.

Let’s take a look at some of the biggest names and most hyped stocks thus far during this AI CAPEX boom and market ‘Melt Up’.

PLTR Weekly

The back office, built for founders

We’ve worked with over 800 startups—from first-time founders at pre-seed to fast-moving teams raising Series A and beyond—and we’d love to help you navigate whatever’s next.

Here’s how we’re willing to help you:

Incorporating a new startup? We’ll take care of it—no legal fees, no delays.

Spending at scale? You’ll earn 3% cash back on every dollar spent with our cards.

Transferring $250K+? We’ll add $2,000 directly to your account.

NVDA Weekly

CRWV Daily

META Weekly

Bottom Line:

CRWV is the only one to give, in my opinion, some stone cold sell signals

All of them since the April bottom have been generally speaking rising on a combination of low volume and tepid Money Flow

In my opinion, these look like longs that “are holding on but very ready to sell”

There has not YET been very dramatic breakdowns or severe distribution as of this publication . . . . . . . but the Money Flow is turning Red on higher and higher Time Frames

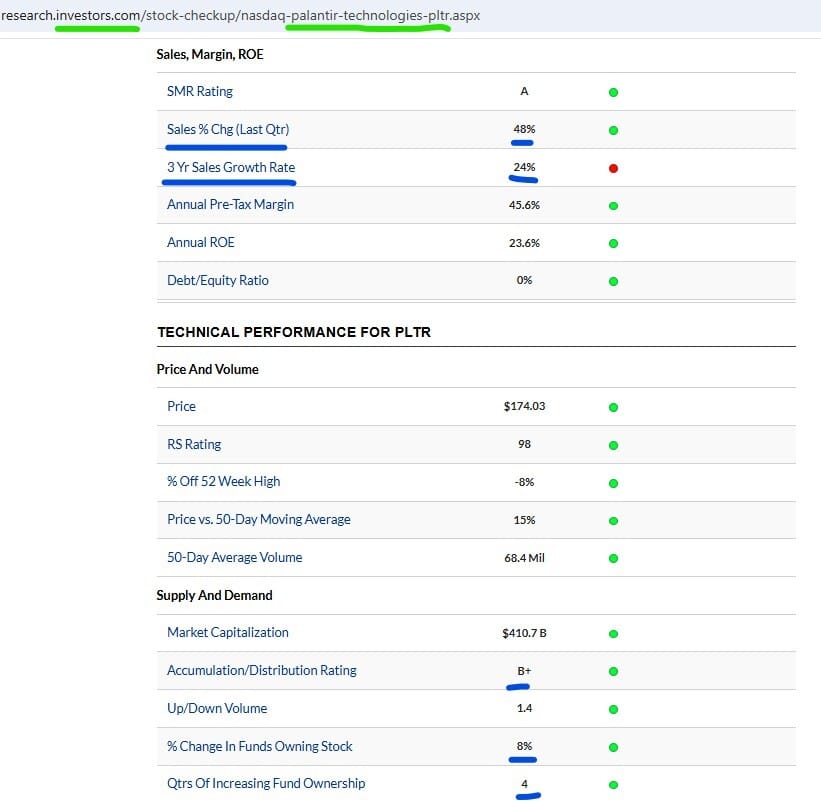

Example PLTR - maybe it’s a great business (maybe it isn’t) and 48% sales growth is excellent in and of itself . . . . . . . . . . but personally I need way, way more than that to long this thing and I don’t like how tepid and average it looks in terms of Accumulation/Distribution

Exception of CRWV - revenue growth is impressive yes but not such that it justifies trading for a zillion times sales or earnings

None of them I personally would buy at the moment or perhaps at all, all the goodness and awesomeness more than already baked in the cake

Bonus - IKBR Weekly

Not the worst assessment in the world for Risk On/Off in my view.